XRP is emerging as a potential tool for corporate FX hedging, offering rapid cross-border settlements. Companies are increasingly seeking FX hedging solutions due to significant losses from currency fluctuations.

What to Know:

- XRP is emerging as a potential tool for corporate FX hedging, offering rapid cross-border settlements.

- Companies are increasingly seeking FX hedging solutions due to significant losses from currency fluctuations.

- Adoption of XRP for FX hedging could significantly impact its price, potentially reaching $250 per token in a bullish scenario.

XRP is gaining attention as a potential solution for foreign exchange (FX) hedging, addressing the growing need for corporate treasuries to mitigate currency fluctuation risks. By serving as a bridge for instant settlements, XRP could offer a faster and more efficient way to manage international transactions. This innovative use case highlights the evolving role of cryptocurrencies in traditional finance.

Companies are increasingly focused on FX hedging due to substantial losses incurred from unhedged exposure. Traditional methods, such as forward contracts, allow firms to lock in future exchange rates, but XRP offers a potentially faster alternative. Recent data indicates that a significant percentage of firms have suffered FX losses, prompting a reevaluation of hedging strategies.

XRP can act as a hedge against FX fluctuations by facilitating near-instantaneous currency transfers via the XRP Ledger (XRPL). Converting U.S. dollars into XRP, transferring them in seconds, and then converting them into euros can minimize exposure to fluctuating exchange rates. Additionally, tools like CME XRP futures and options are available to hedge XRP’s inherent volatility.

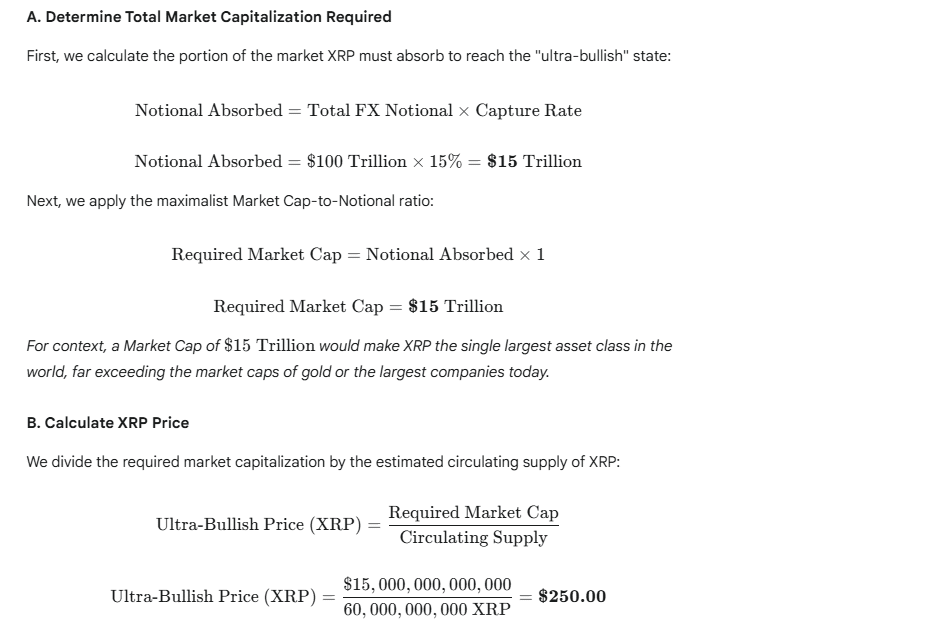

While XRP’s volatility necessitates active risk management through derivatives, its adoption for FX hedging by corporate treasuries could have a tremendous impact on its price. In a bullish scenario, where XRP captures 15% of the global corporate FX derivatives market, its price could reach approximately $250 per token. This projection assumes a market capitalization of $15 trillion, supported by 60 billion XRP in circulation.

As the crypto landscape evolves, XRP’s potential as an FX hedging tool showcases its utility beyond speculative trading. The ability to provide rapid, cost-effective cross-border settlements positions XRP as a valuable asset for companies seeking to manage FX risks and optimize their international operations. Further developments in regulation and market adoption will play a crucial role in realizing this potential.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP is emerging as a potential tool for corporate FX hedging, offering rapid cross-border settlements. Companies are increasingly seeking FX hedging solutions due to significant losses from currency fluctuations. Adoption of XRP for FX hedging could significantly impact its price, potentially reaching $250 per token in a bullish scenario.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.