XRP spot ETFs have launched in certain markets, attracting significant inflows despite not yet triggering an immediate price surge. Market commentators observe a pattern of intraday price appreciation during U.S. trading hours, potentially linked to ETF activity.

What to Know:

- XRP spot ETFs have launched in certain markets, attracting significant inflows despite not yet triggering an immediate price surge.

- Market commentators observe a pattern of intraday price appreciation during U.S. trading hours, potentially linked to ETF activity.

- This consistent, albeit mild, price action could build momentum for a more substantial move in the coming months as liquidity builds.

While the launch of XRP spot ETFs has been met with anticipation, the immediate price impact has been muted, leading some to question their effectiveness. Despite this, these ETFs have quietly amassed substantial assets under management, signaling institutional interest. The key question now is whether this steady accumulation can translate into sustained upward price pressure, setting the stage for a potential breakout.

The recent introduction of four XRP ETFs, including products from Grayscale and Franklin, has collectively drawn in over $580 million. This inflow surpasses that of Solana ETFs within a shorter timeframe, indicating strong initial demand. The launch of these products aims to provide institutional and retail investors with regulated exposure to XRP, streamlining access and potentially boosting overall market liquidity.

Despite the healthy inflows, XRP’s price action following the ETF launches has been relatively subdued. This divergence between ETF inflows and price movement is not uncommon in the early stages of new product launches. It often takes time for the market to fully absorb the new supply and for arbitrage opportunities between the ETF and the underlying asset to stabilize.

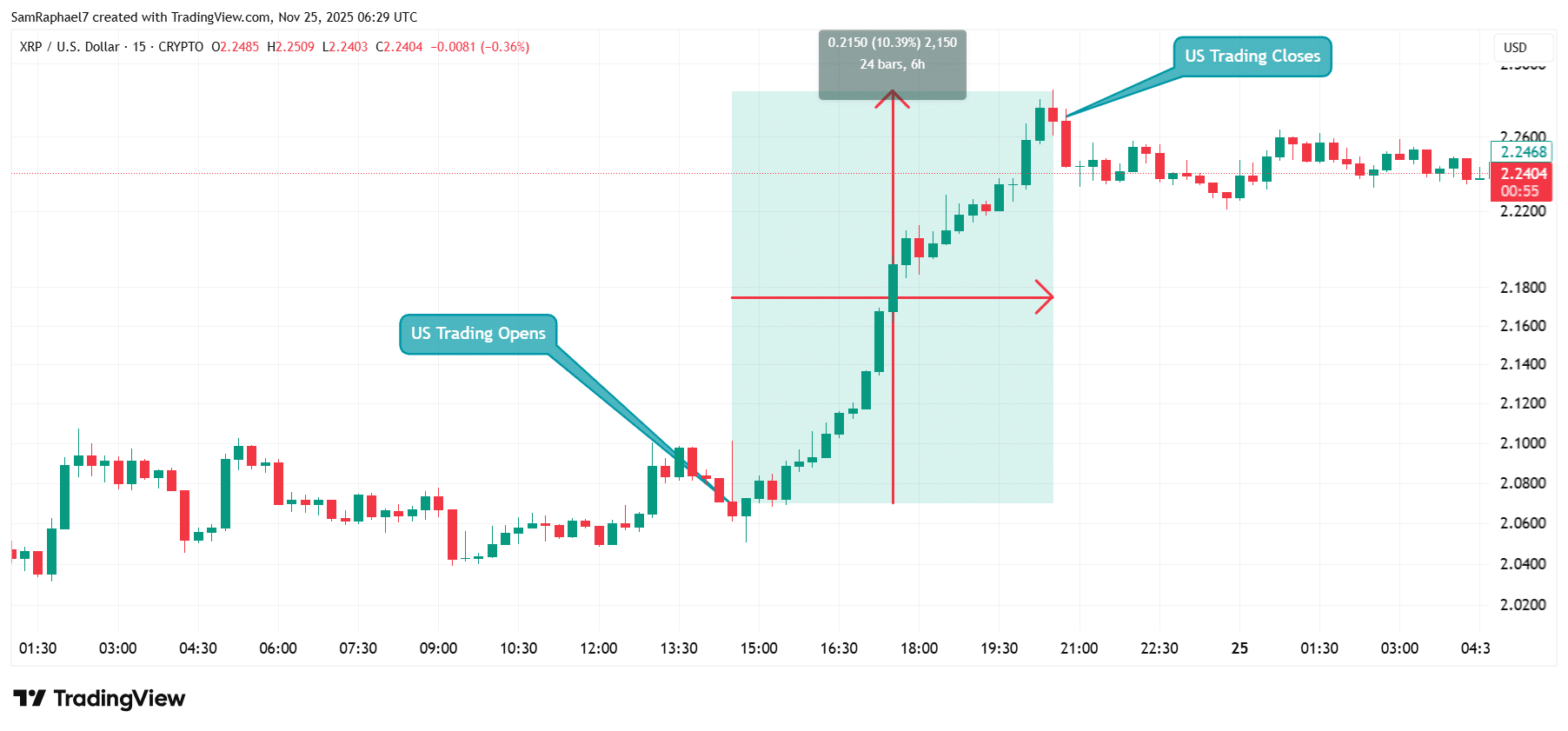

One market commentator has pointed out a potential correlation between XRP’s price and U.S. trading hours, during which the ETFs are actively traded. This observation suggests that ETF-related buying activity could be exerting intraday upward pressure on the price. Whether this pattern is sustainable and indicative of genuine demand remains to be seen, but it offers an intriguing perspective on the ETFs’ potential influence.

Analyzing intraday price movements reveals that XRP often experiences a modest increase during U.S. trading hours, followed by consolidation or slight corrections outside of those hours. This pattern could be attributed to ETF-driven demand during the trading day, with the market then reverting to its baseline once ETF activity subsides. However, it’s important to note that such correlations don’t necessarily imply causation, and other factors could be at play.

Looking ahead, the sustained accumulation of XRP within these ETFs could lead to a supply squeeze, potentially driving prices higher. As more XRP is locked up within the ETF structure, the available supply on exchanges decreases, making the asset more susceptible to price spikes from increased buying pressure. This dynamic is similar to what has been observed with Bitcoin ETFs and their impact on Bitcoin’s price.

In conclusion, while the immediate price impact of XRP ETFs has been limited, their continued accumulation of assets and potential influence on intraday price movements suggest a longer-term bullish outlook. The ETFs could serve as a catalyst for increased institutional adoption and liquidity, ultimately contributing to a more robust and mature market for XRP.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP spot ETFs have launched in certain markets, attracting significant inflows despite not yet triggering an immediate price surge. Market commentators observe a pattern of intraday price appreciation during U.S. trading hours, potentially linked to ETF activity.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.