There’s a strong indication for XRP to rally toward $3.98-$4.32 this month following an RSI golden cross. Profit-taking activities remain subdued, indicating a stronger conviction from holders in the lead-up to October’s ETF decisions.

What to Know:

- There’s a strong indication for XRP to rally toward $3.98-$4.32 this month following an RSI golden cross.

- Profit-taking activities remain subdued, indicating a stronger conviction from holders in the lead-up to October’s ETF decisions.

- XRP’s recent surge above the crucial $3 mark could be a precursor to a significant upswing.

Ripple’s XRP has once again crossed the significant $3 mark, sparking speculation about a potential major rally. A recurring technical signal on its multi-day chart bolsters this bullish outlook.

RSI Golden Cross Predicts 30%-40% Rise in XRP

The 3-day relative strength index (RSI) for XRP has just exhibited a golden cross, indicating a bullish momentum swing. The golden cross occurs when the indicator closes above its 14-period moving average.

XRP’s price history reveals significant rallies following past RSI golden crosses. For example, XRP’s price surged by over 75% a month after the golden cross in June and skyrocketed by an impressive 575% following a similar crossover in November last year.

The latest golden cross occurs as XRP revisits its 50-period exponential moving average (EMA) support, a level that has consistently coincided with previous golden cross rallies. This convergence of a $3 breakout, 50-period EMA support, and RSI crossover increases the likelihood of XRP surging toward the 1.0 Fibonacci retracement level at $3.39 in October, an 11% rise from current levels.

If XRP can decisively close above $3.39, it may further ascend toward the 1.618 Fibonacci extension level, located near $4.32, marking about a 40% increase by October or November.

Profit-Taking Eases for XRP

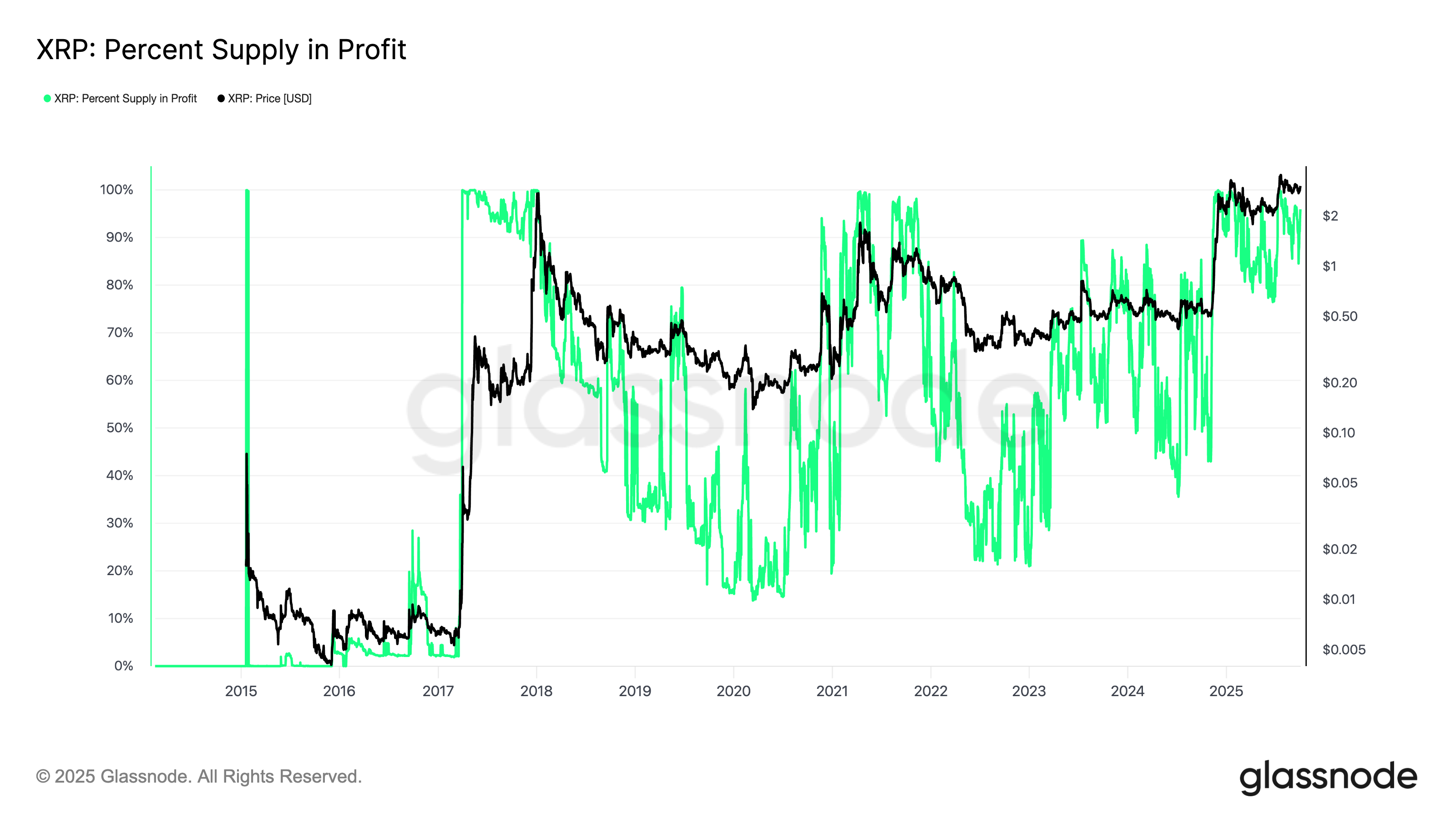

The recent XRP rally above $3 has not led to the kind of severe profit-taking that has characterized previous bull market peaks, as per on-chain data.

Since the November 2024 breakout, the percentage of XRP supply in profit – the portion of circulating XRP trading above its cost basis – has remained high and relatively stable. Unlike previous cycles where rapid sell-offs and sharp drawdowns often occurred when profit levels hit 90% to 100%, XRP holders seem to be demonstrating more patience this time around.

This stability suggests that long-term investors are less inclined to cash out in the short term, indicating stronger conviction in the ongoing trend, especially ahead of several XRP ETF decisions due in October.

While every investment and trading move involves risk, the current market signals for XRP are promising, indicating potential for significant gains in the coming months. However, as always, investors should conduct their own research before making any trading decisions.

Related: XRP Price: $12M Max Pain for Bears

Quick Summary

There’s a strong indication for XRP to rally toward $3.98-$4.32 this month following an RSI golden cross. Profit-taking activities remain subdued, indicating a stronger conviction from holders in the lead-up to October’s ETF decisions. XRP’s recent surge above the crucial $3 mark could be a precursor to a significant upswing.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.