XRP has shown positive momentum, gaining 4.54%, indicating renewed buyer interest. Short-term technical analysis suggests a potential pullback to $2.10 if immediate support fails. Mid-term price action is indecisive, with critical levels at $2.30 for upside and $2.00 for downside risk.

What to Know:

- XRP has shown positive momentum, gaining 4.54%, indicating renewed buyer interest.

- Short-term technical analysis suggests a potential pullback to $2.10 if immediate support fails.

- Mid-term price action is indecisive, with critical levels at $2.30 for upside and $2.00 for downside risk.

XRP is exhibiting signs of a potential recovery as buyers attempt to re-enter the market. This development occurs amidst ongoing discussions regarding regulatory clarity and Ripple’s legal battles, factors that significantly influence institutional sentiment. Understanding these technical levels and market dynamics is crucial for institutions and high-net-worth individuals looking to strategically position themselves in the digital-asset space.

XRP is currently one of the day’s top performers, up by 4.54%. This upward movement suggests renewed buying pressure. However, it’s essential to consider this within the context of broader market volatility and regulatory uncertainties. Similar rallies have occurred in the past, only to be tempered by adverse news or market corrections. For example, previous positive price movements were often followed by sharp declines when the SEC’s case against Ripple saw new developments.

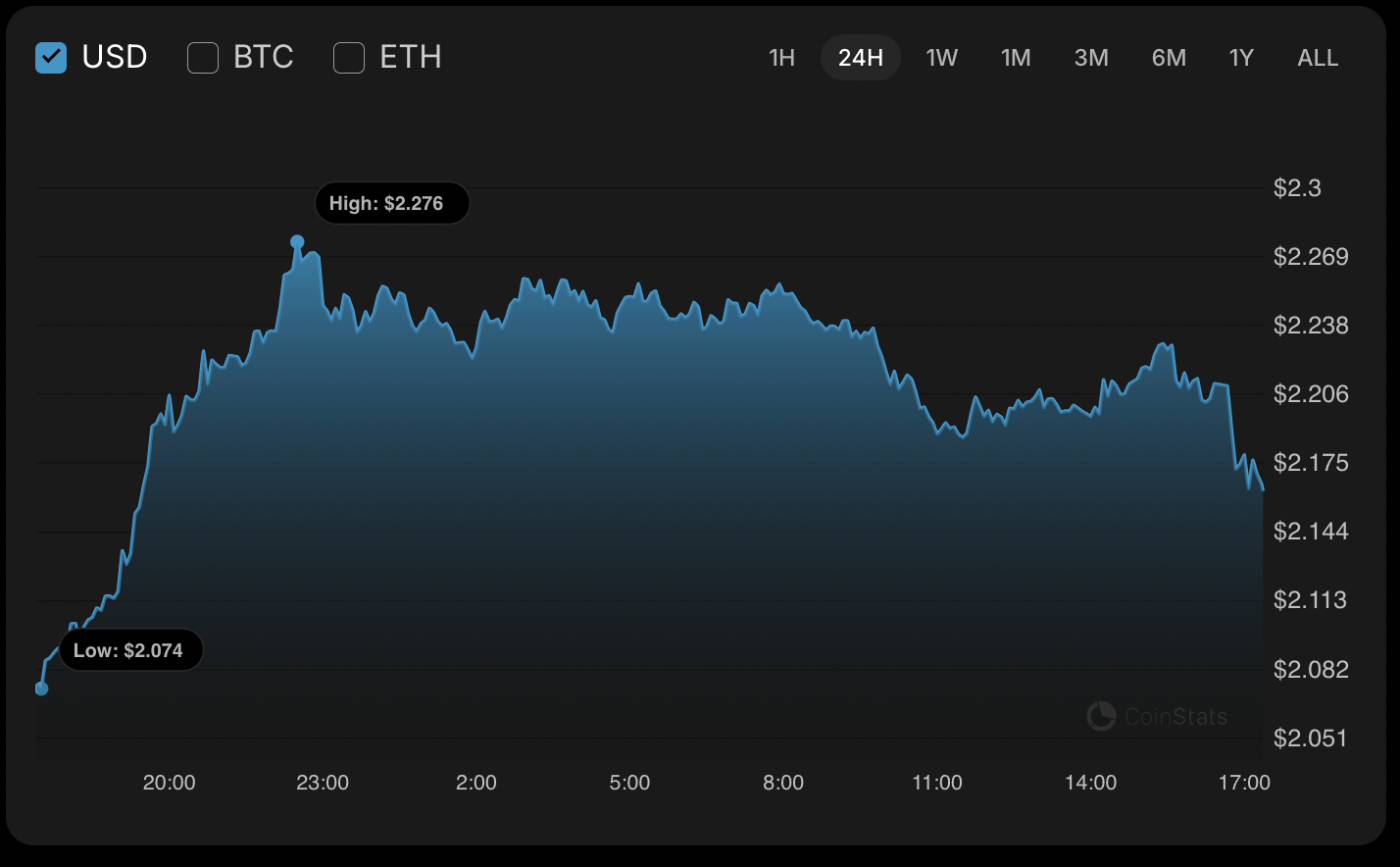

On the hourly chart, XRP’s price is retracing after breaching the $2.1870 support level. A failure to hold this level could precipitate a further decline toward $2.10. Such short-term fluctuations are typical in the crypto market, influenced by speculative trading and algorithmic activity. Institutions should be wary of overreacting to these intraday movements, instead focusing on establishing positions based on longer-term trends and fundamental analysis.

Looking at a longer time frame, the $2.3034 level is a key resistance point. A successful breakout above this level could trigger a rally toward $2.50, driven by pent-up buying pressure. This scenario would likely require a confluence of positive factors, such as favorable regulatory news or increased institutional inflows. Consider the launch of Bitcoin ETFs, which catalyzed significant price appreciation due to the influx of institutional capital.

The analysis suggests that the tug-of-war between buyers and sellers remains unresolved in the medium term. The $2.00 level serves as a critical juncture. A weekly close below this level could signal further downside potential, possibly extending to the $1.50 area. This level represents a significant support zone, and a breach could indicate a shift in market sentiment, potentially driven by macro factors or adverse regulatory developments.

Currently, XRP is trading at $2.1731. This price point underscores the present market equilibrium. For institutional investors, understanding these technical levels is crucial for managing risk and timing entries and exits. As with any digital asset, diversification and a well-thought-out investment strategy are paramount to navigating the inherent volatility.

In summary, XRP’s recent price action indicates a potential for recovery, but significant resistance and support levels remain in play. This dynamic underscores the need for institutional investors to approach XRP with a balanced perspective, combining technical analysis with a thorough understanding of the regulatory landscape and Ripple’s ongoing legal challenges. Such an approach will enable more informed decision-making in this evolving digital-asset market.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP has shown positive momentum, gaining 4.54%, indicating renewed buyer interest. Short-term technical analysis suggests a potential pullback to $2.10 if immediate support fails. Mid-term price action is indecisive, with critical levels at $2.30 for upside and $2.00 for downside risk.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.