XRP is currently trading in a narrow range, reflecting a balance between buying and selling pressure. Low trading volumes suggest a lack of strong conviction from either bulls or bears, pointing to continued sideways movement.

What to Know:

- XRP is currently trading in a narrow range, reflecting a balance between buying and selling pressure.

- Low trading volumes suggest a lack of strong conviction from either bulls or bears, pointing to continued sideways movement.

- A breakout above $2.25 or below $2.15 would likely be needed to establish a clear directional trend.

XRP, the digital asset closely associated with Ripple Labs, finds itself at an interesting juncture. As regulatory uncertainties linger and broader market sentiment remains mixed, XRP’s price action is currently characterized by consolidation. This analysis delves into the technical factors influencing XRP’s short-term trajectory, assessing potential breakout levels and the overall market structure.

Short-Term Technical Outlook

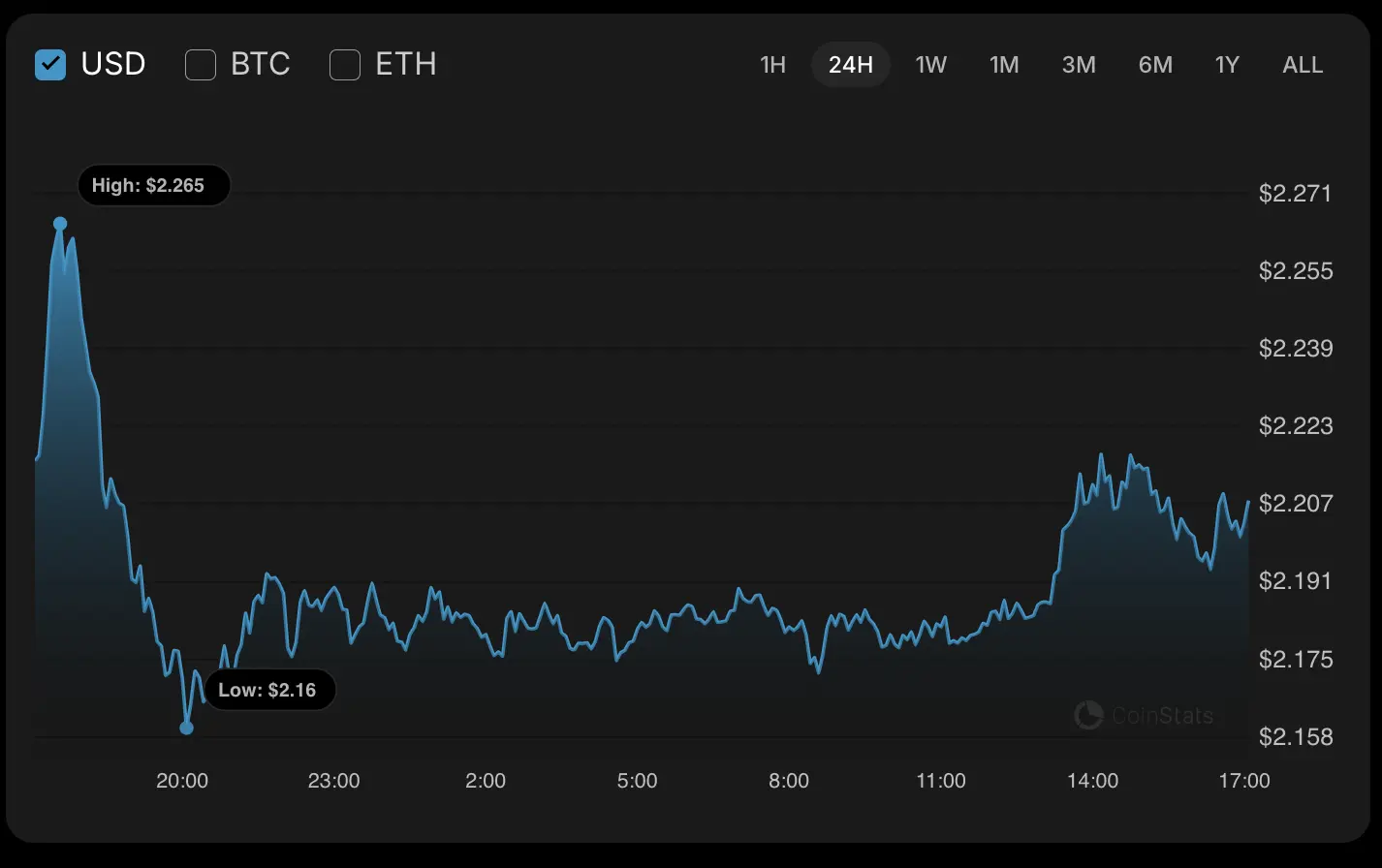

XRP’s recent price action reveals a struggle to overcome immediate resistance levels. The hourly chart indicates a potential retest of the $2.2147 resistance. A successful breach of this level, confirmed by a strong daily close, could signal further upside momentum toward the $2.25 area. However, failure to break through may lead to a retest of lower support levels. Institutional traders often look for such confirmations to validate breakout scenarios, making these levels critical to watch.

Consolidation Within a Defined Range

Examining the broader time frame, XRP is trading within a well-defined channel, bounded by support at $2.1482 and resistance at $2.3034. This sideways movement reflects a market in equilibrium, where neither buyers nor sellers have managed to establish dominance. Such consolidation phases are common in mature assets, often preceding significant breakouts or breakdowns. The resolution of this range will likely dictate XRP’s next major move, with implications for both short-term traders and longer-term investors.

Low Volume and Lack of Conviction

One of the most notable aspects of XRP’s current trading pattern is the persistently low volume. This suggests a lack of strong conviction from either buyers or sellers. Without significant volume, price movements are likely to remain muted, and any breakout attempts may lack the necessary momentum to sustain themselves. Institutional investors, in particular, tend to favor assets with robust liquidity, making low-volume environments less appealing.

Midterm Perspective: Sideways Trading

From a midterm perspective, XRP’s price action remains indecisive. The current candle pattern reflects an absence of strong directional bias, with the price contained within the range of the previous candle. This reinforces the likelihood of continued sideways trading, oscillating between $2.10 and $2.30. Such patterns can frustrate short-term traders but may offer opportunities for range-bound strategies, provided risk management is diligently applied.

Regulatory and Macroeconomic Context

It’s crucial to consider the broader context in which XRP is trading. Regulatory developments surrounding Ripple’s legal battles with the SEC continue to cast a shadow over the asset. Favorable outcomes could act as a catalyst for significant price appreciation, while adverse rulings could trigger further downside pressure. Additionally, macroeconomic factors, such as interest rate policies and overall market risk sentiment, can influence investor appetite for digital assets like XRP.

Potential Catalysts and Future Outlook

Looking ahead, several potential catalysts could disrupt XRP’s current consolidation phase. Positive developments in the Ripple case, increased institutional adoption, or breakthroughs in cross-border payment solutions could all spark renewed interest in the asset. Conversely, further regulatory crackdowns or negative market sentiment could lead to a breakdown below current support levels. Monitoring these factors will be essential for gauging XRP’s future trajectory.

In summary, XRP is currently navigating a period of consolidation, characterized by low volume and a lack of clear directional momentum. The asset is trading within a defined range, and a breakout above $2.25 or below $2.15 would likely be needed to establish a new trend. As always, investors should carefully consider the regulatory and macroeconomic landscape when assessing the potential risks and rewards of holding XRP.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is currently trading in a narrow range, reflecting a balance between buying and selling pressure. Low trading volumes suggest a lack of strong conviction from either bulls or bears, pointing to continued sideways movement.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.