Analysts project XRP could reach a $1 trillion market cap, contingent on spot ETF demand and institutional interest. Reaching this valuation with the current token supply would imply a price of approximately $16.47 per XRP.

What to Know:

- Analysts project XRP could reach a $1 trillion market cap, contingent on spot ETF demand and institutional interest.

- Reaching this valuation with the current token supply would imply a price of approximately $16.47 per XRP.

- The timeline for XRP to hit $16 ranges from 2027 to 2036, depending on adoption rates and regulatory clarity, influencing institutional investment.

XRP continues to be a topic of interest among institutional investors, particularly regarding its potential to reach a $1 trillion market capitalization. While current market conditions reflect a more tempered outlook, several analysts maintain that XRP could achieve significantly higher valuations in the long term. The primary drivers for such growth include the possible introduction of XRP spot ETFs and increased institutional adoption, which could substantially impact its market dynamics.

Projections for XRP Market Cap

Market analysts like EGRAG have identified technical patterns, such as a W-shaped formation on XRP’s market cap chart, suggesting a potential surge toward the $1 trillion mark. Similarly, Omni founder Austin King has emphasized the necessity for XRP to expand its utility within the decentralized finance (DeFi) ecosystem to reach such a valuation. These projections are underpinned by ongoing discussions about institutional adoption and XRP’s growing role in facilitating cross-border payments, which are critical factors for attracting substantial capital inflows.

Price Implications of a $1 Trillion Valuation

A $1 trillion valuation would position XRP as one of the leading digital assets. Achieving this market cap would directly influence the token’s price, which is determined by dividing the total market cap by the circulating supply. With approximately 60.7 billion XRP tokens currently in circulation, a $1 trillion market cap would imply a price of around $16.47 per token. This calculation assumes that the circulating supply remains stable. However, future token unlocks by Ripple could slightly dilute the price required to maintain this valuation, adding a layer of complexity to price predictions.

Timeline Scenarios for XRP to Reach $16

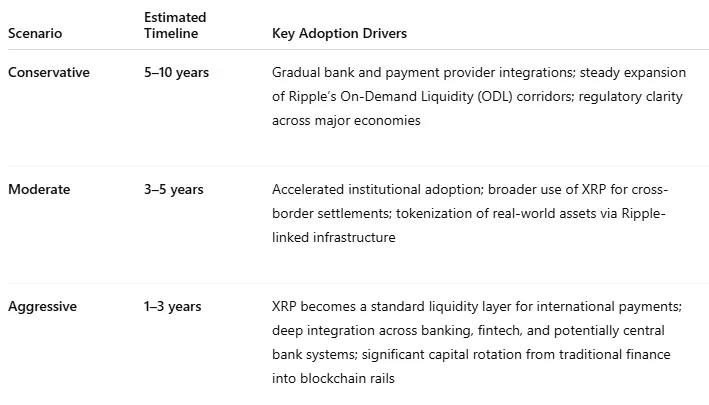

Various analysts and forecasting models offer different timelines for when XRP could reach the $16 price point or achieve a $1 trillion market cap. Changelly analysts estimate this could occur by the end of 2030. More nuanced forecasts consider several scenarios. A conservative outlook suggests a timeline of five to ten years (2031–2036), contingent on gradual adoption by traditional financial institutions and clearer regulatory frameworks. A moderate scenario anticipates this milestone within three to five years (2029–2031), driven by increased use in cross-border settlements and accelerating institutional interest. An aggressive scenario posits that XRP could reach this valuation within one to three years (2027–2029), predicated on deep integration into banking and fintech platforms.

Factors Influencing XRP’s Valuation

Several factors could influence XRP’s long-term valuation. Expanded utility within the DeFi ecosystem, broader acceptance in cross-border payment solutions, and deeper integration into traditional banking and fintech infrastructures are critical. Regulatory clarity in major economies remains a pivotal catalyst, as it would provide the necessary confidence for institutional investors to allocate capital to XRP. Conversely, delays in regulatory approvals or slower-than-expected adoption rates could extend the timeline for XRP to reach its projected valuation.

Conclusion

The projections for XRP reaching a $1 trillion market cap hinge on a combination of market dynamics, technological advancements, and regulatory developments. While the $16 price target remains a long-term aspiration, the actual timeline will depend on XRP’s ability to solidify its role in global finance and attract sustained institutional investment. Investors should closely monitor these factors to assess the viability of these ambitious forecasts and understand the potential risks and rewards.

Related: XRP Signals Breakout Versus Bitcoin

Source: Original article

Quick Summary

Analysts project XRP could reach a $1 trillion market cap, contingent on spot ETF demand and institutional interest. Reaching this valuation with the current token supply would imply a price of approximately $16.47 per XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.