Standard Chartered sharply revised its XRP price target from $8 to $2.80, triggering debate. This adjustment reflects broader crypto market weakness and macroeconomic conditions. The revision impacts XRP sentiment and indicates the volatility in institutional crypto forecasts.

What to Know:

- Standard Chartered sharply revised its XRP price target from $8 to $2.80, triggering debate.

- This adjustment reflects broader crypto market weakness and macroeconomic conditions.

- The revision impacts XRP sentiment and highlights the volatility in institutional crypto forecasts.

Recent scrutiny has fallen on Standard Chartered’s revised XRP price target, which has stirred conversation among market participants. The bank’s adjustment from an ambitious $8 to a more tempered $2.80 has been interpreted differently by various analysts. While some view this as a concerning signal, others argue it aligns with current market realities and doesn’t necessarily undermine XRP’s long-term potential.

Standard Chartered Revises XRP Target

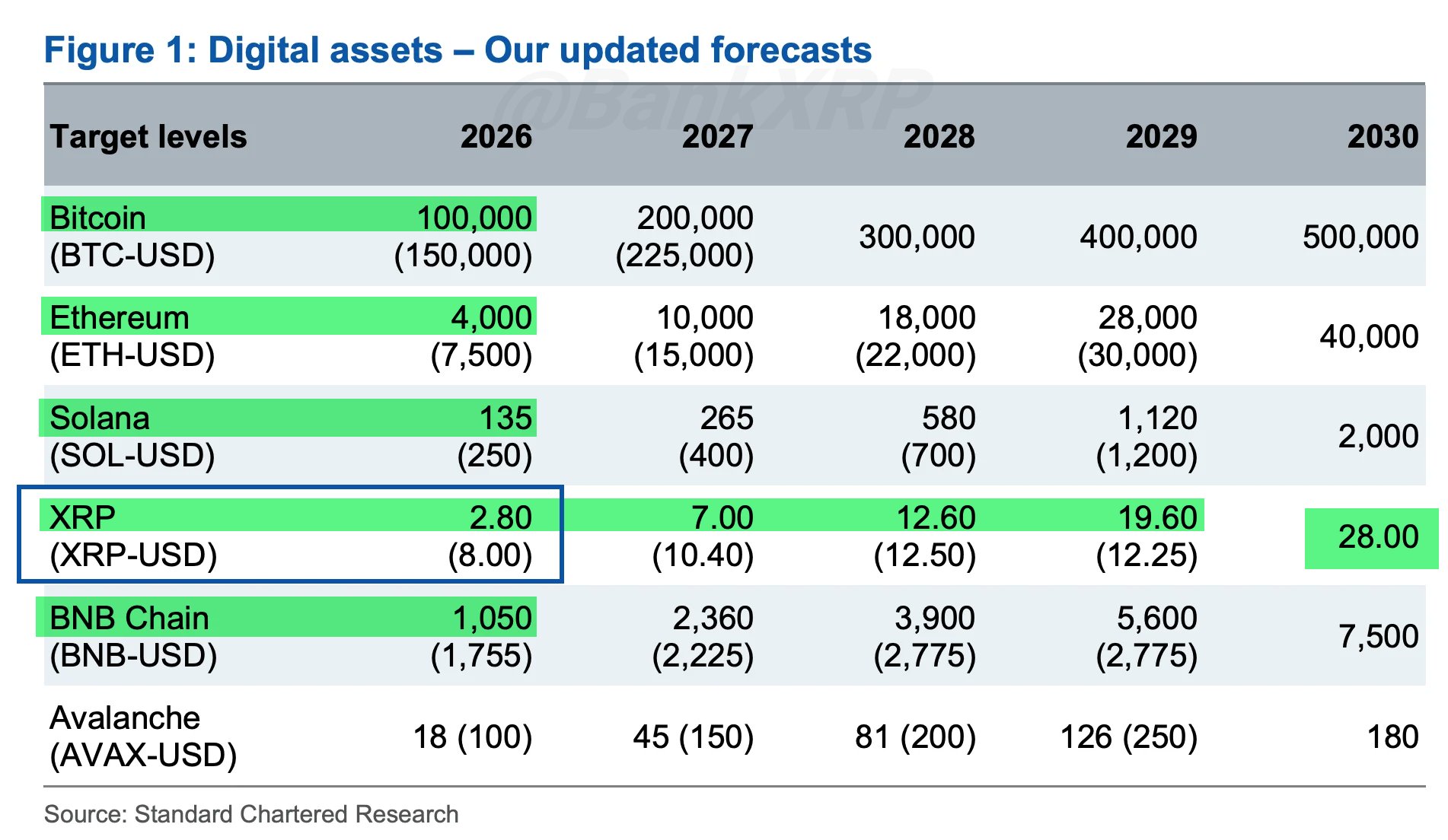

Standard Chartered’s Global Head of Digital Assets Research, Geoffrey Kendrick, issued an updated note to investors, reducing the bank’s end-2026 XRP price target by 65%. This adjustment reflects the significant market correction that has impacted the entire crypto space. XRP, like other digital assets, has experienced substantial volatility, briefly dropping to $1.116 from a peak of $3.66.

Currently trading around $1.48, XRP has struggled to maintain upward momentum. The revised target suggests a more cautious outlook, aligning with the current market dynamics and investor sentiment.

Impact on Bitcoin, Ethereum, and Solana

The revised expectations weren’t limited to XRP; Standard Chartered also adjusted its forecasts for Bitcoin, Ethereum, and Solana. The Bitcoin target decreased from $150,000 to $100,000, Ethereum from $7,000 to $4,000, and Solana from $250 to $135. Despite these near-term reductions, the bank has maintained a long-term 2030 XRP target of $28, indicating sustained confidence in its future growth potential.

Differing Perspectives on the Downgrade

While some analysts like Nick O’Neill view the downgrade as a sign of diminishing expectations, XRP advocate Bill Morgan offers a different perspective. Morgan argues that the initial $8 target was overly optimistic and that the revised $2.80 target is more realistic given present macroeconomic conditions. This viewpoint suggests the adjustment is a recalibration rather than a complete loss of confidence in XRP’s underlying value.

Standard Chartered also highlighted that XRP and Ethereum could gain from developments in stablecoins and tokenized real-world assets. However, the bank cautioned about potential further short-term declines before a broader recovery in 2026.

Potential Catalysts and Market Sentiment

Looking ahead, key catalysts could influence XRP’s trajectory, notably regulatory developments in the U.S., such as the proposed Clarity Act. Treasury Secretary Scott Bessent has indicated that clearer regulatory frameworks could revitalize the digital asset market. Improved regulatory clarity and stabilized liquidity conditions could positively impact sentiment around XRP, irrespective of revised price targets.

Market sentiment remains divided, with some viewing current prices as a buying opportunity, while others anticipate further declines. This divergence underscores the uncertainty and speculative nature of the crypto market.

Conclusion

Standard Chartered’s revised XRP price target reflects a cautious near-term outlook amid broader crypto market challenges. The adjustment has sparked debate, with some seeing it as a negative signal and others as a realistic recalibration. Ultimately, regulatory developments and macroeconomic factors will play crucial roles in shaping XRP’s future performance and investor sentiment.

Related: Crypto Rebels: Goldman CEO Targets El Salvador

Source: Original article

Quick Summary

Standard Chartered sharply revised its XRP price target from $8 to $2.80, triggering debate. This adjustment reflects broader crypto market weakness and macroeconomic conditions. The revision impacts XRP sentiment and highlights the volatility in institutional crypto forecasts.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.