XRP’s recent price action has been choppy, with bulls struggling to maintain upward momentum above the $1.50 level. Technical analysis suggests potential for further downside if XRP fails to hold key support levels, particularly around $1.50.

What to Know:

- XRP’s recent price action has been choppy, with bulls struggling to maintain upward momentum above the $1.50 level.

- Technical analysis suggests potential for further downside if XRP fails to hold key support levels, particularly around $1.50.

- Broader market sentiment and Bitcoin’s performance will likely continue to influence XRP’s price trajectory.

XRP, a digital asset with significant institutional interest due to its potential for cross-border payments, has been navigating a complex market environment. Recent price action suggests a struggle to maintain upward momentum, with the $1.50 level acting as a key battleground between bulls and bears. As regulatory scrutiny and macroeconomic factors continue to shape the digital asset landscape, understanding XRP’s technical setup and potential catalysts is crucial for investors.

Technical Overview

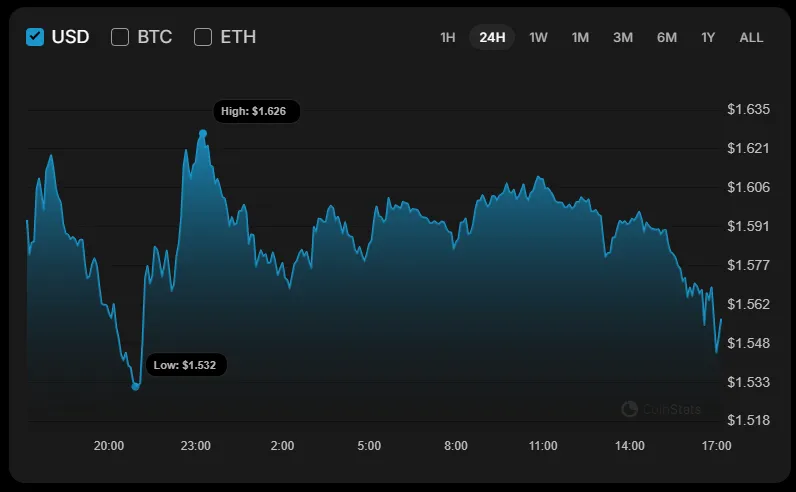

XRP’s price has experienced a decline of over 2% recently, reflecting broader market uncertainty. Hourly charts indicate a false breakout below a support level of $1.5428, suggesting a possible short-term bounce towards the $1.60 range if buyers step in. However, failure to sustain this upward move could signal further weakness. The longer-term outlook reveals a struggle to rebound after a false breakout of the $1.5307 level. A failure to hold above this level could lead to a drop towards the $1.50 zone, testing the resolve of XRP bulls.

Key Support and Resistance Levels

The $1.50 level appears to be a critical support zone for XRP. A sustained break below this level could trigger a more significant sell-off, potentially leading to a test of the $1.30-$1.40 area. Conversely, a successful defense of the $1.50 support could pave the way for a move towards the $1.60 resistance level. Traders should closely monitor these levels for potential entry and exit points. These levels are important for institutions managing risk and allocating capital.

Market Sentiment and Bitcoin’s Influence

XRP’s price action is often correlated with the overall sentiment in the cryptocurrency market, particularly Bitcoin’s performance. A positive shift in Bitcoin’s price could provide a tailwind for XRP, while a negative move could exacerbate selling pressure. Monitoring Bitcoin’s price and market dominance is essential for gauging the broader risk appetite in the digital asset space. This is especially true now that Bitcoin ETFs have changed market structure.

Regulatory Landscape and Institutional Adoption

The regulatory environment surrounding XRP remains a key factor influencing its price and adoption. Clarity on XRP’s regulatory status could attract more institutional investors and drive adoption. Any adverse regulatory developments, on the other hand, could weigh on its price. The ongoing legal battles and regulatory scrutiny are critical factors for institutions considering XRP exposure. Ripple’s legal battles have been a constant overhang on the asset.

Derivatives Positioning and Liquidity

Analyzing XRP’s derivatives market, including futures and options, can provide insights into market sentiment and potential price movements. High open interest in derivatives contracts may indicate increased speculation and volatility. Furthermore, monitoring XRP’s liquidity across various exchanges is crucial for assessing its ability to absorb large buy or sell orders without significant price slippage. Institutional desks pay close attention to order book depth and trade volumes.

In conclusion, XRP’s near-term price trajectory hinges on its ability to hold key support levels and the broader market sentiment. While technical indicators suggest potential for further downside, positive developments in the regulatory landscape or a resurgence in Bitcoin’s price could provide a catalyst for a move higher. Investors should closely monitor these factors and manage their risk accordingly.

Related: XRP Metric Signals Pause in Demand

Source: Original article

Quick Summary

XRP’s recent price action has been choppy, with bulls struggling to maintain upward momentum above the $1.50 level. Technical analysis suggests potential for further downside if XRP fails to hold key support levels, particularly around $1.50. Broader market sentiment and Bitcoin’s performance will likely continue to influence XRP’s price trajectory.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.