XRP price is teetering around the $3.00 mark after losing momentum at a key resistance level, prompting analysts to warn of potential downside risks.

XRP price is teetering around the $3.00 mark after losing momentum at a key resistance level, prompting analysts to warn of potential downside risks.

Slipping Below Resistance Raises Concern

Ripple’s XRP token closed Monday flirting with the $3.00 threshold, giving up earlier gains following a late-session selloff on elevated trading volume. This downturn is believed to stem from a mix of triggered stop-loss orders and institutional investors offloading their positions.

At the time of writing, XRP’s price was trading precisely at $3.00, with 24-hour volume sitting at $6.57 billion. The token has climbed just over 1% in the last day, but it’s still down nearly 5% over the past week. Price fluctuations have ranged between $2.95 and $3.10 in the last 24 hours, while weekly trading has spanned $2.96 to $3.34. XRP currently sits about 18% below its peak of $3.65 reached on July 18.

Technical analyst BitGuru highlighted that XRP has been stuck in a declining pattern since it failed to maintain support above $3.32. Recent price action illustrates a downward trajectory with consistently lower highs and lower lows, now resting atop a critical support zone around $3.00.

A bounce from this level might offer a path toward $3.20, an area that previously halted upward movement. However, should XRP lose hold of the $3.00 support, it could head as low as $2.90 next. A further breakdown might lead the token toward the previously active demand zone between $2.70 and $2.80 seen in July.

On-Chain Activity Remains Solid

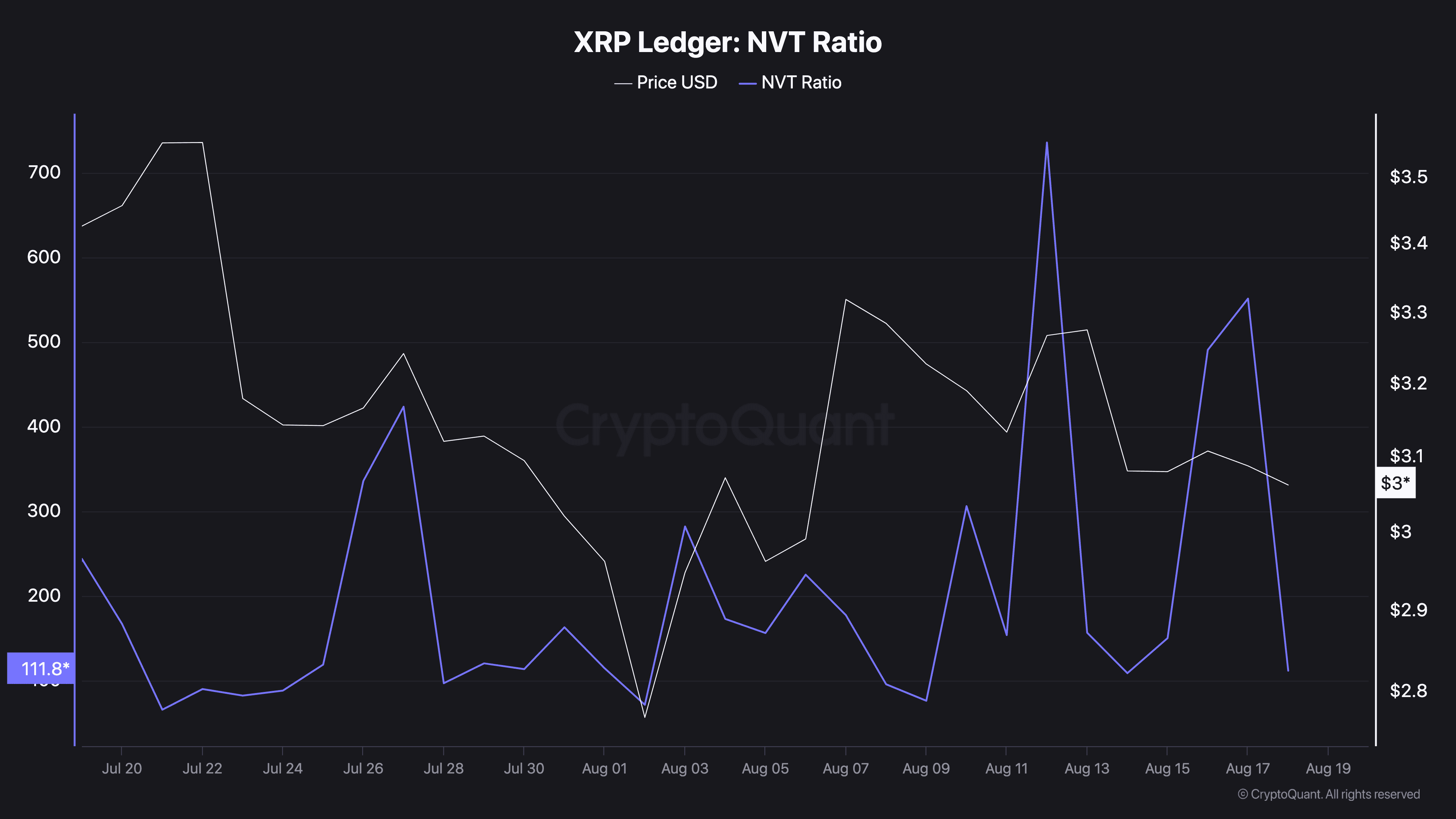

Despite recent losses in price, XRP’s blockchain remains active. The XRP Ledger’s Network Value to Transactions (NVT) ratio has plummeted to 111.8 — an 80% decline — indicating a rise in transactional activity relative to market capitalization.

Chart showing XRP Ledger’s declining NVT ratio, reflecting active on-chain usage. Source: CryptoQuant

This drop in NVT is generally interpreted as a positive sign since it reflects higher user engagement with the network. In other words, despite price pressures, XRP continues to be used actively, suggesting a healthy level of on-chain utility.

Regulatory Uncertainty Deepens

Further complicating XRP’s outlook is continued regulatory hesitation in the U.S. The Securities and Exchange Commission (SEC) has delayed its judgment on multiple exchange-traded fund (ETF) proposals tied to XRP.

Originally scheduled to decide by August 24, the SEC now plans to announce its ruling on Nasdaq’s CoinShares XRP ETF proposal by October 23. The regulator cited a need for more time to evaluate the application and public feedback before making a decision.

Related: XRP Price: $12M Max Pain for Bears

Other issuers are also facing delays. The SEC postponed decisions on several additional applications, including those submitted by Bitwise, Canary, and Grayscale. This ongoing situation prolongs market uncertainty for investors eagerly watching for regulatory clarity on XRP-related investment products.

Quick Summary

XRP price is teetering around the $3.00 mark after losing momentum at a key resistance level, prompting analysts to warn of potential downside risks. Slipping Below Resistance Raises Concern Ripple’s XRP token closed Monday flirting with the $3.00 threshold, giving up earlier gains following a late-session selloff on elevated trading volume.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.