XRP experienced a significant short squeeze, liquidating millions in short positions within a short timeframe. The uneven liquidation flow indicates potential mispositioning in the perpetual futures market. If the current market structure holds, XRP may challenge the $2 level, a price not sustained since December 2025.

What to Know:

- XRP experienced a significant short squeeze, liquidating millions in short positions within a short timeframe.

- The uneven liquidation flow indicates potential mispositioning in the perpetual futures market.

- If the current market structure holds, XRP may challenge the $2 level, a price not sustained since December 2025.

XRP recently triggered a notable short squeeze, highlighting the asset’s volatility and the complexities of trading it in the derivatives market. The move serves as a reminder of the outsized impact perpetual futures positioning can have on spot prices. For institutional investors, understanding these dynamics is crucial for risk management and potential alpha generation.

Liquidation Cascade

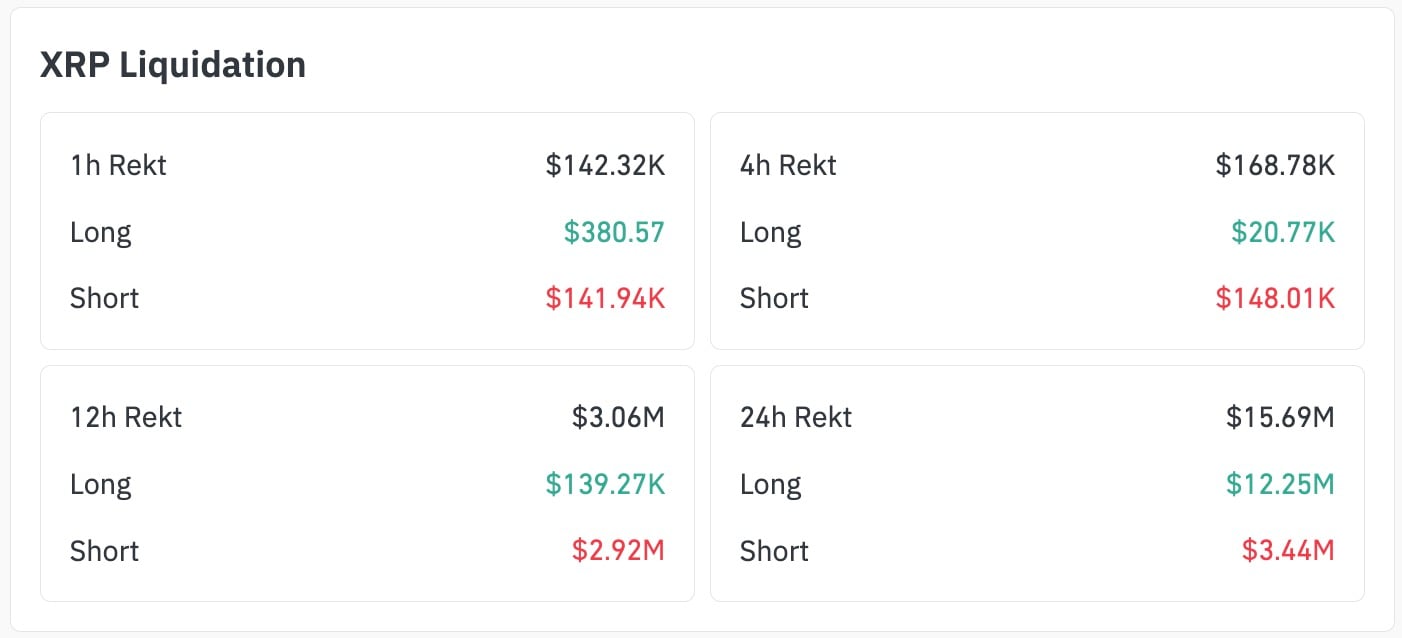

The price of XRP dipped below $1.83 before staging a sharp recovery, catching short sellers off guard. Data indicates a massive liquidation imbalance, with over $2.92 million in short positions wiped out in just 12 hours. This swift upward move triggered cascading stop-outs, exacerbating the price spike. Such events underscore the importance of carefully calibrating risk management strategies when trading assets with high retail interest and corresponding derivative volumes.

Market Mispositioning

The fact that the vast majority of liquidations originated from short positions suggests a degree of mispositioning in the perpetual futures market. This may be due to traders anticipating a short-term retracement after a previous breakout. Such imbalances rarely resolve themselves passively and can fuel further price appreciation if the underlying market structure remains intact. Institutional desks should be aware of these positioning dynamics when assessing potential entry and exit points.

Psychological Resistance

If the current structure holds, XRP’s next target could be the psychological $2 level. This price point has not been sustained for more than 72 hours since December 2025, indicating a significant level of resistance. A successful breach of this level could signal further upside potential, while a rejection could lead to a period of consolidation. Keep in mind that psychological levels often act as magnets for both buyers and sellers, increasing volatility around these areas.

Derivatives Positioning

While the recent short squeeze suggests some degree of speculative fervor, derivatives positioning remains moderate overall. Funding rates and open interest should be closely monitored for signs of overheating, but current leverage levels are below those typically seen before significant corrections. This suggests that there may be room for further price appreciation before the market becomes excessively overbought. However, unexpected macro developments or regulatory actions could quickly change this picture.

Looking Ahead

The recent short squeeze in XRP serves as a reminder of the inherent volatility and potential for outsized moves in the crypto market. While the event may present short-term opportunities for nimble traders, institutional investors should remain focused on long-term fundamentals and risk management. Monitoring derivatives positioning, regulatory developments, and broader market trends will be crucial for navigating the evolving landscape of digital assets.

Related: XRP Milestone Reached: Ripple Confirms $2B

Source: Original article

Quick Summary

XRP experienced a significant short squeeze, liquidating millions in short positions within a short timeframe. The uneven liquidation flow indicates potential mispositioning in the perpetual futures market. If the current market structure holds, XRP may challenge the $2 level, a price not sustained since December 2025.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.