Technical patterns like bull flags and inverse head-and-shoulders suggest a $3 price target for XRP. Significant decrease in XRP on exchanges and record outflows point to strong accumulation. Positive 90-day spot CVD indicates sustained demand and potential for a rally.

What to Know:

- Technical patterns like bull flags and inverse head-and-shoulders suggest a $3 price target for XRP.

- Significant decrease in XRP on exchanges and record outflows point to strong accumulation.

- Positive 90-day spot CVD indicates sustained demand and potential for a rally.

XRP is showing promising signals, with multiple technical and on-chain indicators suggesting a potential rally toward $3 in the coming weeks. A decrease in XRP on exchanges, coupled with bullish chart patterns, hints at growing investor confidence. Here’s a breakdown of the key factors supporting this outlook for XRP.

The four-hour chart reveals a validated bull flag pattern, suggesting a potential rise to $2.92. Bull flags are typically bullish continuation patterns, indicating that XRP is poised to resume its upward trajectory. This pattern, combined with a healthy relative strength index, supports the case for a near-term breakout.

Additionally, an inverse head-and-shoulders pattern has formed in the three-hour timeframe, further supporting a potential rally to $3. The measured target for this pattern aligns with the $3.02 mark, reinforcing the bullish sentiment. A breakout above the pattern’s neckline could trigger a parabolic price increase.

“$XRP has printed an inverse H&S pattern,”

Data from Glassnode shows a substantial decrease in XRP supply on exchanges over the past 30 days. The XRP balance on exchanges dropped by 1.4 billion tokens, indicating a reduced intention to sell among holders. This scarcity, combined with record outflows from exchanges, suggests strong accumulation by larger investors.

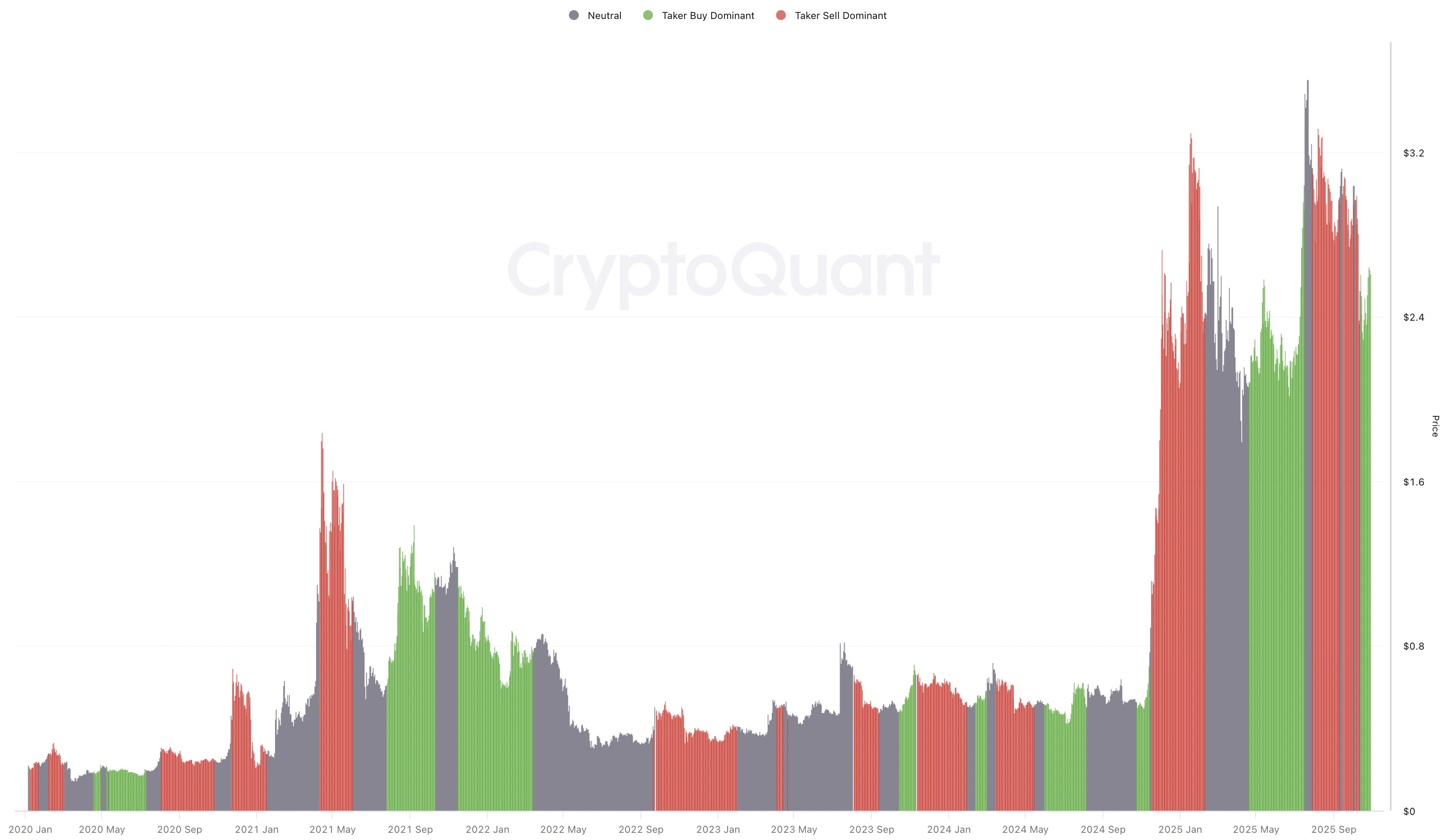

Analyzing the 90-day spot taker cumulative volume delta (CVD) reveals that buy orders have become dominant since Oct. 14. Positive CVD indicates optimism among traders, suggesting they are actively accumulating XRP. This sustained demand could set the stage for another wave of upward movement.

In conclusion, XRP exhibits several bullish signals, from technical chart patterns to on-chain data indicating accumulation. While the cryptocurrency market remains volatile, these factors suggest a potential upward trajectory for XRP, with a possible target of $3 in the near term. Monitoring market dynamics and regulatory developments remains crucial for investors.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

Technical patterns like bull flags and inverse head-and-shoulders suggest a $3 price target for XRP. Significant decrease in XRP on exchanges and record outflows point to strong accumulation. Positive 90-day spot CVD indicates sustained demand and potential for a rally.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.