XRP has shown mixed indicates, with short-term bullish potential countered by broader bearish trends. Low trading volumes suggest a continuation of sideways price action in the near term. A break below $1.80 could trigger a deeper correction towards the $1.60 level.

What to Know:

- XRP has shown mixed signals, with short-term bullish potential countered by broader bearish trends.

- Low trading volumes suggest a continuation of sideways price action in the near term.

- A break below $1.80 could trigger a deeper correction towards the $1.60 level.

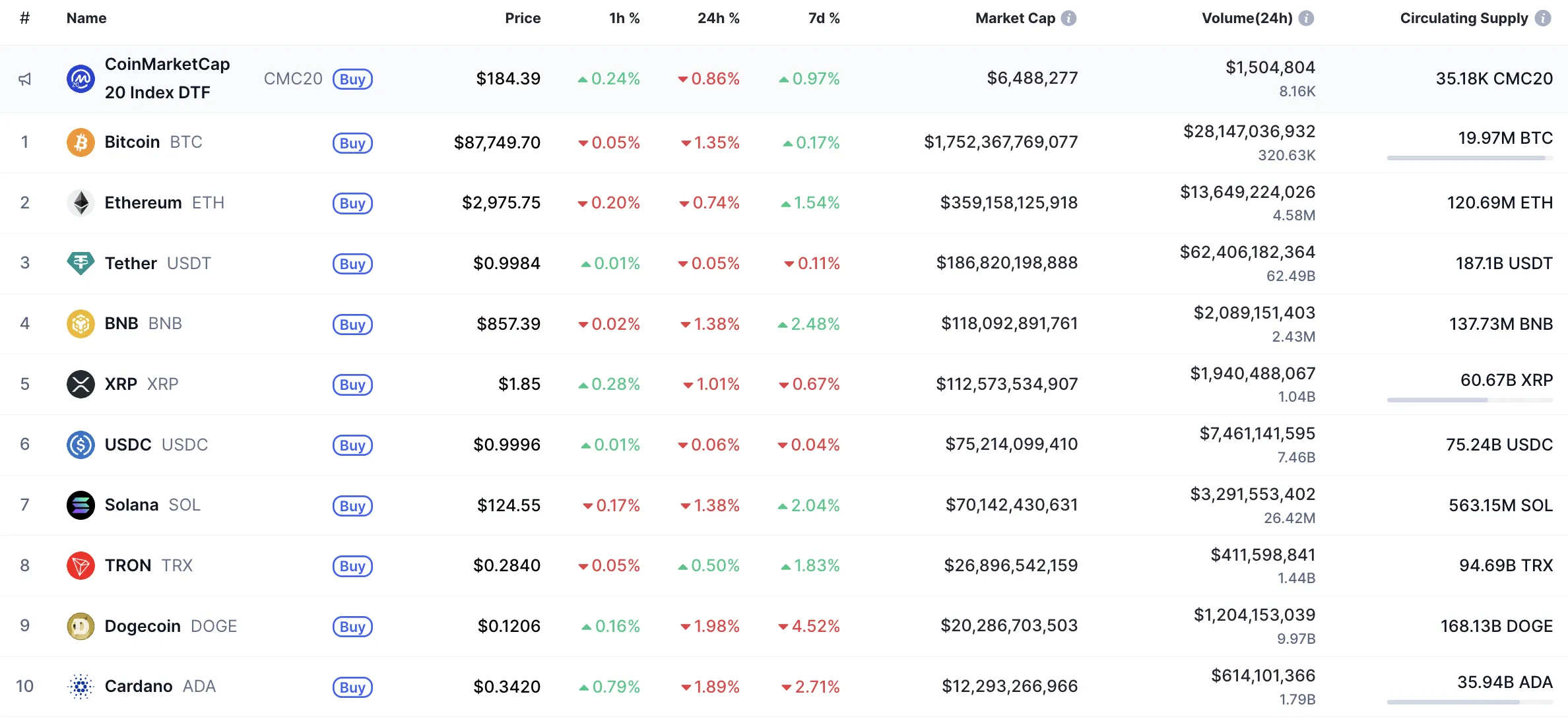

XRP’s recent price action reflects the broader uncertainty gripping the digital asset market. While some see potential for short-term gains, the overall trend remains bearish, raising concerns among institutional investors. Understanding these nuances is crucial for navigating the current market environment and making informed investment decisions.

Short-Term Bullish Signals

Despite the prevailing bearish sentiment, XRP’s hourly chart indicates a potential for upward movement. If bulls can sustain the price above the immediate resistance at $1.8558, a push towards the $1.88 area is plausible. This short-term bullish outlook could attract day traders and momentum-based funds, potentially injecting some liquidity into the market. However, whether this momentum can be sustained remains to be seen, especially considering the broader market headwinds.

Broader Bearish Trends

Zooming out to a larger time frame, the picture for XRP appears less optimistic. The current price is significantly distanced from key levels, indicating a lack of strong buying interest. This could be attributed to various factors, including regulatory uncertainties, concerns about Ripple’s ongoing legal battles, and the general risk-off sentiment dominating the crypto market. Institutional investors, in particular, tend to shy away from assets facing such headwinds, further压制ing potential upside.

Low Trading Volume and Sideways Action

One of the most striking aspects of XRP’s recent performance is the persistently low trading volume. This suggests a lack of conviction among both buyers and sellers, leading to sideways price action. In such an environment, it becomes difficult to predict directional movements, and the market is prone to whipsaws and false breakouts. This type of market behavior can be particularly frustrating for institutional investors who prefer clear trends and ample liquidity.

Key Support Level to Watch

From a technical analysis perspective, the $1.80 level represents a crucial support zone for XRP. A decisive break below this level could trigger a cascade of sell orders, potentially pushing the price down towards the $1.60 zone. This scenario would likely be exacerbated by stop-loss orders being triggered and could lead to a significant correction. Investors should closely monitor this level and be prepared to adjust their positions accordingly.

Midterm Outlook and Potential Reversal Signals

As of now, there are no clear reversal signals on the midterm charts for XRP. This suggests that the current bearish trend is likely to persist, at least in the short to medium term. However, market conditions can change rapidly, and it’s essential to remain vigilant for any signs of a potential turnaround. Such signals could include a surge in trading volume, a break above key resistance levels, or positive news regarding Ripple’s legal situation.

In conclusion, XRP’s current market position is precarious, with short-term bullish possibilities overshadowed by broader bearish trends and low trading volumes. A break below the $1.80 support level could lead to a more profound correction, while a lack of clear reversal signals suggests continued downside pressure. Institutional investors should exercise caution and closely monitor key technical levels and market developments before making any significant investment decisions.

XRP is trading at $1.8580 at press time.

Related: XRP: Ripple Exec Forecasts Wins in 2026

Source: Original article

Quick Summary

XRP has shown mixed signals, with short-term bullish potential countered by broader bearish trends. Low trading volumes suggest a continuation of sideways price action in the near term. A break below $1.80 could trigger a deeper correction towards the $1.60 level.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.