XRP is showing signs of a strong rebound from the $2 level, fueled by recent ETF inflows and positive technical indicators. Key resistance levels between $2.23 and $2.50 could present challenges, potentially leading to a pullback toward $1.82 if bullish momentum stalls.

What to Know:

- XRP is showing signs of a strong rebound from the $2 level, fueled by recent ETF inflows and positive technical indicators.

- Key resistance levels between $2.23 and $2.50 could present challenges, potentially leading to a pullback toward $1.82 if bullish momentum stalls.

- A potential 50% rally toward $3.30–$3.50 is suggested by historical patterns and on-balance volume analysis, but hinges on overcoming immediate resistance.

XRP is exhibiting renewed strength, bouncing off the $2 mark with potential upside toward the $3.30–$3.50 range in the coming weeks. This positive momentum is occurring against a backdrop of increasing institutional interest, as evidenced by the recent launch of XRP-linked ETFs, including Grayscale’s GXRP and Franklin Templeton’s XRPZ. The inflows into these ETFs, exceeding $164 million daily, signal a growing appetite for XRP exposure among institutional and high-net-worth investors.

The past week has seen XRP rebound nearly 25% from the critical $2 support level. This level has served as a reliable launchpad for previous rallies. The recent ETF launches have provided additional tailwinds, injecting fresh capital into the market and bolstering investor confidence. This dynamic mirrors what we’ve seen in Bitcoin markets following the launch of spot Bitcoin ETFs, where substantial inflows have driven price appreciation.

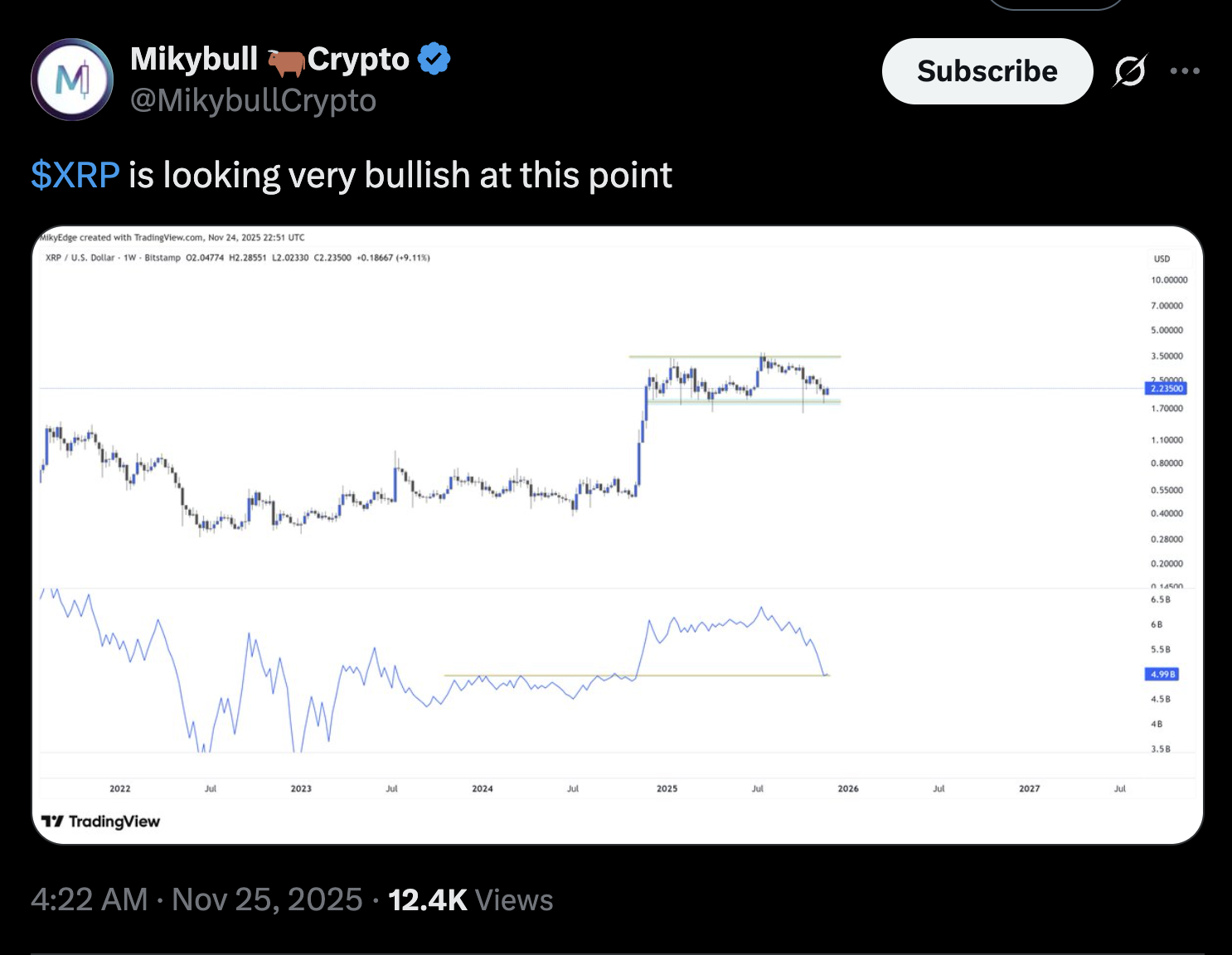

From a technical perspective, XRP’s ability to defend the $1.95–$2.05 support band within its prevailing parallel channel is a bullish sign. This zone has consistently acted as a support level since December 2024, with each retest leading to significant bounces toward the channel’s upper boundary near $3.50. If this pattern holds, we could see XRP gain another 50% by the end of the year. This kind of channel trading is common in mature assets, and XRP’s adherence to these patterns suggests increasing market sophistication.

On-balance volume (OBV) is providing further validation of the bullish outlook. OBV measures buying and selling pressure by tracking volume flow. The recent bounce in OBV from a major support area, coinciding with the price touching $2, indicates genuine buying interest. This suggests that spot buyers are stepping in, reinforcing the price recovery. OBV is a useful tool to confirm price trends, and its current behavior aligns with the bullish narrative for XRP.

Analysts are drawing parallels between XRP’s current market structure and its explosive 2017 breakout. The $2 region is behaving similarly to the mid-range support that XRP reclaimed before its historic rally eight years ago. With prices stabilizing around $2 and buyers returning, there’s a strong possibility that XRP could revisit the upper boundary near $3.30–$3.50. This echoes the expansion phase that followed a similar technical setup in 2017. Historical patterns often provide valuable insights, and the comparison to 2017 is particularly compelling.

Despite the positive signals, XRP faces several technical hurdles. The token is currently testing the 0.236 Fibonacci retracement level near $2.23 as resistance. A decisive breakout above this level would then encounter the 50-day and 200-day EMAs, which have capped XRP’s upside attempts since early October. These EMAs sit near the upper trendline of XRP’s descending channel, a pattern that has guided the price lower since the summer. If this pattern holds, XRP could rotate back to the channel’s lower boundary, potentially dropping toward the 0.0 Fib line near $1.82 by the end of the year. Fibonacci levels and moving averages are key indicators watched by technical traders, and these levels will likely influence XRP’s price action in the near term.

The potential for a pullback toward $1.82 would weaken the bullish setup and suggest the recent bounce was only temporary. Monitoring these key levels will be crucial in determining the sustainability of the current rally. Market sentiment can shift quickly, and a failure to overcome these resistance levels could trigger a wave of selling pressure.

XRP’s recent rebound is supported by strong ETF inflows, positive technical indicators, and historical patterns. While challenges remain, the potential for a 50% rally toward $3.30–$3.50 is within reach if XRP can overcome key resistance levels. The launch of XRP ETFs marks a significant step toward greater institutional adoption, which could provide further support for price appreciation. However, investors should remain vigilant and monitor key technical levels to manage risk effectively.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is showing signs of a strong rebound from the $2 level, fueled by recent ETF inflows and positive technical indicators. Key resistance levels between $2.23 and $2.50 could present challenges, potentially leading to a pullback toward $1.82 if bullish momentum stalls.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.