XRP demonstrates short-term bullish indicates amid broader market softness, potentially targeting $2.15. Mid-term outlook for XRP remains neutral, caught between $1.82 and $2.30, requiring a decisive break for directional conviction.

What to Know:

- XRP demonstrates short-term bullish signals amid broader market softness, potentially targeting $2.15.

- Mid-term outlook for XRP remains neutral, caught between $1.82 and $2.30, requiring a decisive break for directional conviction.

- Close monitoring of the $2 level is crucial; a weekly close near this point may foreshadow a decline towards $1.80.

XRP, often a bellwether for sentiment in the digital asset space, currently trades with mixed signals. As regulatory clarity around Ripple’s case evolves and institutional interest in digital assets grows, understanding XRP’s technical positioning becomes increasingly relevant for portfolio allocation and risk management. This analysis delves into XRP’s recent price action, evaluating potential opportunities and risks for sophisticated investors.

Short-Term Bullish Reversal

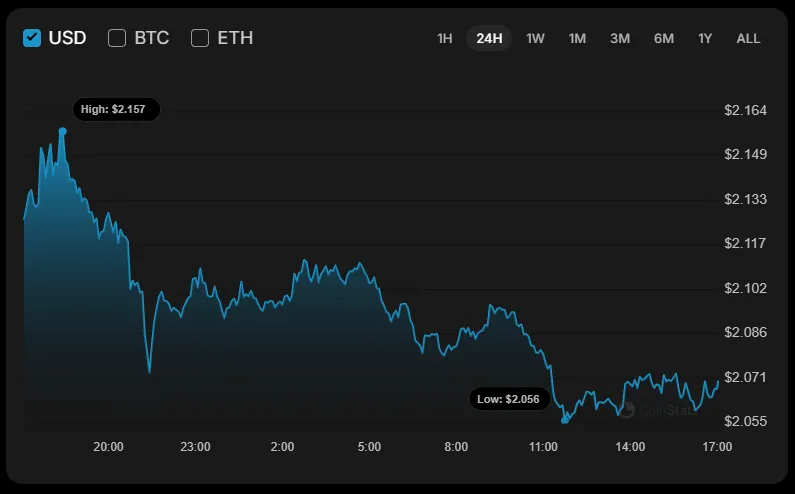

XRP’s price experienced a 1.49% decline over the last 24 hours, yet hourly charts suggest a potential bullish reversal. A false breakout below the $2.0575 support level has been followed by upward momentum. Should the daily candle close near resistance, a move towards $2.15 could materialize. This short-term dynamic presents opportunities for nimble traders but requires careful monitoring of order book depth and potential resistance levels.

Neutral Mid-Term Perspective

Zooming out, XRP’s mid-term trajectory lacks clear direction. The price oscillates within a wide channel, bounded by $1.8209 support and $2.3034 resistance. This indecision reflects broader uncertainty in the digital asset market, where macro factors and regulatory developments exert significant influence. Institutional investors should recognize this range-bound behavior, adjusting positions accordingly and awaiting a definitive breakout before committing significant capital.

Key $2.00 Level

The $2.00 level serves as a pivotal point for XRP. A weekly close near this mark could signal further downside, potentially leading to a test of the $1.80 support zone. Conversely, sustained price action above $2.00 could attract renewed buying interest, reinforcing the bullish narrative. Prudent investors will closely observe this level, factoring it into their risk models and hedging strategies.

Market Structure Considerations

XRP’s price discovery occurs across a fragmented landscape of exchanges, each with varying levels of liquidity and regulatory oversight. This market structure introduces complexities for institutional participants seeking efficient execution and minimal slippage. Furthermore, the availability of derivatives products, such as futures and options, can influence price dynamics and hedging strategies. Understanding these nuances is essential for navigating XRP’s market effectively.

Regulatory and Macroeconomic Context

XRP’s price sensitivity to regulatory news, particularly concerning Ripple’s legal battles, cannot be overstated. Favorable rulings tend to catalyze upward price movements, while adverse outcomes can trigger sharp corrections. Concurrently, broader macroeconomic trends, such as interest rate policies and inflation expectations, impact risk appetite and capital flows into digital assets. A comprehensive investment thesis must account for these external factors.

Historical Parallels and Future Outlook

XRP’s price action often mirrors past cycles in the digital asset market. Periods of exuberance are typically followed by consolidation phases, as the market digests new information and adjusts to evolving conditions. The launch of Bitcoin ETFs, for example, led to an initial surge in prices, followed by a period of sideways trading. Similarly, XRP may experience volatility as regulatory clarity emerges and institutional adoption progresses. Investors should remain vigilant, adapting their strategies to the prevailing market environment.

In summary, XRP presents a mixed picture, characterized by short-term bullish potential and mid-term uncertainty. Prudent investors will closely monitor key price levels, assess regulatory developments, and consider broader macroeconomic trends when formulating their investment strategies. As the digital asset market matures, rigorous analysis and disciplined risk management will be paramount for achieving sustainable returns.

Related: XRP Faces Make-or-Break Moment

Source: Original article

Quick Summary

XRP demonstrates short-term bullish signals amid broader market softness, potentially targeting $2.15. Mid-term outlook for XRP remains neutral, caught between $1.82 and $2.30, requiring a decisive break for directional conviction. Close monitoring of the $2 level is crucial; a weekly close near this point may foreshadow a decline towards $1.80.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.