XRP has demonstrated resilience, rebounding to around $2.20, but faces a critical juncture as it navigates a consolidation phase. Liquidation data reveals a market characterized by high volatility, with both long and short positions experiencing significant wipeouts, highlighting the risks of leveraged trading in XRP.

What to Know:

- XRP has demonstrated resilience, rebounding to around $2.20, but faces a critical juncture as it navigates a consolidation phase.

- Liquidation data reveals a market characterized by high volatility, with both long and short positions experiencing significant wipeouts, highlighting the risks of leveraged trading in XRP.

- Technical indicators suggest a cautiously optimistic outlook, contingent on XRP overcoming key resistance levels to sustain its recovery.

XRP’s recent price action has captured the attention of institutional investors, particularly as it attempts to recover from a November downtrend. As regulatory clarity around XRP evolves, its potential inclusion in more mainstream financial products becomes increasingly relevant. This analysis delves into XRP’s price dynamics, recent liquidations, and technical indicators to provide a comprehensive outlook for institutional and high net worth investors.

Technical Analysis and Price Levels

The daily XRP/USD chart reveals a token attempting to stabilize around $2.22 after a notable downtrend. XRP’s ability to reclaim the 20-day Bollinger Band midpoint at $2.21 is a constructive sign, suggesting that bullish sentiment is returning after a brief dip to the lower band near $1.92, which now serves as critical support. The upper Bollinger Band around $2.50 represents the next major resistance level. Should XRP sustain a close above $2.25, it would likely embolden further advances toward the $2.50 mark. Conversely, failure to maintain this level could trigger a retest of the $2.00-$1.92 range.

Momentum and Market Sentiment

The Chande Momentum Oscillator (9) has rebounded sharply from negative territory to around +21, signaling a shift in short-term momentum toward buyers. While not yet in overbought territory, this indicator suggests that XRP has room to extend its recovery if buying pressure persists. However, it’s essential to recognize that the broader market picture remains fragile until XRP decisively breaches the $2.50 resistance zone. This level will be critical in confirming a sustained bullish trend and attracting more risk-averse institutional capital.

Liquidation Dynamics and Volatility

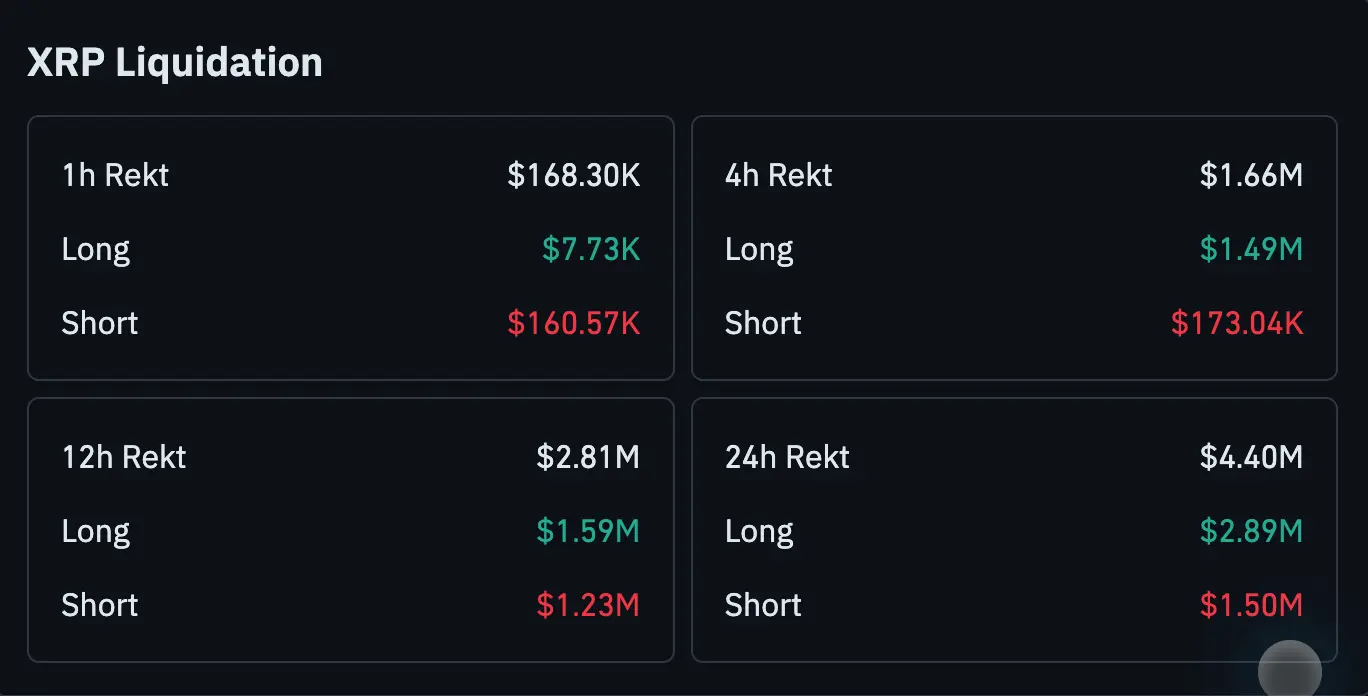

Recent XRP liquidation data underscores the high degree of volatility in the market, with derivatives traders experiencing significant losses on both sides. Over the past 24 hours, approximately $4.40 million in XRP positions were liquidated, with $2.89 million in long positions and $1.50 million in short positions. This dynamic highlights the dangers of excessive leverage in XRP trading and the potential for sharp intraday swings to trigger cascading liquidations.

Short-Term Market Pressures

Drilling down into shorter time frames, the past four hours reveal that $1.66 million was liquidated, with long positions still dominating at $1.49 million. However, the most recent hour saw nearly all liquidations coming from short positions ($160.57K vs. $7.73K in longs). This pattern aligns with XRP’s recent bounce off support, where earlier downside moves forced overleveraged longs out of the market, while the subsequent uptick squeezed late-entering shorts. Such dynamics are reminiscent of meme stock squeezes, albeit on a smaller scale and within the more mature context of the crypto derivatives market.

Institutional Implications and Market Structure

For institutional investors, these liquidation patterns underscore the importance of robust risk management and a thorough understanding of market microstructure. The high degree of leverage and volatility in XRP trading can create opportunities for sophisticated traders but also pose significant risks for those who are unprepared. As XRP’s regulatory landscape becomes clearer, we anticipate increased institutional interest, particularly if exchange-traded funds (ETFs) are approved, which could further stabilize its market structure and reduce volatility.

Looking Ahead

In summary, XRP is navigating a critical phase as it attempts to recover from its recent downtrend. Technical indicators suggest a cautiously optimistic outlook, contingent on XRP overcoming key resistance levels. Liquidation data highlights the inherent volatility and risks associated with leveraged trading in XRP. Institutional investors should closely monitor these dynamics as they assess XRP’s potential role in their portfolios, emphasizing risk management and a deep understanding of market structure.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP has demonstrated resilience, rebounding to around $2.20, but faces a critical juncture as it navigates a consolidation phase. Liquidation data reveals a market characterized by high volatility, with both long and short positions experiencing significant wipeouts, highlighting the risks of leveraged trading in XRP.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.