XRP shows signs of upward momentum, potentially targeting $2.20-$2.30 range. Sideways trading between $2.10 and $2.30 remains a plausible scenario in the medium term. Traders should monitor price action and key resistance levels for confirmation of bullish continuation.

What to Know:

- XRP shows signs of upward momentum, potentially targeting $2.20-$2.30 range.

- Sideways trading between $2.10 and $2.30 remains a plausible scenario in the medium term.

- Traders should monitor price action and key resistance levels for confirmation of bullish continuation.

XRP, also known as Ripple, has recently displayed positive price action, drawing attention from institutional investors monitoring the digital asset space. As regulatory clarity around XRP gradually improves, institutions are increasingly evaluating its potential within their portfolios. Recent price movements suggest a possible continuation of this upward trend, contingent on maintaining sufficient liquidity and overcoming key resistance levels.

Short-Term Technical Outlook

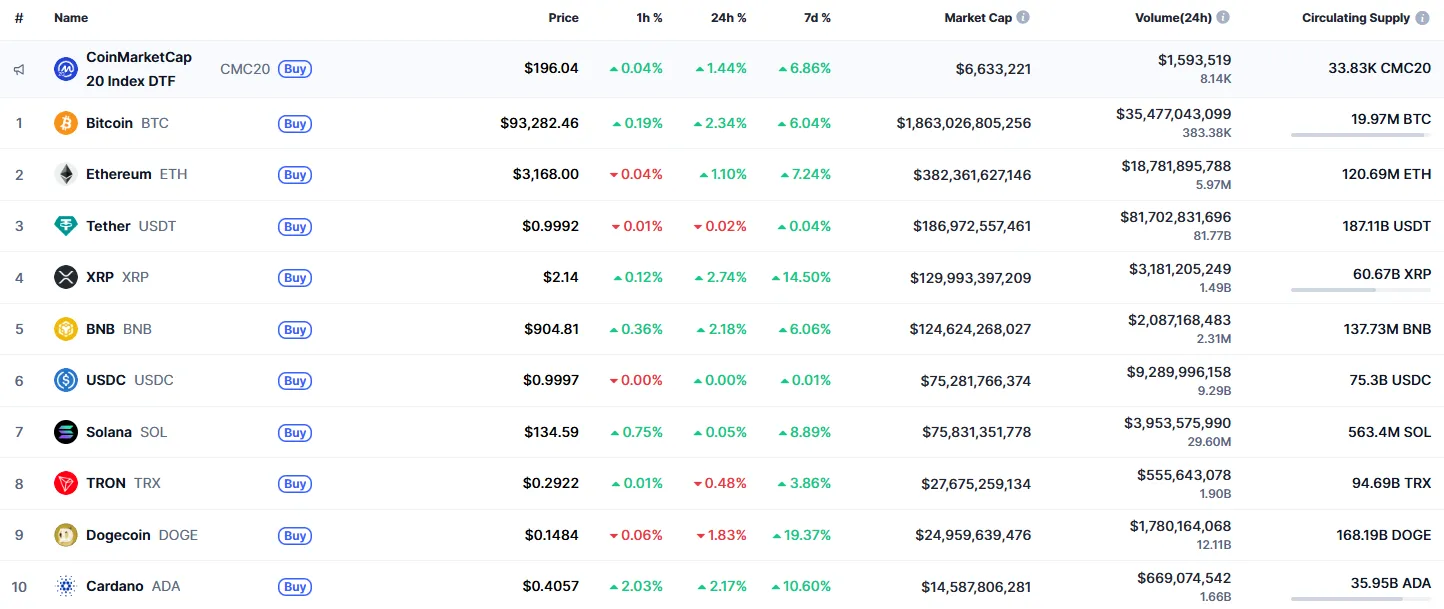

XRP’s price has seen a 2.74% increase over the last 24 hours, signaling renewed buying interest. Analyzing the hourly chart, a bounce off the $2.1122 support level indicates potential for further gains. Should XRP sustain a close above the $2.1665 resistance, a move towards $2.20 becomes increasingly probable. This short-term bullish scenario relies on continued positive sentiment and consistent trading volumes.

Broader Timeframe Analysis

Examining a larger time frame, the absence of immediate reversal signals suggests the bullish trend may persist. Traders should closely observe the peak of each bar’s closure to gauge momentum. A closure around current levels could pave the way for an advance towards the $2.20-$2.30 range by week’s end. This analysis assumes no significant negative news or market-wide corrections that could disrupt the current trajectory.

Mid-Term Consolidation

From a mid-term perspective, XRP’s price action suggests a potential consolidation phase. Following a bullish bar closure, the price is trending upwards, but buyers may need more time to build sufficient momentum for a sustained breakout. Sideways trading within the $2.10-$2.30 range is a plausible scenario, as the market digests recent gains and assesses future catalysts. This consolidation phase could provide institutions with opportunities to accumulate positions.

Institutional Accumulation and Regulatory Factors

Institutional interest in XRP is closely tied to regulatory developments and the overall market structure for digital assets. Favorable regulatory outcomes could significantly boost institutional inflows, driving XRP’s price higher. Conversely, adverse regulatory decisions could dampen enthusiasm and trigger a sell-off. The current environment necessitates a cautious yet opportunistic approach, with institutions carefully weighing the risks and rewards.

Historical Parallels and Market Structure

Drawing parallels to past market events, the launch of Bitcoin ETFs provides a useful reference point. The initial ETF launches triggered significant price appreciation, but also periods of consolidation as the market absorbed the new supply. Similarly, XRP could experience increased volatility as it navigates regulatory hurdles and institutional adoption. Understanding these historical patterns can inform trading strategies and risk management.

Derivatives Positioning and Liquidity

Derivatives positioning in XRP, including futures and options, can offer insights into market sentiment and potential price movements. High open interest in call options, for example, may suggest bullish expectations. Liquidity, both on centralized exchanges and decentralized platforms, plays a crucial role in price discovery and stability. Adequate liquidity ensures efficient trading and reduces the risk of significant price slippage.

XRP’s current price of $2.1490 reflects a market in anticipation of further developments. While technical indicators suggest potential for upward movement, the trajectory hinges on a combination of factors, including sustained buying pressure, regulatory clarity, and broader market sentiment. Institutions should remain vigilant, employing robust risk management strategies to navigate the inherent uncertainties of the digital asset market.

Related: XRP Golden Cross Signals Bitcoin Target

Source: Original article

Quick Summary

XRP shows signs of upward momentum, potentially targeting $2.20-$2.30 range. Sideways trading between $2.10 and $2.30 remains a plausible scenario in the medium term. Traders should monitor price action and key resistance levels for confirmation of bullish continuation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.