XRP faces bearish pressure, with sellers currently dominating the market. Short-term analysis suggests a potential drop to the $2.50-$2.55 range if bearish trends continue. Midterm outlook remains neutral due to the price being distant from key support and resistance levels, indicating low volatility.

What to Know:

- XRP faces bearish pressure, with sellers currently dominating the market.

- Short-term analysis suggests a potential drop to the $2.50-$2.55 range if bearish trends continue.

- Midterm outlook remains neutral due to the price being distant from key support and resistance levels, indicating low volatility.

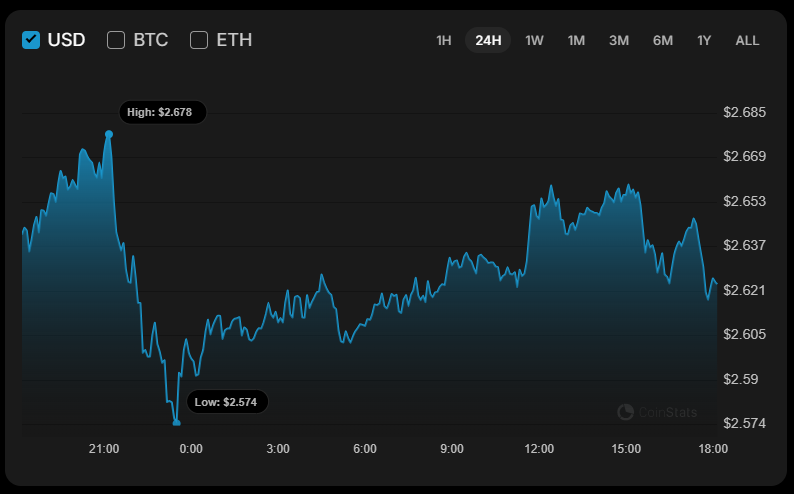

Recent analysis indicates that XRP is experiencing downward pressure, with sellers exerting more influence than buyers. The price of XRP has seen a slight decrease over the past 24 hours, reflecting this bearish sentiment. Investors and traders are closely watching key levels to gauge potential future movements.

Hourly charts reveal a potential retracement after a failed attempt to breach the $2.6605 resistance. Failure to regain momentum could lead to a test of the immediate support level. Monitoring these short-term movements is crucial for traders looking to capitalize on quick price changes.

Looking at the daily timeframe, the bearish outlook is reinforced. A close at or below current prices could signal further declines toward the $2.50-$2.55 range. This level is significant as a potential buying opportunity or a point of further capitulation.

The midterm perspective shows a lack of clear dominance from either buyers or sellers. With the price hovering between key support and resistance, volatility is expected to remain low. This consolidation phase could precede a more significant move, depending on broader market conditions and regulatory developments.

Currently, trading volume is low, suggesting reduced chances of sharp price fluctuations in the near term. This period of relative calm could be an opportunity for investors to reassess their positions and strategies. Keeping an eye on Bitcoin’s movements and any regulatory news will be important.

In conclusion, XRP’s current market position indicates a need for cautious observation. While short-term bearish signals are present, the midterm outlook remains neutral, suggesting potential stability. Investors should stay informed on market dynamics and regulatory updates to make well-informed decisions.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP faces bearish pressure, with sellers currently dominating the market. Short-term analysis suggests a potential drop to the $2.50-$2.55 range if bearish trends continue. Midterm outlook remains neutral due to the price being distant from key support and resistance levels, indicating low volatility.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.