XRP experienced a 2.11% price decrease, reflecting current market volatility. Short-term analysis suggests potential further declines if selling pressure persists. Midterm outlook indicates a possible test of the $2.00 support level by the end of the month.

What to Know:

- XRP experienced a 2.11% price decrease, reflecting current market volatility.

- Short-term analysis suggests potential further declines if selling pressure persists.

- Midterm outlook indicates a possible test of the $2.00 support level by the end of the month.

XRP’s price has seen notable fluctuations, capturing the attention of traders and investors alike. Recent analysis indicates potential bearish trends that could influence XRP’s valuation in the coming weeks. Understanding these patterns is crucial for those looking to navigate the crypto market effectively.

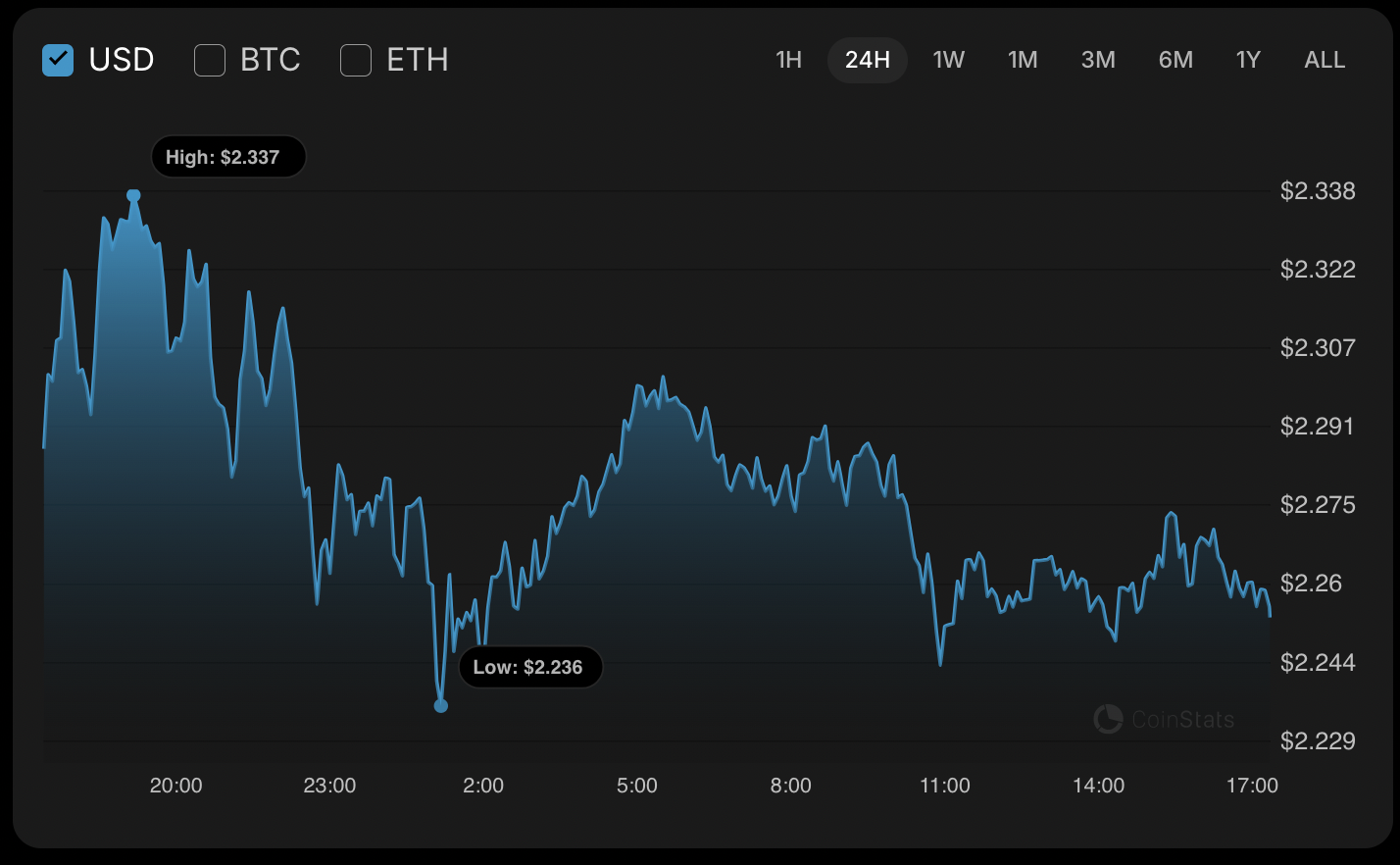

XRP’s hourly chart reveals a descent toward the $2.2428 support level, suggesting that sustained selling pressure could trigger a breakout. This could lead to a further price decrease, potentially reaching the $2.23-$2.24 range. Monitoring this level is essential for anticipating short-term movements.

The daily chart reinforces the bearish outlook, with the current bar poised to close negatively, suggesting a possible test of the $2.10-$2.20 range in the near term. Such a scenario would be relevant for the upcoming week, requiring investors to stay vigilant.

From a midterm perspective, bears appear to maintain control of the market, and if the weekly bar sustains its current trajectory, a test of the $2.00 zone by the end of the month could materialize. This longer-term view is vital for strategic planning in the XRP market.

As of press time, XRP is trading at $2.2596, reflecting the ongoing market dynamics and potential future movements. Investors should closely watch key support and resistance levels to make informed decisions in this evolving landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP experienced a 2.11% price decrease, reflecting current market volatility. Short-term analysis suggests potential further declines if selling pressure persists. Midterm outlook indicates a possible test of the $2.00 support level by the end of the month. XRP’s price has seen notable fluctuations, capturing the attention of traders and investors alike.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.