XRP ETFs experienced significant outflows amid escalating geopolitical tensions, reversing recent gains. Broader market anxieties, reflected in ETF trends, have negatively impacted XRP’s price. Outflows from XRP ETFs put downward pressure on XRP’s price, affecting liquidity and market sentiment.

What to Know:

- XRP ETFs experienced significant outflows amid escalating geopolitical tensions, reversing recent gains.

- Broader market anxieties, reflected in ETF trends, have negatively impacted XRP’s price.

- Outflows from XRP ETFs put downward pressure on XRP’s price, affecting liquidity and market sentiment.

Geopolitical tensions have triggered a broad crypto market sell-off, impacting digital assets and investment products. XRP has been particularly affected, with its price declining amid substantial outflows from XRP-focused ETFs. This market update examines the recent ETF outflows, XRP’s price action, and the broader market context influencing these movements.

XRP ETF Outflows

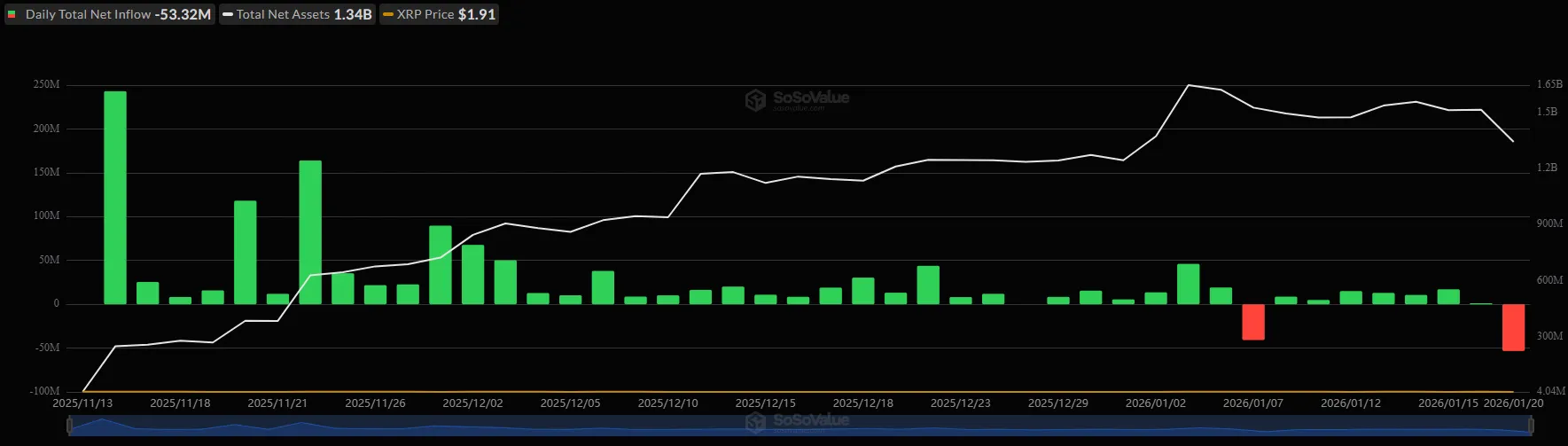

After a period of consistent inflows, XRP ETFs experienced a sharp reversal, marked by significant outflows. On the worst trading day to date, investors withdrew $53.32 million from these funds. This outflow reduced the cumulative net inflows from $1.28 billion to $1.22 billion, effectively erasing the gains of the previous week.

XRP Price Decline

The outflows from XRP ETFs have coincided with a decline in XRP’s price. After reaching a multi-month peak of $2.40 in early January, XRP has since fallen, breaching the $2.00 support level and briefly dipping to $1.84. The digital asset is struggling to maintain levels above $1.90 amid persistent selling pressure.

Broader Market Context

The negative performance of XRP and its related investment products reflects broader market anxieties. Escalating geopolitical tensions have increased risk aversion among investors, leading to capital outflows from the crypto market. Bitcoin and Ethereum have also experienced volatility, underscoring the widespread impact of macroeconomic factors on digital assets.

Implications for Liquidity

The ETF outflows and price decline have implications for XRP’s liquidity. Reduced investment inflows can decrease market depth, potentially leading to increased price volatility. Market participants should be aware of these dynamics and adjust their trading strategies accordingly.

Future Outlook

The near-term outlook for XRP will likely depend on the resolution of geopolitical tensions and the overall market sentiment. Further ETF outflows could exert additional downward pressure on XRP’s price, while a stabilization of the macroeconomic environment could provide some relief. Monitoring ETF flows and broader market trends will be crucial for assessing XRP’s future performance.

In conclusion, XRP is currently facing headwinds due to ETF outflows and broader market anxieties. Investors should closely monitor these developments and consider their potential impact on XRP’s price and liquidity.

Related: XRP Stablecoin Prediction Signals Market Turn

Source: Original article

Quick Summary

XRP ETFs experienced significant outflows amid escalating geopolitical tensions, reversing recent gains. Broader market anxieties, reflected in ETF trends, have negatively impacted XRP’s price. Outflows from XRP ETFs put downward pressure on XRP’s price, affecting liquidity and market sentiment.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.