XRP is once again at the center of debate as crypto analysts weigh in on whether it’s poised for a massive rally or if its current price already indicates the cycle high.

XRP is once again at the center of debate as crypto analysts weigh in on whether it’s poised for a massive rally or if its current price already signals the cycle high.

Recent Price Movements and Market Sentiment

After a steep drop from a July peak of $3.66 to a low of $2.69 recorded on September 1, XRP has shown signs of recovery, climbing back nearly 5.57%. This moderate rebound has revived speculation on whether additional upward momentum remains or if XRP has already reached its highest point for this crypto cycle.

Market sentiment is divided. Some analysts believe there’s limited room left for XRP to grow beyond its recent highs, while others argue the upward trajectory is far from over. One such voice, Crypto Rover, forecasted that if Ethereum (ETH) hits $9,500 in the coming months, XRP may only peak at $4.8—a 57% increase from its current level.

How EGRAG Crypto Visualizes XRP’s Potential

In contrast, renowned market analyst EGRAG Crypto strongly disagrees with the idea that XRP’s rally might halt around $4 or so. In his latest analysis, he posits a binary outlook: either XRP continues its climb toward $22, or it has already plateaued at $3.66.

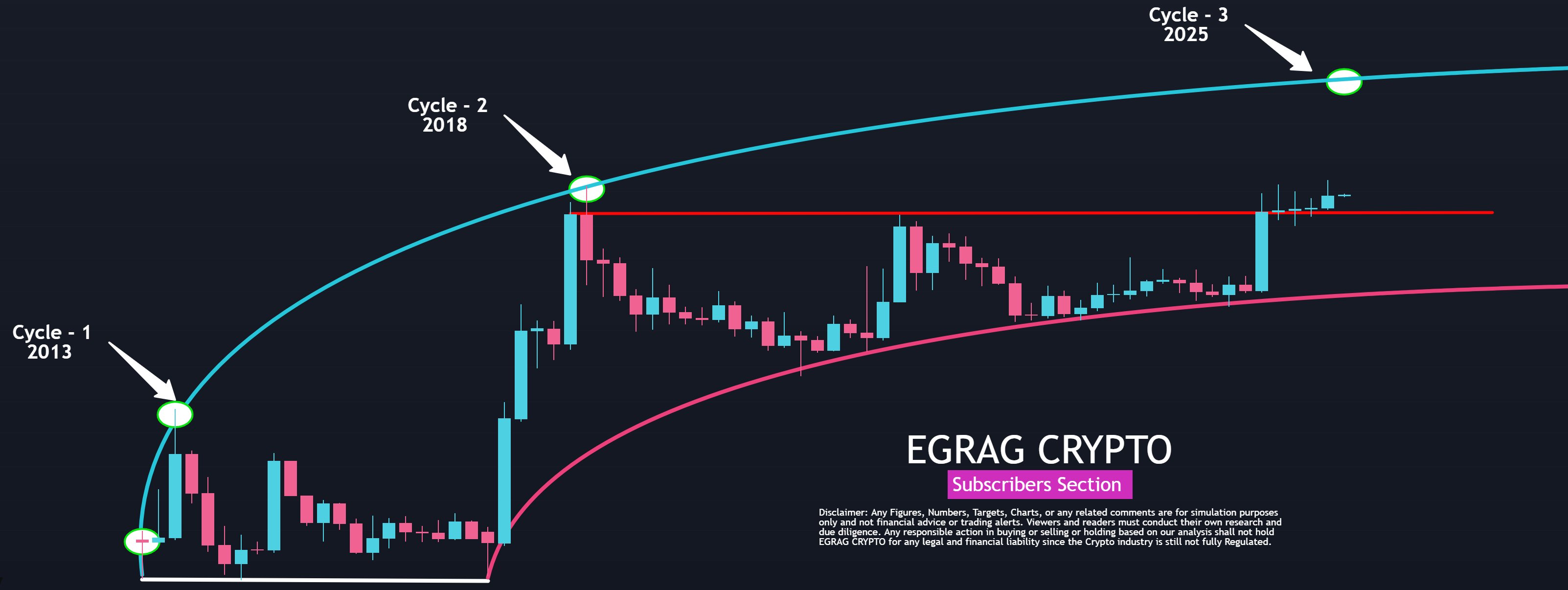

Backing his argument, EGRAG shared a historical price chart available to his subscribers. As a preview, he showcased two prominent curves in his model—one marking cyclical price tops and the other marking bottoms. Examining previous movements, XRP’s earlier tops were perfectly aligned with this upper curve.

During its first major cycle in December 2013, XRP hit $0.0614, respecting the upper boundary. Later, in January 2018’s bull run, XRP peaked at $3.31, again matching the same top curve. Notably, XRP deviated from this pattern in its 2021 cycle when it didn’t touch the upper boundary.

Technical chart outlining XRP’s historical cycle tops and projection for the current cycle. | Source: EGRAG Crypto

The $22 Prediction: Hope or Hype?

Currently, EGRAG’s model suggests that XRP has not yet touched the upper curve for its ongoing cycle. This curve corresponds to a projected price level of around $22—representing a 674% increase from its recent value of $2.84. The prediction draws strong interest due to its alignment with past cycle behavior.

However, EGRAG cautions that if XRP fails to reach this level in the coming months, the coin may have already seen its zenith at $3.66—mirroring its subdued push during the 2021 cycle. This all-or-nothing perspective has sparked debate across the fintech and crypto trading spheres.

Alternate Views Point to Further Upside

Not all analysts agree with the notion that XRP may have hit its limit. A trader known as Batman recently expressed optimism about a short-term rally. His comments followed XRP sweeping downside liquidity and staging a bounce near $2.70—typically a bullish signal.

12-hour chart reveals strong support and rebound signs. | Source: Batman

Related: XRP Price: $12M Max Pain for Bears

These differing takes highlight the uncertainty surrounding XRP’s next move. Whether it’s destined for another major climb or has already exhausted its bullish momentum remains to be seen. Yet with predictions like EGRAG’s calling for a 674% breakout, XRP enthusiasts and market speculators alike will be watching closely in the months ahead.

Quick Summary

XRP is once again at the center of debate as crypto analysts weigh in on whether it’s poised for a massive rally or if its current price already signals the cycle high.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.