XRP faces bearish pressure, testing key support levels. Sideways trading is expected in the short term, with a range between $2.40 and $2.50. Broader market correction influences XRP’s price action.

What to Know:

- XRP faces bearish pressure, testing key support levels.

- Sideways trading is expected in the short term, with a range between $2.40 and $2.50.

- Broader market correction influences XRP’s price action.

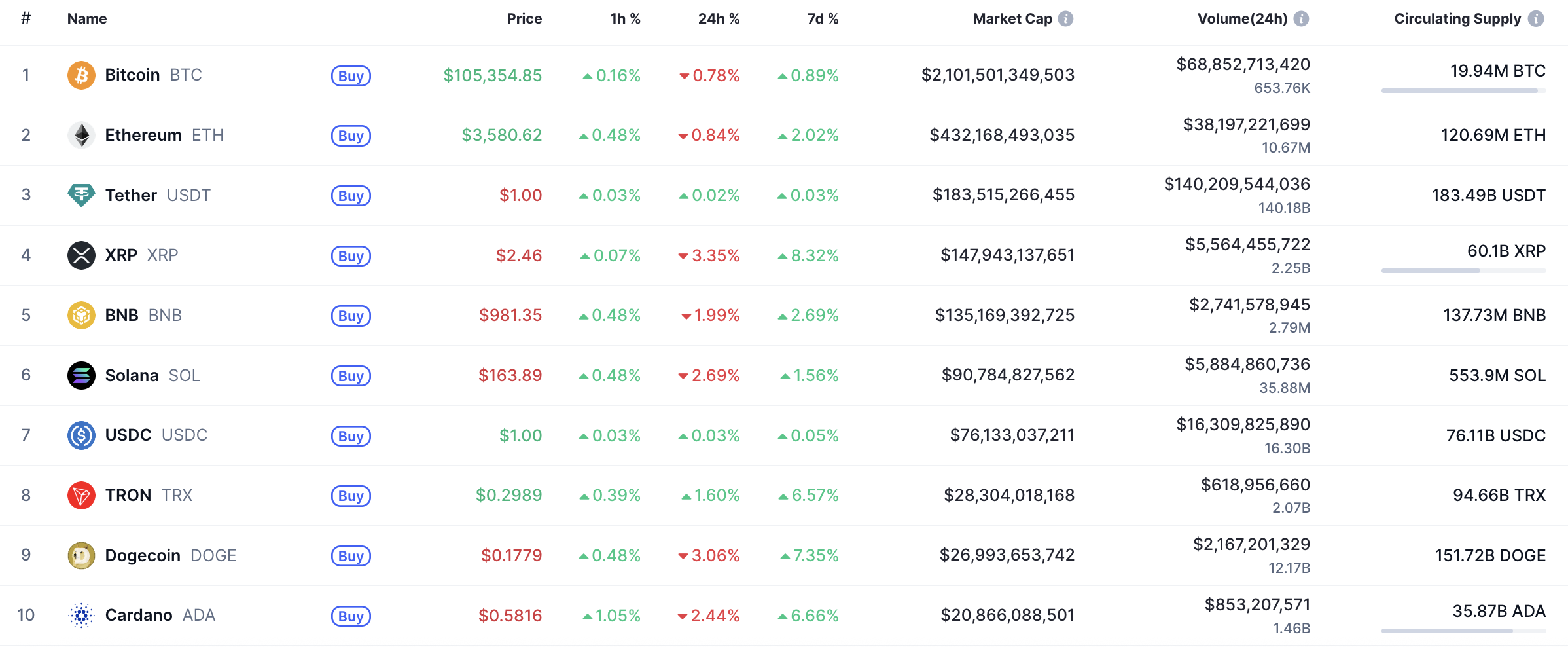

The cryptocurrency market is currently undergoing a correction, impacting assets like XRP. XRP is experiencing bearish pressure, trading near critical support levels that could dictate its short-term trajectory. Investors are closely monitoring these levels to gauge potential entry or exit points.

XRP’s hourly chart indicates a bearish trend as it hovers near the $2.4450 support. A failure to rebound from this level could lead to a further decline toward $2.40, presenting a potential challenge for bullish investors. Traders should watch for buyer activity to determine if support will hold.

On a larger scale, XRP has bounced off the $2.5549 resistance, suggesting a period of consolidation. If the daily close is significantly below this resistance, a test of the $2.35-$2.40 range is likely, creating a possible buying opportunity. Market participants should prepare for potential volatility as XRP navigates these levels.

Midterm analysis reveals that XRP’s price is distant from pivotal levels, and trading volume is subdued. This suggests that significant price movements are unlikely in the immediate future. Expect XRP to trade sideways between $2.40 and $2.50 as the market seeks direction.

In conclusion, XRP’s current price action reflects broader market uncertainty. While bearish signals are present, the potential for sideways trading offers stability. Investors should closely monitor key support and resistance levels to make informed decisions as the market develops.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP faces bearish pressure, testing key support levels. Sideways trading is expected in the short term, with a range between $2.40 and $2.50. Broader market correction influences XRP’s price action. The cryptocurrency market is currently undergoing a correction, impacting assets like XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.