Dogecoin is showing signs of a potential breakout, reminiscent of past rallies, contingent on maintaining key support levels. Solana’s Seeker (SKR) token experienced a significant surge, highlighting the potential of user-centric airdrops in fostering network engagement.

What to Know:

- Dogecoin is showing signs of a potential breakout, reminiscent of past rallies, contingent on maintaining key support levels.

- Solana’s Seeker (SKR) token experienced a significant surge, highlighting the potential of user-centric airdrops in fostering network engagement.

- XRP is at a critical juncture with substantial ETF holdings that could exacerbate downside pressure if key support levels fail to hold.

The digital asset market is currently in a consolidation phase, with Bitcoin hovering near $89,200 and Ethereum trailing at $2,930. Institutional investors are closely monitoring altcoin movements, digesting the implications of recent options expirations, and assessing potential impacts from global trade developments. Amidst this backdrop, Dogecoin, Solana’s SKR token, and XRP are exhibiting notable price action that warrants a deeper examination of their underlying dynamics and potential market impact.

Dogecoin’s Wedge Formation: A Potential Moonshot?

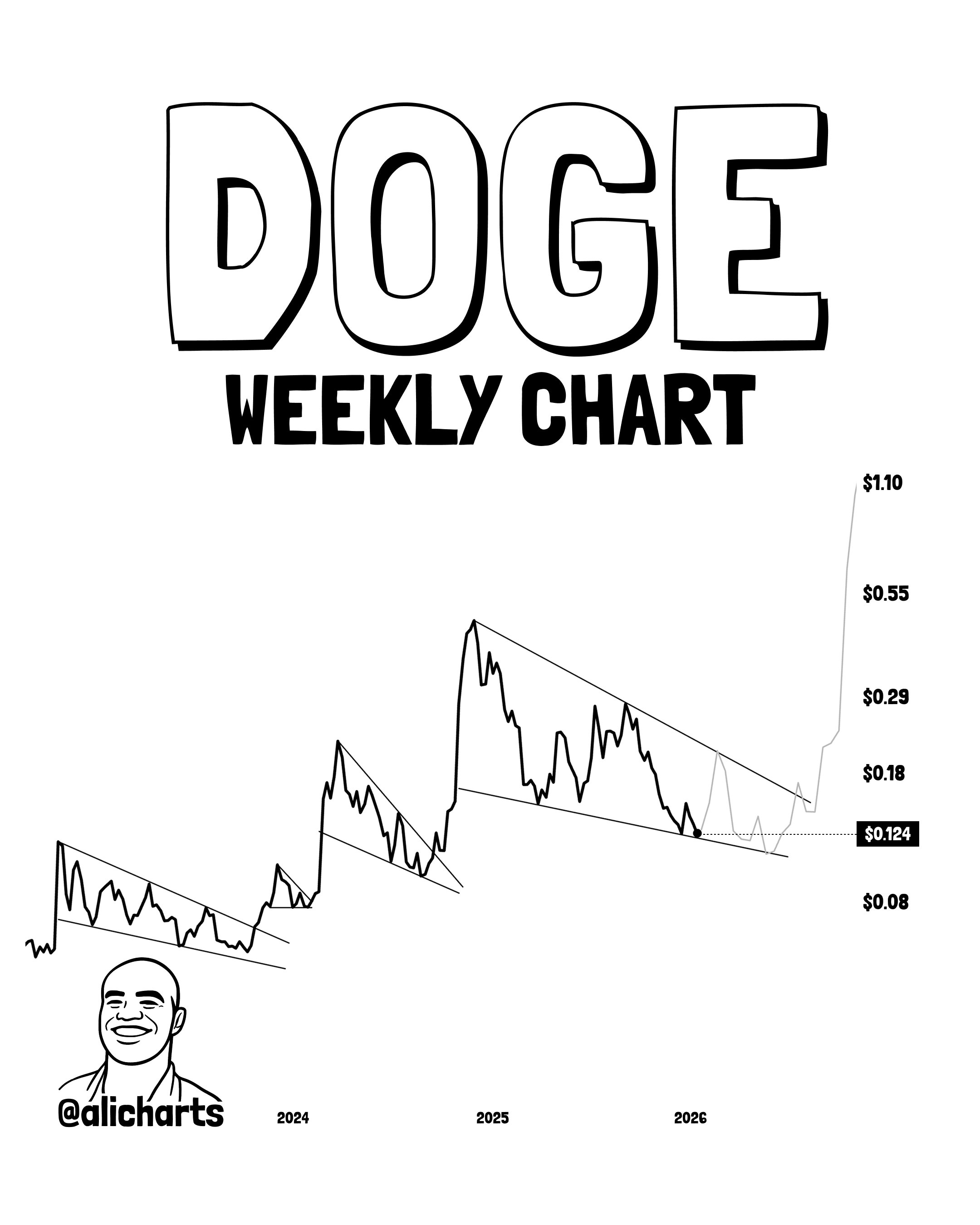

Dogecoin, the original meme coin, is once again capturing attention with a textbook descending wedge formation. Technical analysis suggests a potential breakout targeting $1.10, reminiscent of its previous retail-driven surges. However, traders should be wary of downside spikes toward the $0.08-$0.12 range before any parabolic reversal. The recent launch of a 21Shares Dogecoin ETF, backed by the Dogecoin Foundation, adds a layer of institutional legitimacy to the meme coin narrative, potentially fueling further upside if inflows materialize.

The presence of a new ETF introduces a structural element that could influence Dogecoin’s price discovery. If the wedge pattern confirms, the chart itself may become a self-fulfilling prophecy, attracting momentum traders and retail investors. The last time Dogecoin broke from a wedge of this magnitude, it resulted in a 10x price increase within weeks, underscoring the potential for significant gains, albeit with commensurate risk.

Solana’s SKR Token: A Case Study in User-Centric Airdrops

Solana’s Seeker (SKR) token, airdropped to users of the Solana Saga phone, experienced a remarkable 400% surge, highlighting the effectiveness of user-centric airdrops in driving network engagement. Unlike passive holding rewards, SKR’s eligibility required actual usage of the Solana Saga phone, filtering out opportunists and incentivizing genuine participation. This approach rewarded users and generated significant interest in hardware-linked token mechanics.

The success of SKR underscores the potential for Solana to expand its ecosystem through innovative token distribution models. The airdrop, worth over $8,000 to many recipients, sparked interest in Solana’s hardware offerings and spurred the creation of “Saga-farm” operations. As Solana continues to develop its ecosystem, SKR may serve as a valuable case study for future hardware-token integrations.

XRP’s ETF Dilemma: A Double-Edged Sword?

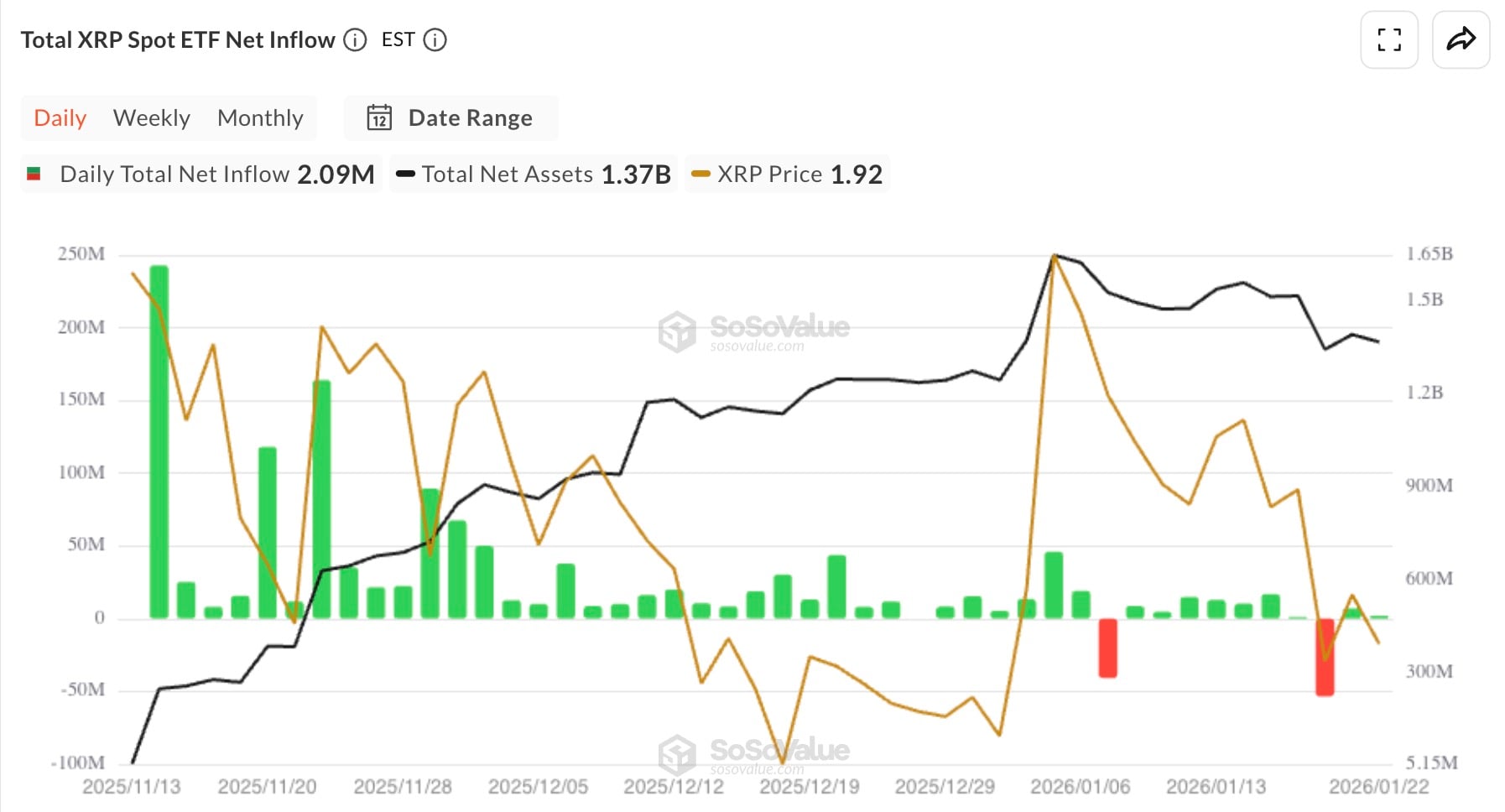

XRP ETFs have amassed $1.37 billion in assets, representing 1.17% of XRP’s market cap. While institutional appetite for XRP is evident, price action has not mirrored this strength, with XRP struggling to break above the $1.97-$2 resistance. A failure to hold the $1.90 support level could trigger a sell-off, potentially unleashing $1.37 billion in XRP into the market.

The risk lies in the fact that ETF holdings represent real tokens. A shift in sentiment could trigger stop-loss orders or redemptions, leading to a significant increase in XRP supply, particularly during low-liquidity sessions. While exchange wallet balances remain thin and ETF inflows persist, market participants are closely monitoring the $1.85-$1.90 range as a critical defense against heavier liquidation risk.

Navigating the Crypto Landscape: Key Catalysts and Levels to Watch

The crypto market continues to exhibit sideways movement, influenced by post-expiry fatigue and macroeconomic uncertainties. Key catalysts to watch this week include U.S.-EU trade updates, discussions on institutional tokenization in Davos, and potential commentary on the CLARITY Act. These developments could introduce volatility and impact the price action of various digital assets.

Traders and investors should closely monitor key levels for Dogecoin, SKR, XRP, and Bitcoin. For Dogecoin, $0.124 is the level to watch for wedge confirmation, with downside risk at $0.08 and upside potential to $1.10 if the breakout holds. SKR’s key levels are $0.048-$0.065 for retest or continuation zones, while XRP’s critical support lies at $1.85-$1.90. Bitcoin’s key levels are $88,500 for support and $90,000 for psychological resistance.

In conclusion, the digital asset market is at a critical juncture, with Dogecoin, Solana’s SKR token, and XRP exhibiting unique dynamics that warrant close monitoring. The success of user-centric airdrops, the potential for meme coin breakouts, and the risks associated with ETF holdings are all factors that could shape the market’s trajectory in the coming weeks. Prudent risk management and a keen understanding of market structure will be essential for navigating this evolving landscape.

Related: XRP Surge Signals Future Liquidity

Source: Original article

Quick Summary

Dogecoin is showing signs of a potential breakout, reminiscent of past rallies, contingent on maintaining key support levels. Solana’s Seeker (SKR) token experienced a significant surge, highlighting the potential of user-centric airdrops in fostering network engagement.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.