Peter Brandt shared an XRP chart analysis amid a recent rally, suggesting the asset remains range-bound. This analysis arrives amid broader crypto market optimism and increasing interest in XRP ETFs. Institutional investors should note the key resistance levels that must be broken for a sustained breakout.

What to Know:

- Peter Brandt shared an XRP chart analysis amid a recent rally, suggesting the asset remains range-bound.

- This analysis arrives amid broader crypto market optimism and increasing interest in XRP ETFs.

- Institutional investors should note the key resistance levels that must be broken for a sustained breakout.

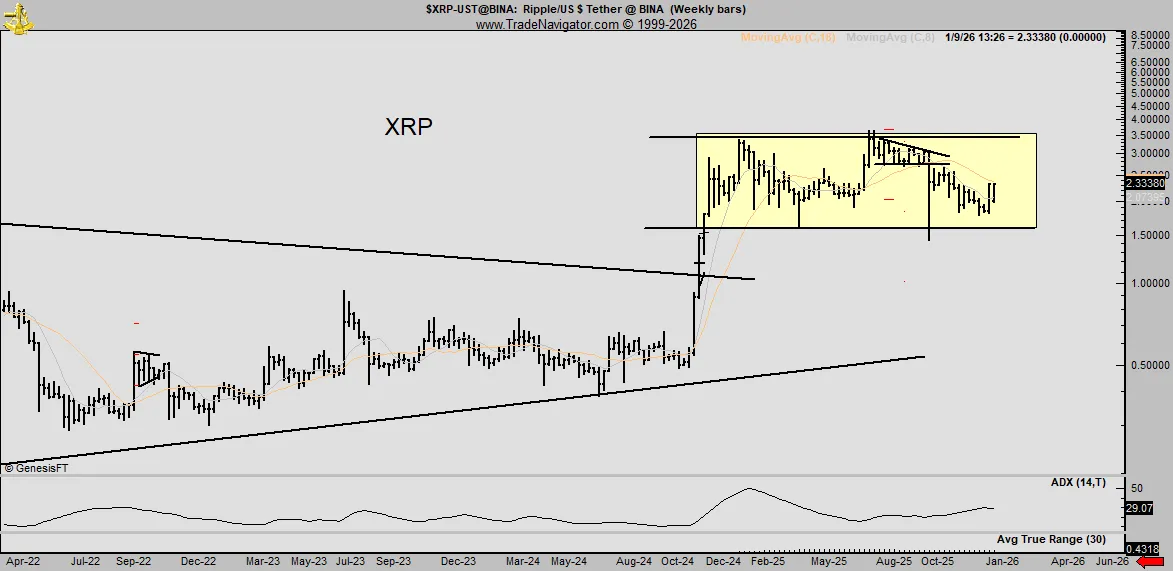

XRP has recently outperformed most top cryptocurrencies, fueled by general market optimism and speculation around potential XRP ETFs. However, veteran market analyst Peter Brandt recently offered a more tempered perspective, sharing a chart suggesting XRP is still trading within a multi-year range. This analysis serves as a reminder of the resistance XRP faces and the importance of key levels for confirming any sustained bullish breakout.

Brandt’s Perspective on XRP’s Price Action

Brandt’s analysis highlights that despite recent gains, XRP remains within a defined range on the weekly timeframe. Since breaking out of a multi-year triangle pattern in late 2024, XRP has essentially traded between $1.61 and $3.66. The recent price surge, while positive, hasn’t yet broken this established pattern, suggesting caution for investors expecting an immediate surge to new all-time highs.

This perspective provides a valuable reality check, especially given the tendency for enthusiasm to build quickly in the crypto market. Brandt’s analysis underscores that XRP faces significant resistance, and its reaction to these levels will be crucial in determining its future trajectory.

Key Resistance Levels to Watch

According to Brandt’s chart, the critical level for XRP to overcome is the $3.5 resistance mark. A sustained trade above this price point would signal a potential breakout and a shift in bullish momentum. This represents a substantial increase from current levels and highlights the challenge XRP faces in establishing a new uptrend.

Furthermore, breaking above the July 2025 high of $3.66 would provide additional confirmation of bullish intent, potentially paving the way for new all-time highs. Until these levels are decisively breached, XRP remains susceptible to further range-bound trading or even a retest of lower support levels.

Institutional Interest and ETF Potential

The potential for a U.S. spot XRP ETF continues to fuel speculation and optimism around the asset. Increased institutional demand through ETFs could provide the necessary momentum to break through the identified resistance levels. However, regulatory hurdles and market structure considerations remain important factors in the ETF approval process.

Historical Context and Market Cycles

It’s important to remember that crypto markets are prone to boom-and-bust cycles. XRP has experienced periods of significant volatility in the past, and historical performance is not necessarily indicative of future results. Institutional investors should carefully consider their risk tolerance and conduct thorough due diligence before allocating capital to XRP or any other digital asset.

Derivatives Positioning and Liquidity

Analyzing derivatives positioning and liquidity in XRP markets can provide additional insights into potential price movements. High levels of leverage or concentrated positions could amplify volatility, while thin order books can exacerbate price swings. Monitoring these factors can help institutions manage risk and navigate potential market turbulence.

Brandt’s analysis serves as a valuable reminder of the importance of technical analysis and risk management in the crypto market. While the potential for XRP ETFs and broader market optimism may be bullish catalysts, key resistance levels must be overcome to confirm a sustained uptrend. Investors should remain vigilant and carefully assess market conditions before making investment decisions.

Related: XRP Warning Signals Bearish Turn

Source: Original article

Quick Summary

Peter Brandt shared an XRP chart analysis amid a recent rally, suggesting the asset remains range-bound. This analysis arrives amid broader crypto market optimism and increasing interest in XRP ETFs. Institutional investors should note the key resistance levels that must be broken for a sustained breakout.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.