Tokentus Investment AG CEO Oliver Michel notes the divergence between Ripple’s strong business performance and XRP’s lackluster price action. He attributes this disconnect to market timing and short-term conditions overshadowing Ripple’s operational progress.

What to Know:

- Tokentus Investment AG CEO Oliver Michel notes the divergence between Ripple’s strong business performance and XRP’s lackluster price action.

- He attributes this disconnect to market timing and short-term conditions overshadowing Ripple’s operational progress.

- The analysis suggests that institutional inflows into XRP ETFs have not yet translated into positive price movement, creating an opportunity for future repricing.

The market’s perception of XRP has been a topic of much debate, particularly when juxtaposed with Ripple’s advancements in the blockchain space. Oliver Michel, CEO of Tokentus Investment AG, recently shed light on this dynamic, pointing out the growing disparity between Ripple’s business successes and XRP’s market valuation. His analysis suggests that the current price weakness of XRP may not accurately reflect Ripple’s underlying strength and future potential.

Ripple’s “Amazon-Style” Expansion

Michel characterizes Ripple’s operational expansion as robust, highlighting strategic acquisitions, forays into regulated banking, and the introduction of new products like stablecoins. He likens the Ripple ecosystem to an “Amazon-style” platform, suggesting a comprehensive suite of blockchain and crypto services. This analogy underscores Ripple’s ambition to be a dominant player in the digital asset landscape, with a broad range of offerings designed to cater to diverse needs.

Fundamentals Versus Market Sentiment

Michel draws a distinction between business fundamentals and market sentiment, noting that price action can either lead or lag behind operational progress. In the case of XRP, he believes the market is currently undervaluing Ripple’s achievements. This sentiment echoes a common frustration among XRP holders, who have witnessed Ripple’s advancements without corresponding price appreciation. Michel emphasizes that short-term market conditions often dictate price movements, while the impact of operational progress unfolds over a longer time horizon.

ETF Inflows and Price Disconnect

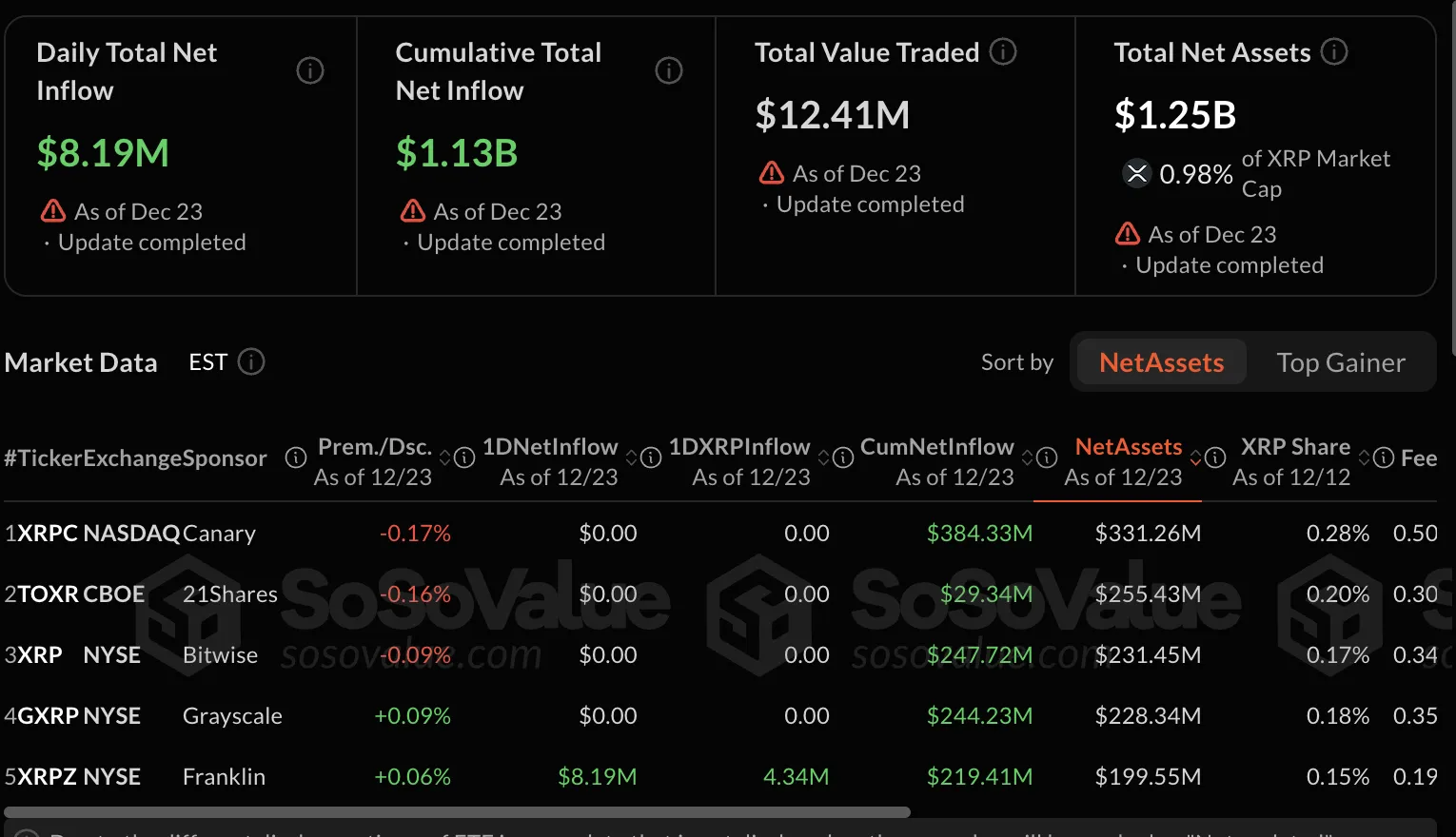

Despite the launch of five XRP ETFs since November, attracting $1.13 billion in inflows and bringing total assets to $1.25 billion, XRP’s price has continued to struggle. This divergence between institutional demand and price action deepens the mystery surrounding XRP’s market behavior. The inflows suggest that institutional investors see value in XRP, yet this conviction has not translated into positive price momentum.

Timing, Not a Deeper Problem

Michel suggests that the disconnect between Ripple’s business performance and XRP’s price is primarily a matter of timing. He posits that the growing institutional and business adoption has not yet been reflected in XRP’s valuation, implying a future correction. This perspective offers a degree of optimism for XRP holders, suggesting that the market will eventually recognize Ripple’s progress and reprice XRP accordingly.

Potential for Sharp Repricing

Michel concludes that XRP’s current price weakness should be viewed as temporary, anticipating a future reconciliation between Ripple’s operational success and XRP’s valuation. This could lead to a sharp repricing once the market catches up with Ripple’s advancements. While he refrains from providing a specific timeline, his analysis suggests that XRP’s underperformance is not indicative of failure but rather a delay in market recognition. Such delays are not uncommon in the crypto market, where sentiment and speculation can often overshadow fundamental developments.

The analysis suggests that while XRP’s price action has been underwhelming, Ripple’s underlying business remains strong. The potential for future repricing, driven by institutional adoption and market recognition, could offer opportunities for investors. However, as with any investment, it’s crucial to consider the inherent risks and uncertainties of the crypto market.

Related: XRP Profitability Drops, Signals Potential Rally

Source: Original article

Quick Summary

Tokentus Investment AG CEO Oliver Michel notes the divergence between Ripple’s strong business performance and XRP’s lackluster price action. He attributes this disconnect to market timing and short-term conditions overshadowing Ripple’s operational progress.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.