XRP is facing growing pressure as delays in regulatory approvals for spot ETFs and uncertainties in crypto regulation cloud its short-term prospects. While tokens like Bitcoin (BTC) and Ethereum (ETH) climb to new highs, XRP remains subdued, partly due to the lack of action from regulators.

XRP is facing growing pressure as delays in regulatory approvals for spot ETFs and uncertainties in crypto regulation cloud its short-term prospects. While tokens like Bitcoin (BTC) and Ethereum (ETH) climb to new highs, XRP remains subdued, partly due to the lack of action from regulators.

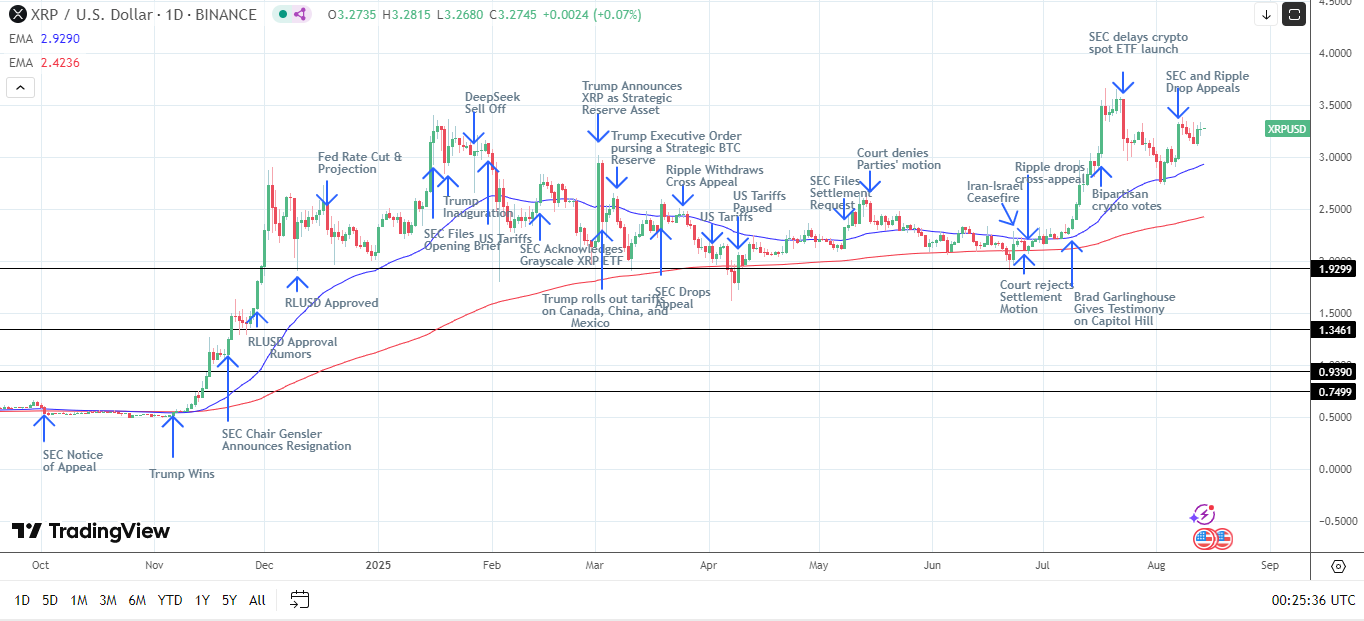

Earlier in August, XRP peaked at $3.3826 following a court filing that marked progress in the ongoing legal battle concerning Ripple. However, that momentum faded quickly as traders took profits. Over the following four sessions, XRP slipped, only beginning to stabilize by midweek. On Wednesday, August 13, XRP managed to gain just 0.14%, even as the total crypto market valuation surged to $4.11 trillion, a record high.

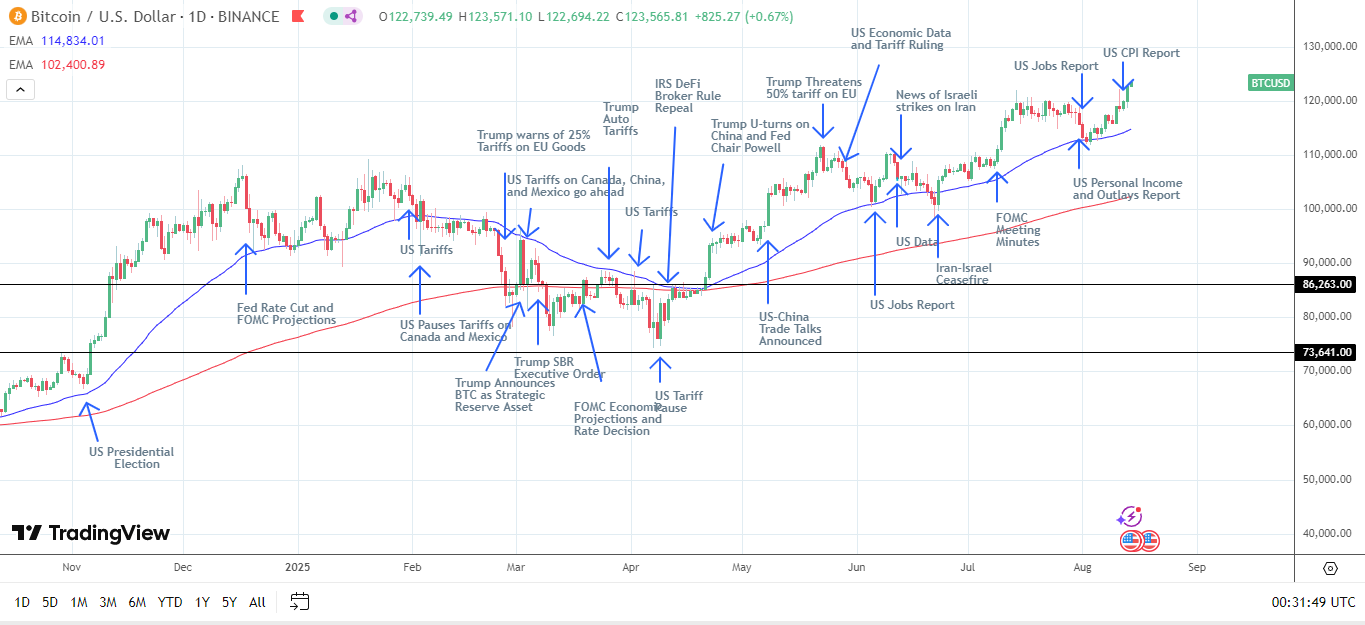

In contrast, Bitcoin hit $122,970 and Ethereum approached its 2021 high. Solana (SOL) surged past $200 for the first time in half a year. A major factor behind the divergence is ETF participation. All three of these assets benefit from SEC-approved spot ETFs. In XRP’s case, however, the SEC has remained quiet on pending applications and issued stay orders on multi-crypto ETFs that include XRP. This regulatory stagnation limits XRP’s growth potential and makes it less appealing to institutional investors in the short term.

Since the start of August, Ethereum has gained 28%, Solana 17%, and XRP only 8%. The lack of ETF inflows is a significant barrier keeping XRP below its competitors.

Adding to XRP’s challenges is continued regulatory ambiguity. Ripple’s Chief Legal Officer, Stuart Alderoty, recently sent a letter to Senate Banking Committee Chair Tim Scott criticizing a proposed bill regulating digital assets. Alderoty warned that the bill would leave decisions to the discretion of the current SEC, with no fixed endpoint, putting the crypto market at the mercy of future regulatory shifts. Without clear direction from Washington, cryptocurrency firms like Ripple must navigate a landscape that could change drastically with each administration.

Still, XRP has a few hopeful prospects in focus. Should Ripple secure a U.S. banking charter or take on SWIFT with scalable remittance solutions, XRP could see a spike in adoption. These developments might trigger a breakout and potentially help XRP revisit previous highs.

Looking forward, XRP’s price will largely depend on a few critical events:

- Approval or denial of XRP-focused ETFs

- Ripple’s effort to obtain a U.S. bank license

- Progress in replacing or competing with SWIFT

- Legislation updates after Congress returns in September

The price currently hovers around $3.2721. Breaking above $3.3 could open a path to $3.5, and possibly the July 18 record high of $3.6606. A slide below $3.2, on the other hand, may expose $3.00 as the next line of psychological support, with the 50-day exponential moving average as the technical fallback.

Meanwhile, Bitcoin has surged to an all-time high of $123,731, bolstered by strong inflows into spot ETFs and rising corporate demand. Fed rate cut speculation also plays a role, as investors seek refuge in digital assets like BTC amid macroeconomic shifts. Market participants are nearly certain of a Fed rate cut in September, with further easing expected in Q4, according to market indicators.

Institutional buying has driven much of Bitcoin’s rally. Funds including BlackRock’s iShares, Metaplanet, Smarter Web, and H100 recently bought nearly all the week’s new BTC supply. These moves signal aggressive positioning by institutions ahead of expected interest rate cuts and regulatory developments.

On August 13 alone, BTC-related ETFs saw substantial inflows: ARK 21Shares added $36.6 million, and Fidelity’s Wise Origin fund added $26.7 million. Total net inflows reached $86.9 million, which may mark six consecutive days of gains for the sector. ETF inflows remain a key factor propelling Bitcoin’s price.

Related: XRP Price: $12M Max Pain for Bears

As for XRP, traders should keep an eye on potential ETF announcements, legislative actions like the CLARITY Act, and U.S. economic data, all of which could serve as catalysts. Until then, XRP may struggle to match the rally of BTC and ETH without a clear shift in regulatory stance or major institutional developments.

Quick Summary

XRP is facing growing pressure as delays in regulatory approvals for spot ETFs and uncertainties in crypto regulation cloud its short-term prospects. While tokens like Bitcoin (BTC) and Ethereum (ETH) climb to new highs, XRP remains subdued, partly due to the lack of action from regulators.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.