XRP spot ETFs are rapidly absorbing over-the-counter (OTC) and dark pool liquidity, potentially leading to a supply crunch. As OTC supply diminishes, price discovery is expected to shift to public exchanges, increasing volatility.

What to Know:

- XRP spot ETFs are rapidly absorbing over-the-counter (OTC) and dark pool liquidity, potentially leading to a supply crunch.

- As OTC supply diminishes, price discovery is expected to shift to public exchanges, increasing volatility.

- Anticipation of additional XRP ETF launches, especially from major issuers like BlackRock, Vanguard, and Fidelity, could exacerbate supply pressures.

The potential launch of XRP spot ETFs has garnered significant attention from institutional investors, particularly as the regulatory landscape surrounding XRP continues to evolve. Recent analysis suggests that these ETFs are quickly depleting the available XRP supply in OTC markets and dark pools, which could lead to substantial price volatility and a shift in market dynamics. The implications of this evolving supply-demand balance are critical for understanding XRP’s near-term price trajectory.

Rapid Depletion of OTC Liquidity

Jake Claver, CEO of Digital Ascension Group, highlights that XRP spot ETFs have been aggressively acquiring XRP, rapidly diminishing the available supply in OTC and dark pool venues. Initial estimates suggested a pool of 1 to 2 billion XRP in these private liquidity channels. However, approximately 800 million XRP have already been absorbed within the first week of ETF activity. This rapid depletion indicates that a significant portion of the accessible OTC supply may already be exhausted, potentially forcing ETFs to seek liquidity from public exchanges sooner than anticipated.

This dynamic has significant implications for market structure. Typically, institutions prefer OTC markets for large transactions to minimize price slippage and market impact. As these private channels dry up, the shift to exchanges could introduce increased volatility and price discovery based on retail demand, a pattern observed in other crypto assets during periods of high institutional interest.

Shift to Public Exchanges and Price Volatility

Claver emphasizes that the muted price movement of XRP thus far is attributable to ETFs primarily sourcing XRP through private channels. Once these OTC supplies are depleted, ETFs will be compelled to acquire XRP on public exchanges, which could trigger significant price volatility. He points to a recent anomaly on Kraken, where XRP briefly spiked to $91, as a possible preview of the market’s reaction to increased institutional demand on exchanges with relatively thin liquidity.

Historically, similar scenarios have played out in other markets. The launch of Bitcoin ETFs, for example, led to an initial surge in demand that strained existing liquidity, resulting in price swings. The potential entry of major issuers like BlackRock, Vanguard, and Fidelity into the XRP ETF market could amplify this effect, as their substantial assets under management would require significant XRP acquisitions.

Anticipated ETF Launches and Supply Shock

The anticipation of additional XRP spot ETF launches, particularly from major players like BlackRock, Vanguard, and Fidelity, could further intensify the supply crunch. Claver suggests that the number of XRP spot ETFs could eventually surpass that of Bitcoin, increasing the demand for XRP. This increased demand, coupled with a shrinking OTC supply, could lead to a supply shock, where the available XRP is insufficient to meet the growing institutional interest.

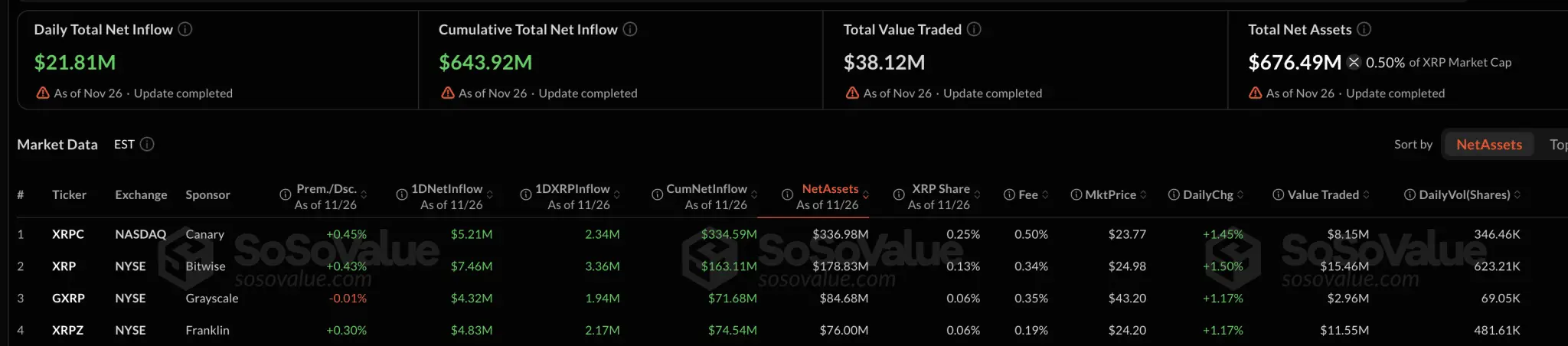

Chad Steingraber, another XRP commentator, supports this view, noting that ETFs are now the strongest near-term driver of XRP’s price. He points to the rapid accumulation of XRP by Bitwise and other ETFs as evidence of the accelerating institutional demand. If daily ETF trading volume reaches $75-$80 million, ETFs may require 20-30 million XRP per day, potentially leading to a supply shock within months.

Historical Parallels and Market Preparedness

Drawing parallels with past market events, the expected dynamics in XRP mirror the initial phases of Bitcoin ETF launches. The transition from private to public markets for asset acquisition often results in increased price volatility and the potential for rapid price appreciation. The key difference, however, lies in the existing liquidity of XRP markets compared to Bitcoin at the time of its ETF launch. XRP’s liquidity may prove less robust, potentially leading to more pronounced price swings.

Claver warns that the broader XRP community may not be fully prepared for the potential market impact of these developments. The combination of accelerating ETF inflows, major issuers entering the market, and diminishing OTC supply could create unprecedented demand pressures. Investors should closely monitor ETF flows, exchange order books, and regulatory developments to anticipate and navigate the evolving market conditions.

Regulatory Considerations and Long-Term Outlook

The regulatory landscape remains a critical factor influencing XRP’s market dynamics. Clarity and favorable regulatory outcomes could further boost institutional confidence and accelerate ETF inflows. Conversely, any adverse regulatory actions could dampen enthusiasm and slow down the accumulation of XRP by ETFs.

The long-term outlook for XRP hinges on sustained institutional interest and the continued growth of the digital asset market. As more institutions allocate capital to crypto assets, XRP could benefit from broader market tailwinds. However, the sustainability of the current demand surge will depend on XRP’s ability to maintain its competitive position and adapt to evolving market conditions.

In summary, the impending XRP supply crunch, driven by spot ETF inflows and the potential entry of major issuers, presents both opportunities and risks for investors. Monitoring liquidity dynamics, regulatory developments, and ETF flows will be crucial for navigating the evolving market landscape.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP spot ETFs are rapidly absorbing over-the-counter (OTC) and dark pool liquidity, potentially leading to a supply crunch. As OTC supply diminishes, price discovery is expected to shift to public exchanges, increasing volatility.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.