Hypothetical analysis suggests XRP could reach $6,194 if its supply matched Bitcoin’s, based on current market cap. The analysis indicates XRP’s underperformance relative to Bitcoin since 2018, despite higher inflation.

What to Know:

- Hypothetical analysis suggests XRP could reach $6,194 if its supply matched Bitcoin’s, based on current market cap.

- The analysis highlights XRP’s underperformance relative to Bitcoin since 2018, despite higher inflation.

- This thought experiment illustrates XRP’s potential value if supply dynamics were drastically different, though a supply reduction mechanism isn’t built into the XRPL.

A recent thought experiment has captured the attention of XRP investors: what if XRP had the same circulating supply as Bitcoin? The analysis suggests a theoretical price of $6,194 per XRP token, a significant leap from its current levels. While purely hypothetical, this scenario underscores the ongoing debate about XRP’s market dynamics and potential upside.

Diverging Paths: XRP vs. Bitcoin

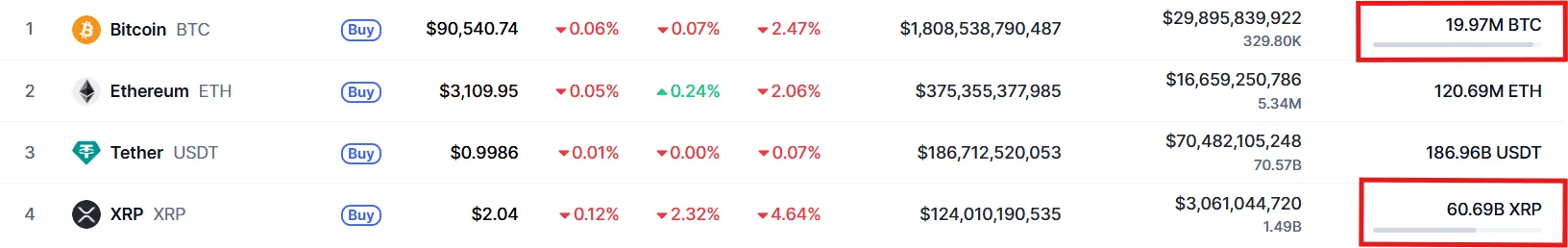

Since 2014, the market capitalization gap between XRP and Bitcoin has widened considerably. In late 2014, Bitcoin’s market cap was only about five times larger than XRP’s. By early 2018, that ratio had narrowed to 2.1x. However, today, Bitcoin’s market cap is over 14 times larger than XRP’s. This divergence occurred even as XRP experienced a higher rate of token inflation, highlighting Bitcoin’s superior price appreciation relative to XRP.

Supply Dynamics and Market Cap

Currently, XRP has a circulating supply of approximately 60.69 billion tokens, compared to Bitcoin’s 19.97 million. This difference in supply is a key factor in the hypothetical price calculation. The analysis posits that if XRP maintained its current market cap of $123.7 billion but had Bitcoin’s circulating supply, the price per XRP token would theoretically reach $6,194. This represents a 303,527% increase from its current market price.

The SEC Lawsuit Narrative

Some XRP proponents attribute XRP’s relative underperformance to the SEC lawsuit initiated in December 2020, which alleged that XRP was an unregistered security offering. This legal action led to XRP’s delisting from several U.S. exchanges, hindering its participation in the 2021 bull market. While the lawsuit undoubtedly impacted XRP’s market trajectory, it’s difficult to quantify the precise extent of its influence.

Hypothetical Scenarios and Investor Sentiment

The idea of a reduced XRP supply boosting its price resonates with some investors who believe that burning a significant portion of the token supply would lead to price appreciation. However, it’s important to note that the XRPL’s burn mechanism was not designed to deliberately manipulate the token supply for price impact. Any substantial reduction in XRP supply would require a coordinated effort and would likely face significant hurdles.

Concluding Thoughts

While the hypothetical scenario of XRP reaching $6,194 is unlikely in the current market structure, it serves as a valuable thought experiment. It highlights the impact of tokenomics on price potential and the challenges XRP faces in closing the gap with Bitcoin. Investors should consider this analysis as a theoretical exercise, not a price prediction, and focus on the evolving regulatory landscape and adoption trends surrounding XRP and the broader digital asset market.

Related: XRP Tweet Sparks Speculation on 2026 Progress

Source: Original article

Quick Summary

Hypothetical analysis suggests XRP could reach $6,194 if its supply matched Bitcoin’s, based on current market cap. The analysis highlights XRP’s underperformance relative to Bitcoin since 2018, despite higher inflation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.