XRP has seen an impressive rebound lately, drawing attention to how small net inflows on exchanges can significantly influence its market cap. Last week, XRP dipped to a low of $2.0647, dropping 9.4% from its earlier peak of $2.281.

XRP has seen an impressive rebound lately, drawing attention to how small net inflows on exchanges can significantly influence its market cap.

Last week, XRP dipped to a low of $2.0647, dropping 9.4% from its earlier peak of $2.281. This decline unfolded during a highly publicized clash between Elon Musk and President Donald Trump, a conflict that also wreaked havoc on the stock of Tesla. The confrontation extended into the crypto world given both individuals’ ties to digital assets, including XRP.

At the time of writing, XRP has fully recovered and is trading at $2.23. Analysts are now closely examining the modest inflows that fueled this resurgence, suggesting these could be key indicators of future trends.

XRP Sees $18.6M Inflow, Triggers $10B Market Cap Boost

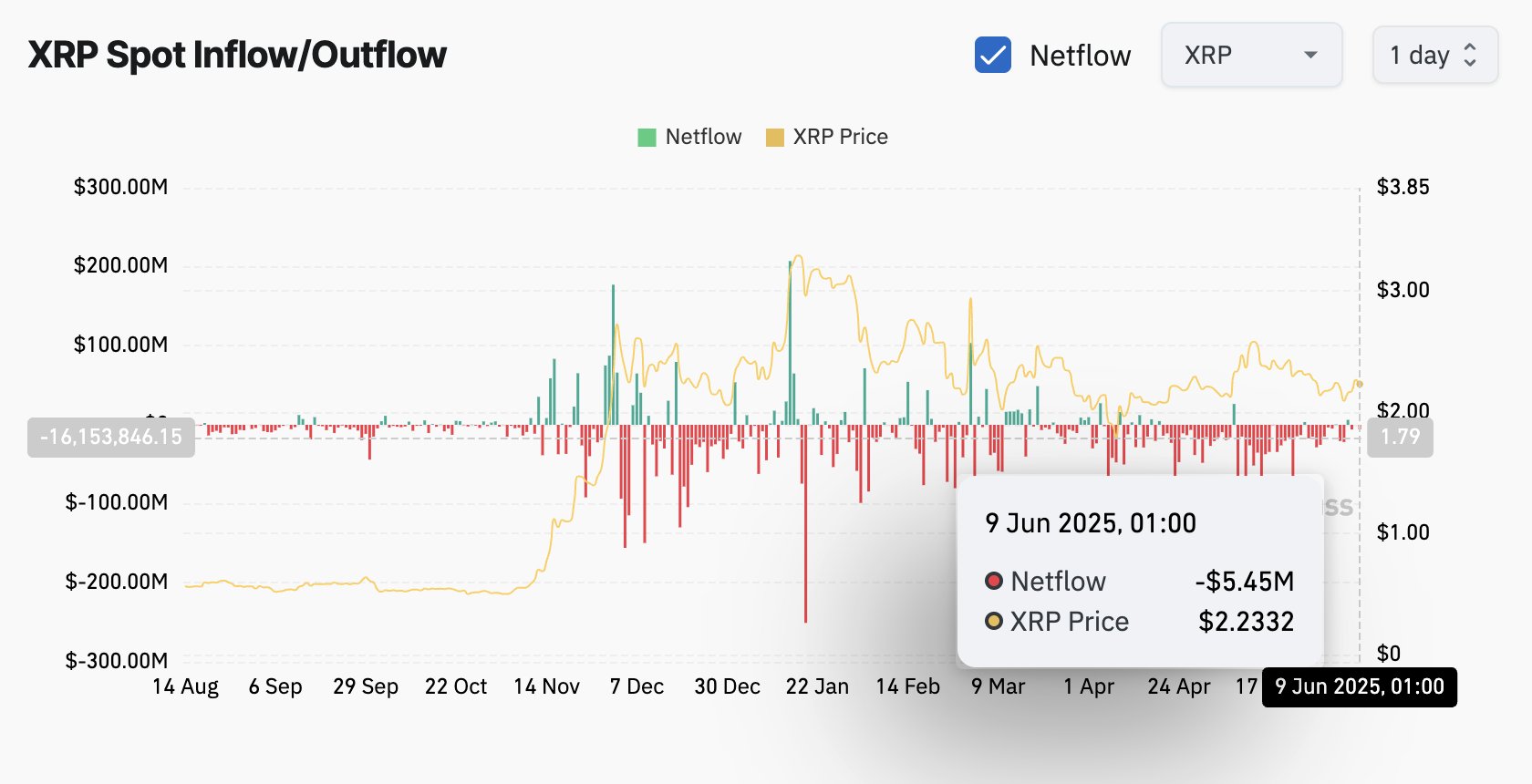

Chad Steingraber, a prominent figure in the XRP community, pointed out in a tweet that on June 6, XRP rose from $2.08 to $2.17 following a relatively small net inflow of $18.6 million. Surprisingly, this led to a $10 billion increase in XRP’s total market cap. In this scenario, each dollar added to net inflow seemed to contribute roughly $538 in market cap expansion.

Another well-known XRP influencer, Zach Rector, commented on these figures, emphasizing how minimal investment can lead to significant price movements. He also suggested that investors might regret not purchasing XRP at its current levels if these upward trends continue due to sustained inflows.

Market Cap Multiplier Reaches 647x on June 7

In a follow-up post made on June 8, Steingraber highlighted an even more notable development. XRP climbed from $2.17 to $2.28 on June 7, supported by just $17 million in net inflows. This triggered approximately $11 billion in market cap growth, based on XRP’s full 100 billion token supply. Here, the market cap multiplier spiked to about 647x — meaning each dollar of inflow potentially boosted the market cap by $647.

However, XRP ended that same day with negative netflow of about $5.88 million, leading to a price retracement, where it closed at $2.17. On the following day, a minor inflow of $41,500 lifted XRP’s closing price to $2.267. At press time, XRP continues to experience negative netflow of around $5.45 million, yet the token remains stable around $2.23.

Taking this multiplier into account, community analyst Tomasz Wilkosz argued that XRP has the potential to reach $8.64, should it see a hypothetical investment of $1 billion.

Focus on ETFs and Long-Term Flows

Despite these noteworthy netflow-to-market cap multipliers, XRP’s broader market has seen recurring negative flows over the past several months. This might explain its mostly stagnant performance in recent times.

On the other hand, periods of high inflows have aligned with noticeable price increases. For instance, on January 15, 2025, XRP experienced a substantial $207 million positive netflow, sending its price above $3.20 — a strong signal that inflows directly correlate with price movement.

Looking ahead, the XRP community is placing high hopes on XRP spot ETF applications. If approved, these investment products would require fund managers to hold actual XRP tokens, potentially creating consistent upward pressure through ongoing demand.

In the same way Bitcoin ETFs have generated daily inflows and outflows, some analysts speculate that ETF allocations attracting just $4 billion could push XRP above $20, applying the same market cap multiplier methodology previously observed.

Clarifying the Meaning Behind Netflow

The netflow data referenced in this analysis mainly tracks currency entering or leaving centralized exchanges, not actual market purchasing activity. As noted in an earlier report, even enormous crypto movements — such as a $500 million XRP withdrawal — don’t necessarily influence price if they’re not matched by corresponding buy-side pressure.

Related: Expert Advice: Sell XRP If You’re Confused

Ultimately, while netflow patterns offer valuable insights, interpreting them as indicators of capital flow into XRP must be done cautiously. For real investment behavior analysis, order book data and buy volumes are far more telling. Nevertheless, the multiplier effect seen in recent XRP performance points to the token’s high sensitivity to exchange movements — a characteristic that investors and traders alike should monitor closely.

Quick Summary

XRP has seen an impressive rebound lately, drawing attention to how small net inflows on exchanges can significantly influence its market cap. Last week, XRP dipped to a low of $2.0647, dropping 9.4% from its earlier peak of $2.281.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.