XRP experienced a massive short squeeze, liquidating over $364,000 in short positions and highlighting the risks of concentrated positioning. The price action suggests a potential shift in market control, as the clearing of shorts removes a significant source of selling pressure.

What to Know:

- XRP experienced a massive short squeeze, liquidating over $364,000 in short positions and highlighting the risks of concentrated positioning.

- The price action suggests a potential shift in market control, as the clearing of shorts removes a significant source of selling pressure.

- Maintaining a price level above $1.90 is crucial for XRP to sustain its upward momentum and potentially attract renewed interest.

XRP’s recent price action serves as a stark reminder of the volatility inherent in digital asset markets, particularly when positioning becomes heavily skewed in one direction. The magnitude of the short squeeze, resulting in a 45,901% liquidation imbalance, underscores the potential for rapid and significant price swings. This event is particularly relevant for institutional investors who must carefully manage risk and understand the dynamics of market positioning.

Liquidation Cascade

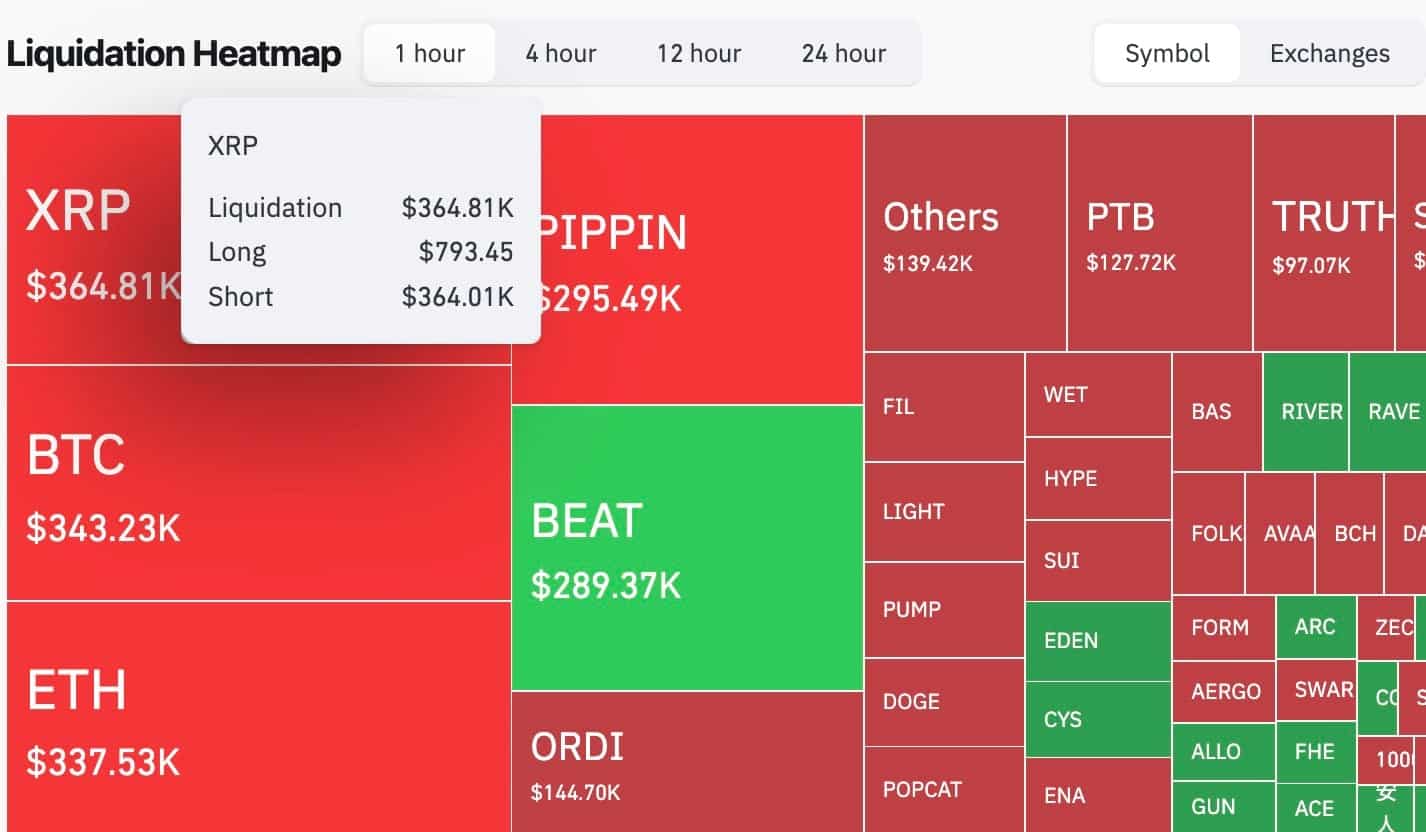

The data from CoinGlass reveals a compelling narrative: a staggering $364,010 in short positions were liquidated, dwarfing the mere $793 in long liquidations. This extreme imbalance suggests that a significant number of traders were betting against XRP, creating a tinderbox of potential energy. Once the price began to move against them, a cascade of forced closures ensued, exacerbating the upward momentum. Such events are not uncommon in markets, but the scale of this liquidation highlights the dangers of crowded trades, a lesson well-heeded by seasoned portfolio managers.

Price Action and Market Structure

XRP’s intraday price action further confirms the shift in market dynamics. The climb from $1.86 to $1.94 was not a fleeting spike but a sustained advance, characterized by higher lows and consistent buying pressure. This suggests genuine demand rather than just a knee-jerk reaction to the short squeeze. For institutional investors, this type of price behavior can signal a potential change in trend and warrant further investigation into the underlying fundamentals and market sentiment.

Implications for Future Price Movement

The clearing of short positions often leads to a period of reduced selling pressure, as the most motivated sellers have already exited the market. If XRP can maintain its price above $1.90, it could establish a new support level and attract fresh buying interest. However, it’s important to note that market conditions can change rapidly, and a resurgence of bearish sentiment could trigger another wave of selling. Prudent risk management and a disciplined approach to position sizing are essential for navigating such uncertainties.

Regulatory and Macro Considerations

While the technical factors surrounding XRP’s short squeeze are noteworthy, it’s crucial to consider the broader regulatory and macro environment. Ongoing legal battles involving Ripple and the SEC continue to cast a shadow over XRP’s long-term prospects. Furthermore, shifts in macroeconomic policy, such as changes in interest rates or quantitative easing, can impact the overall demand for digital assets. Institutional investors must carefully weigh these factors when assessing the risk-reward profile of XRP and other cryptocurrencies.

Historical Parallels

The XRP short squeeze is reminiscent of other instances in financial markets where concentrated positioning led to dramatic price swings. The GameStop saga of early 2021, where a coordinated effort by retail investors triggered a massive short squeeze, serves as a recent example. These events highlight the importance of understanding market structure, monitoring positioning data, and being prepared for unexpected volatility. History doesn’t repeat itself, but it often rhymes, and astute investors can learn valuable lessons from past market events.

In conclusion, XRP’s recent short squeeze underscores the importance of risk management and understanding market dynamics in the digital asset space. The clearing of short positions has created an opportunity for XRP to establish a new support level, but ongoing regulatory uncertainties and macroeconomic factors remain significant considerations. Institutional investors should approach XRP with caution, conducting thorough due diligence and employing disciplined risk management strategies.

Related: Crypto: XRP Saves, Ethereum Levels, More

Source: Original article

Quick Summary

XRP experienced a massive short squeeze, liquidating over $364,000 in short positions and highlighting the risks of concentrated positioning. The price action suggests a potential shift in market control, as the clearing of shorts removes a significant source of selling pressure.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.