XRP experienced a massive short squeeze, with liquidations heavily skewed towards short positions following a favorable CPI release. The event reflects XRP’s sensitivity to macro events and its role as a liquidity proxy in the digital asset market.

What to Know:

- XRP experienced a massive short squeeze, with liquidations heavily skewed towards short positions following a favorable CPI release.

- The event underscores XRP’s sensitivity to macro events and its role as a liquidity proxy in the digital asset market.

- The sustainability of any potential breakout above the $2.08 resistance will depend on spot market reaction and continued positive sentiment.

XRP has once again captured the attention of institutional investors, this time not due to regulatory developments or company-specific news, but rather a dramatic short squeeze in the derivatives market. The backdrop: cooling inflation data in the United States. The implication: a painful lesson for leveraged short sellers and a potential catalyst for further price appreciation, assuming spot market participants validate the move.

Derivatives Market Carnage

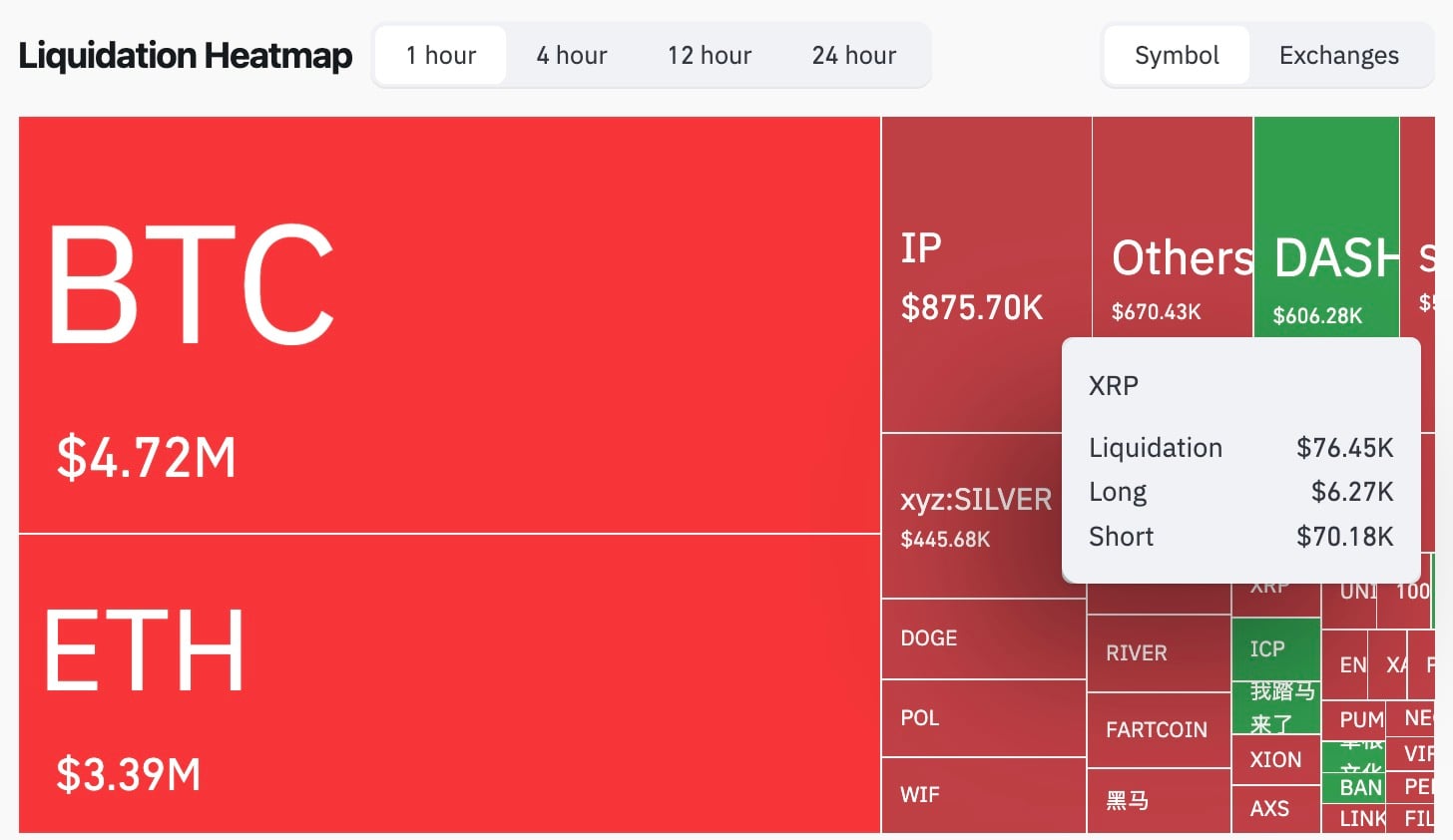

The numbers tell the story: a staggering 1,122% imbalance in liquidations, with short positions bearing the brunt of the pain. According to CoinGlass data, XRP liquidations totaled $76,450 in a single hour, with over $70,000 coming from short positions compared to just over $6,000 from longs. This extreme asymmetry suggests a concentrated build-up of short positions that were caught off-guard by a sudden price spike. Such events are not uncommon in crypto, but the magnitude of this particular squeeze is notable.

CPI Data Ignites the Fuse

The catalyst for this squeeze appears to be the release of softer-than-expected Core CPI data. With inflation showing signs of cooling, derivatives traders quickly priced in expectations for more aggressive interest rate cuts by the Federal Reserve. This shift in sentiment triggered a wave of buying across risk assets, and XRP, with its heavily shorted derivatives market, became a prime target. The lesson here is clear: macro events can have an outsized impact on even the most idiosyncratic crypto assets, especially when leverage is involved.

XRP: A Liquidity Proxy?

The article posits that XRP moved “as a liquidity proxy rather than a trend follower.” This is a crucial observation. XRP’s price action often reflects broader market sentiment and liquidity flows, rather than being driven by project-specific fundamentals. This behavior can be both a blessing and a curse. In times of market exuberance, XRP can outperform as traders seek exposure to the crypto space. Conversely, during periods of risk aversion, XRP can underperform as liquidity dries up. Institutional investors should be aware of this dynamic when allocating capital.

Echoes of the Past

Seasoned market participants will recognize the parallels between this XRP short squeeze and similar events in other asset classes. The GameStop saga, for example, saw a heavily shorted stock explode in price as retail investors coordinated to squeeze out hedge funds. While the specifics differ, the underlying dynamic is the same: concentrated short positions create vulnerability to sudden price spikes. These events serve as a reminder of the importance of risk management and the potential for unexpected volatility in leveraged markets.

Spot Market Holds the Key

The question now is whether this short squeeze can translate into sustained price appreciation for XRP. The article correctly points out that the answer depends on how spot flows react. If spot buyers step in to support the rally, it could signal a genuine shift in sentiment and pave the way for a breakout above the $2.08 resistance level. However, if the rally is driven solely by short covering, it may prove to be short-lived. Institutional investors should closely monitor spot market volumes and order book depth to gauge the sustainability of the move.

Related: XRP News: Ripple CEO Move Signals Expansion

Source: Original article

Quick Summary

XRP experienced a massive short squeeze, with liquidations heavily skewed towards short positions following a favorable CPI release. The event underscores XRP’s sensitivity to macro events and its role as a liquidity proxy in the digital asset market.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.