XRP experienced a highly unusual short liquidation event, with short positions disproportionately affected compared to long positions. Despite the recent price increase, XRP remains below its December low, and its technical setup suggests potential downside risk.

What to Know:

- XRP experienced a highly unusual short liquidation event, with short positions disproportionately affected compared to long positions.

- Despite the recent price increase, XRP remains below its December low, and its technical setup suggests potential downside risk.

- The key question is whether this liquidation event signals a true trend reversal or just a temporary relief within a broader bearish trend.

XRP has recently experienced a highly unusual liquidation event, drawing attention from institutional investors monitoring digital asset market structure. The event saw a massive imbalance in liquidations, with short positions being disproportionately affected. Understanding the context of this event, its potential implications, and whether it signals a genuine shift in market sentiment is crucial for informed investment decisions.

Liquidation Imbalance

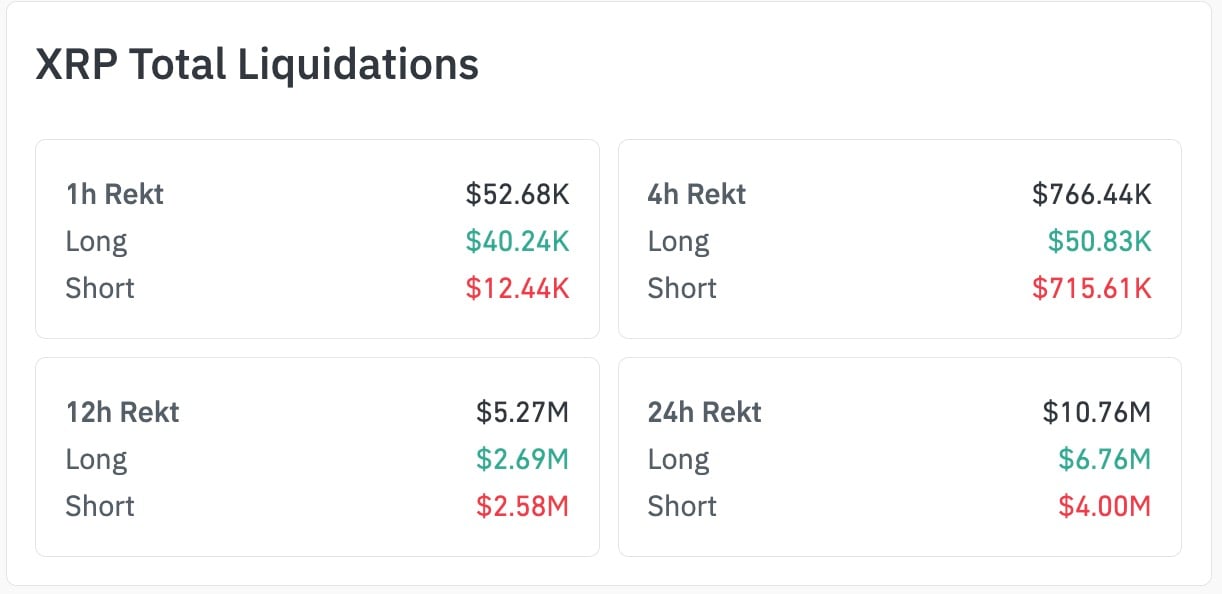

On February 1st, XRP witnessed a significant liquidation event, with short positions taking a heavy hit. Data from CoinGlass revealed $715,610 in short liquidations compared to a mere $50,830 in long liquidations over a four-hour period. This 1,407% imbalance is a rare occurrence, suggesting a potential short squeeze or market anomaly. Such events are closely watched by institutional desks as indicators of market fragility and potential for outsized moves.

Recent Price Action

This liquidation spike followed a period of downward pressure, where XRP declined from over $3 to around $1.53 before a slight recovery. While the recent price increase of 2.9% is positive, XRP remains below its December low, and faces significant resistance levels at $1.89 and $2. The inability to breach these levels could signal continued bearish sentiment. This price action highlights the importance of considering both short-term fluctuations and broader trends when assessing investment opportunities.

Technical Analysis

From a technical perspective, XRP managed to hold onto a local support level, but the next target appears to be around $1.45. Higher timeframe charts continue to indicate a bearish trend, suggesting further downside risk. Technical analysis plays a crucial role in institutional investment strategies, helping to identify potential entry and exit points based on historical price patterns and market indicators.

Reversal Signal or Liquidation Echo?

The central question is whether this liquidation event represents a genuine trend reversal or simply a temporary relief within a larger bearish cycle. Historically, short-side liquidations often provide only temporary relief and rarely lead to full cycle bottoms. If XRP fails to bounce back above the $1.80-$2 range soon, it could indicate that the market is overreacting to the liquidation event. Institutional investors will be closely monitoring price action and volume to determine the true significance of this event.

Market Overreaction

The 1,407% liquidation gap is undoubtedly a notable event, but its long-term impact remains uncertain. If bulls cannot capitalize on this event and drive prices higher, it may be viewed as a costly misstep by those who were overly pessimistic. The market’s reaction in the coming days will be crucial in determining whether this liquidation event marks a turning point or simply a short-term anomaly. This underscores the importance of disciplined risk management and avoiding overreactions to short-term market fluctuations.

In conclusion, the recent liquidation event in XRP is a significant development that warrants close attention from institutional investors. While the event may provide short-term relief, the overall trend remains bearish, and further price appreciation is needed to confirm a genuine reversal. Prudent investors should carefully analyze price action, volume, and market sentiment to make informed decisions, avoiding the temptation to overreact to short-term fluctuations.

Related: Ethereum Takes $200M Punch: Crypto Liquidity Signals

Source: Original article

Quick Summary

XRP experienced a highly unusual short liquidation event, with short positions disproportionately affected compared to long positions. Despite the recent price increase, XRP remains below its December low, and its technical setup suggests potential downside risk.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.