XRP price could reach remarkable new heights if it becomes the go-to asset for domestic settlements among U.S. banks. Currently, XRP is trading around $2.82, an impressive rebound from a year ago that reflects over 400% growth.

XRP price could reach remarkable new heights if it becomes the go-to asset for domestic settlements among U.S. banks.

Currently, XRP is trading around $2.82, an impressive rebound from a year ago that reflects over 400% growth. Even so, many investors argue the digital token is still trading below its intrinsic value, especially when considering its use in payment systems worldwide.

U.S. Domestic Settlements and Market Scale

The speculation around XRP’s future price intensified recently as discussions emerged about the potential for U.S. banks to adopt it for domestic settlements. Based on Federal Reserve statistics, in 2024, American banks processed approximately $28.27 trillion through the National Settlement Service (NSS)—the core infrastructure for clearing and settling interbank payments in the U.S.

Broken down, that’s roughly $77.45 billion in daily settlements. Compared to earlier years, such as 2023’s $26.52 trillion rate, this upward trend highlights the rapidly increasing scale of domestic transactions within the nation’s financial system.

With trillions moving daily, the idea of XRP serving as a settlement asset is gaining traction for good reason. And naturally, this leads to projections about how much its price could rise in response to such a transformative usage scenario.

Comparing XRP’s Market Activity to NSS Volumes

XRP presently operates on a considerably smaller scale. It trades at nearly $3, has a circulating supply of 59.48 billion tokens, and commands a market cap of around $178.87 billion. Its average daily trading volume hovers near $6.62 billion—far less than the NSS’s $77.45 billion in daily transaction volume.

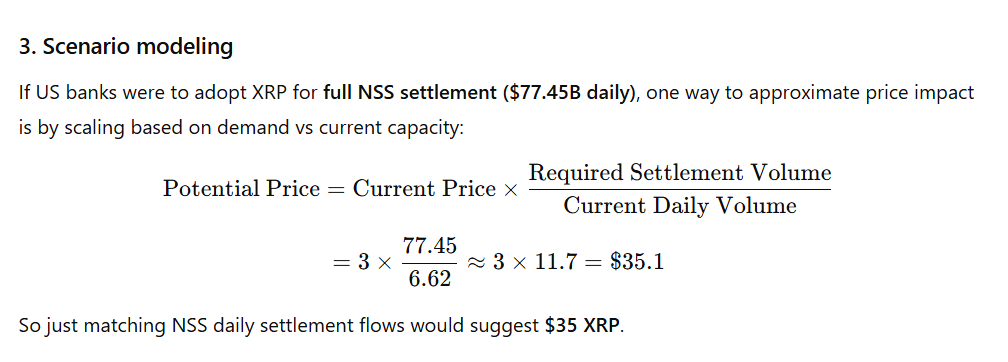

To estimate XRP’s value if it matched NSS’s flow, analysts turned to OpenAI’s ChatGPT for modeling. The results highlight a stark gap: XRP handles less than one-ninth of NSS daily volume at current levels. Scaling upward by that logic, XRP’s price would need to grow by about 11.7x, equating to a projected price of roughly $35 per token.

Projection based on XRP matching NSS daily transaction volume at $35 per token

Factors That Could Drive XRP Higher

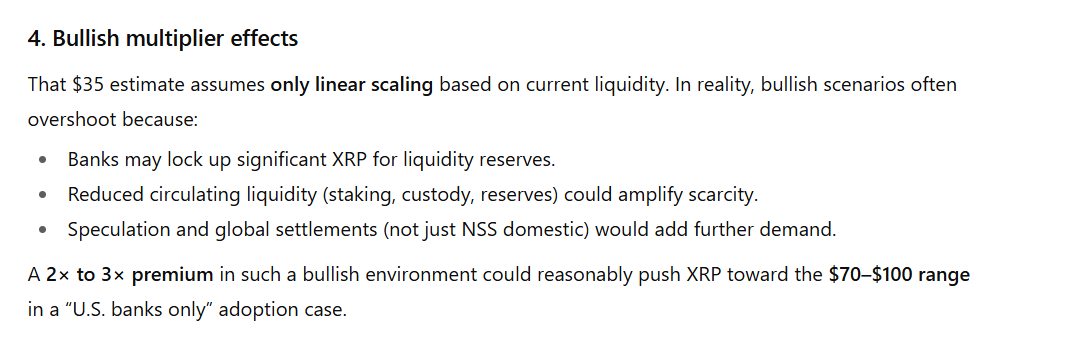

It’s important to recognize that these figures are based on linear projections. Real markets rarely follow perfectly straight trajectories. ChatGPT emphasizes that full-scale adoption by U.S. financial institutions could lead to more complex and bullish behavior.

One likely factor would be institutional demand. Banks would need to retain large amounts of XRP as liquidity reserves, effectively removing a substantial portion of the circulating supply. This move would reduce available liquidity, pushing prices higher due to scarcity.

Additionally, increased investor speculation and hype around utility-driven adoption could accelerate price movements. If XRP does gain traction as a settlement layer at this scale, both market confidence and momentum could surge.

By factoring in scarcity, speculation, and momentum typically seen in bullish markets, ChatGPT estimates that XRP’s price could reach between $70 and $100 per token under these expanded use-case scenarios.

Related: XRP Price: $12M Max Pain for Bears

Enhanced forecast: XRP price could surge to as high as $100 if banking adoption triggers bullish conditions

Quick Summary

XRP price could reach remarkable new heights if it becomes the go-to asset for domestic settlements among U.S. banks. Currently, XRP is trading around $2.82, an impressive rebound from a year ago that reflects over 400% growth.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.