A substantial 1.44 trillion SHIB was moved from Coinbase Prime to a single, new Shiba Inu whale address, suggesting accumulation by a large player. XRP derivatives markets saw a massive 18,913% liquidation imbalance, overwhelmingly impacting short positions, though spot prices remained relatively stable.

What to Know:

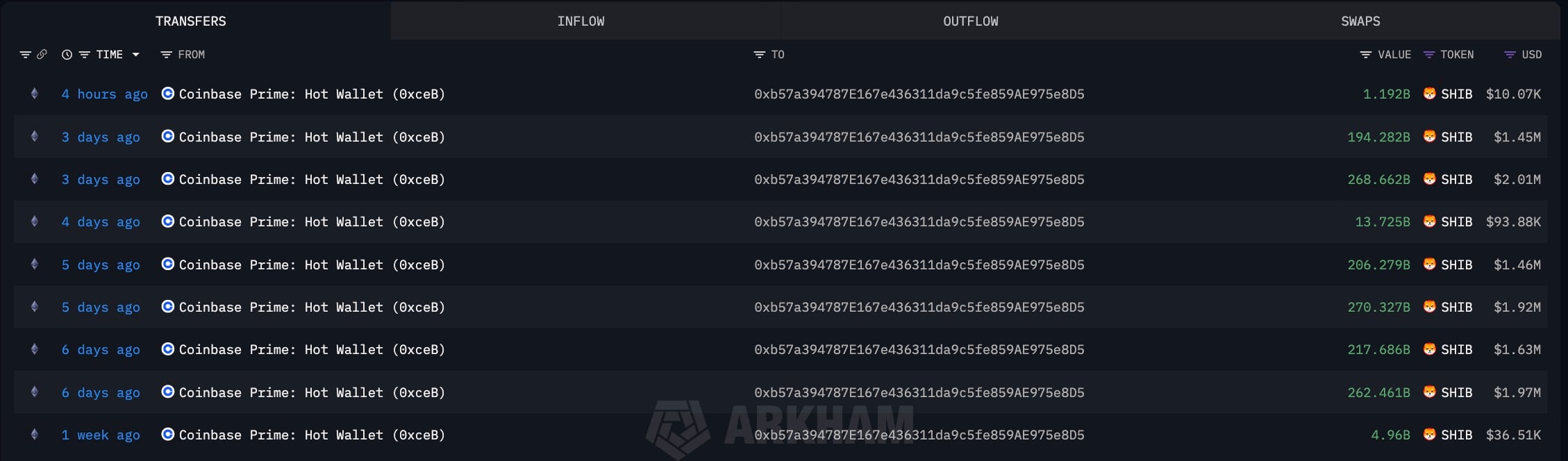

- A substantial 1.44 trillion SHIB was moved from Coinbase Prime to a single, new Shiba Inu whale address, suggesting accumulation by a large player.

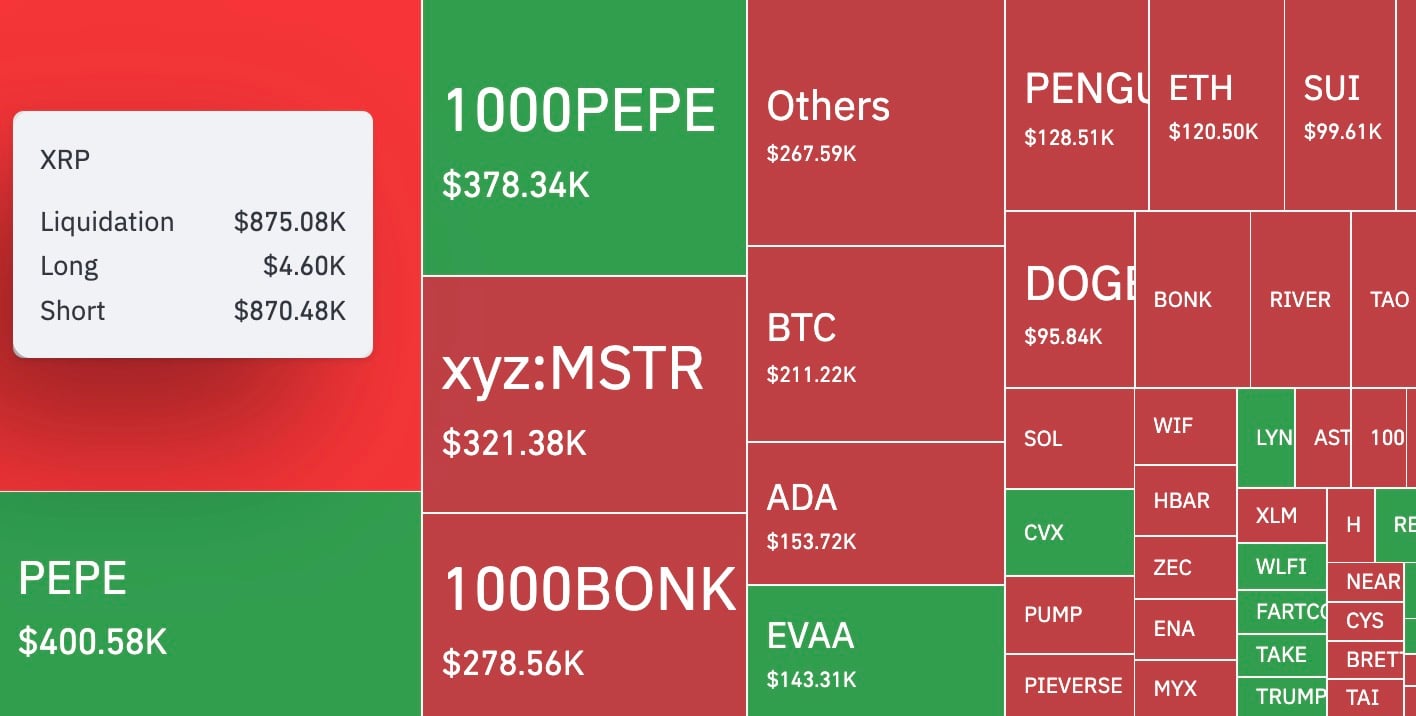

- XRP derivatives markets saw a massive 18,913% liquidation imbalance, overwhelmingly impacting short positions, though spot prices remained relatively stable.

- Bitcoin flirts with the psychological $100,000 level as its weekly chart shows continued strength, keeping the possibility of reaching this milestone in January alive.

As we navigate the early days of 2026, the digital asset market continues to present intriguing dynamics. Recent movements in Shiba Inu (SHIB), XRP, and Bitcoin highlight the ongoing interplay between retail interest, derivatives markets, and the ever-elusive institutional adoption. These events underscore the importance of understanding market structure and potential catalysts for both bullish and bearish scenarios.

Shiba Inu Whale Accumulation

The transfer of 1.44 trillion SHIB from Coinbase Prime to a single address is a noteworthy event. Such a large movement from a prime brokerage account typically indicates accumulation by a high net worth individual or an institution. The immediate market reaction was a price increase, reflecting the perceived reduction in available supply on exchanges. However, it remains to be seen whether these tokens are destined for long-term cold storage or a staging wallet for future distribution. This type of supply dynamic is reminiscent of the early days of Bitcoin, where large holders could significantly influence price action based on relatively small movements.

XRP Derivatives Market Turmoil

The extreme liquidation imbalance in XRP derivatives, with shorts bearing the brunt, is a classic example of a short squeeze. The fact that this occurred without a significant corresponding move in the spot price suggests either a highly concentrated short position being unwound or potential manipulation in the derivatives market. This scenario highlights the risks associated with leveraged trading, particularly in altcoins with lower liquidity and higher volatility. Institutional investors should be wary of such imbalances, as they can create artificial price movements and increase the potential for cascading liquidations.

Bitcoin’s Push Towards $100,000

Bitcoin’s continued strength, as evidenced by its weekly chart, keeps the $100,000 target within reach. The proximity of the current price to the mid-band of the Bollinger Bands on the weekly timeframe is indeed a focal point for market participants. This level represents a natural area of resistance, and a sustained break above it could signal further upside potential. However, it’s crucial to remember that technical indicators are not crystal balls. The macro environment, regulatory developments, and institutional inflows will ultimately determine whether Bitcoin can maintain its upward trajectory. The current setup is similar to previous bull cycles, where psychological levels act as magnets for price action.

Altcoin Season or Flash in the Pan?

The combined movements in SHIB, XRP, and Bitcoin raise the question of whether we are entering a new phase of altcoin outperformance. While the SHIB whale activity and XRP short squeeze may be isolated incidents, they could also be early indicators of renewed interest in the broader altcoin market. Historically, Bitcoin bull runs have often been followed by periods of altcoin speculation, as investors seek higher-risk, higher-reward opportunities. However, it’s important to exercise caution and conduct thorough due diligence before allocating capital to altcoins, as many projects lack fundamental value and are prone to pump-and-dump schemes.

Regulatory Scrutiny and Market Maturity

As the digital asset market matures, regulatory scrutiny will continue to intensify. The SEC’s stance on various crypto projects, particularly those involving unregistered securities offerings, remains a significant headwind. The outcome of ongoing legal battles, such as the SEC v. Ripple case, will have far-reaching implications for the industry. Institutional investors must closely monitor regulatory developments and ensure compliance with all applicable laws and regulations. A clear and consistent regulatory framework is essential for fostering long-term growth and stability in the digital asset market.

In conclusion, the recent market activity across SHIB, XRP, and Bitcoin provides valuable insights into the current state of the digital asset landscape. While the potential for further upside remains, investors should proceed with caution, carefully assessing risk and reward, and remaining vigilant in the face of market volatility and regulatory uncertainty. The interplay between retail speculation, derivatives positioning, and institutional adoption will continue to shape the future of this evolving asset class.

Related: XRP Signals Potential Based on Bollinger Bands

Source: Original article

Quick Summary

A substantial 1.44 trillion SHIB was moved from Coinbase Prime to a single, new Shiba Inu whale address, suggesting accumulation by a large player. XRP derivatives markets saw a massive 18,913% liquidation imbalance, overwhelmingly impacting short positions, though spot prices remained relatively stable.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.