XRP ETFs are seeing consistent inflows, signaling growing interest from both retail and institutional investors. The broader context involves traditional financial institutions like pension funds and insurance companies exploring digital asset investments.

What to Know:

- XRP ETFs are seeing consistent inflows, signaling growing interest from both retail and institutional investors.

- The broader context involves traditional financial institutions like pension funds and insurance companies exploring digital asset investments.

- Increased institutional participation could significantly impact XRP’s price and market dynamics, potentially driving long-term value.

XRP ETFs have steadily gained traction since their market debut, attracting attention from a diverse range of investors. Recent commentary from Canary Capital’s CEO hints at a potential surge in demand from pension funds and insurance companies, a development that could reshape XRP’s long-term price trajectory. These institutional inflows represent a significant shift in market dynamics, suggesting growing acceptance of XRP as a viable asset class.

XRP ETF Market Overview

Canary Capital spearheaded the XRP ETF movement with the launch of its XRPC product on November 13, which saw a robust initial response with $245 million in inflows. Subsequently, Bitwise, Franklin Templeton, Grayscale, and 21Shares introduced their own XRP ETFs. Impressively, all five ETFs have recorded consistent daily inflows since inception, culminating in over $1 billion in total inflows after 21 days. As of now, the combined inflows stand at approximately $1.14 billion, reflecting sustained investor confidence in XRP.

Canary CEO Highlights Institutional Interest

In a recent podcast, Canary Capital CEO Steven McClurg discussed the growth of XRP ETFs, noting the collaborative launch approach with Bitwise. McClurg pointed out that new ETFs typically attract retail investors initially, which was the case for XRP ETFs in the first two weeks. However, he revealed that Canary Capital soon began receiving inquiries from pension funds and insurance companies globally. These institutions represent a critical audience for Canary Capital, and their growing interest underscores XRP’s appeal to traditional financial players.

XRP as Financial Infrastructure

McClurg emphasized that XRP’s attractiveness to traditional financial firms lies in its function as financial infrastructure. This resonates with Wall Street and global capital markets seeking assets with clear use cases. The institutional perspective views XRP not merely as a speculative asset but as a foundational component of future financial systems. This shift in perception could drive substantial long-term investment and integration of XRP into broader financial frameworks.

Potential Price Impact of Institutional Involvement

With XRP ETFs now holding $1.14 billion in inflows, the potential impact of deeper institutional involvement on XRP’s price is a subject of increasing discussion. While the exact effect remains uncertain, sustained inflows from large institutions could provide significant price support over time. The long-term investment strategies of pension funds and insurance companies could reduce market volatility and establish a more stable valuation for XRP, contrasting with the often speculative behavior of retail investors.

Google Gemini’s Analysis on XRP Price

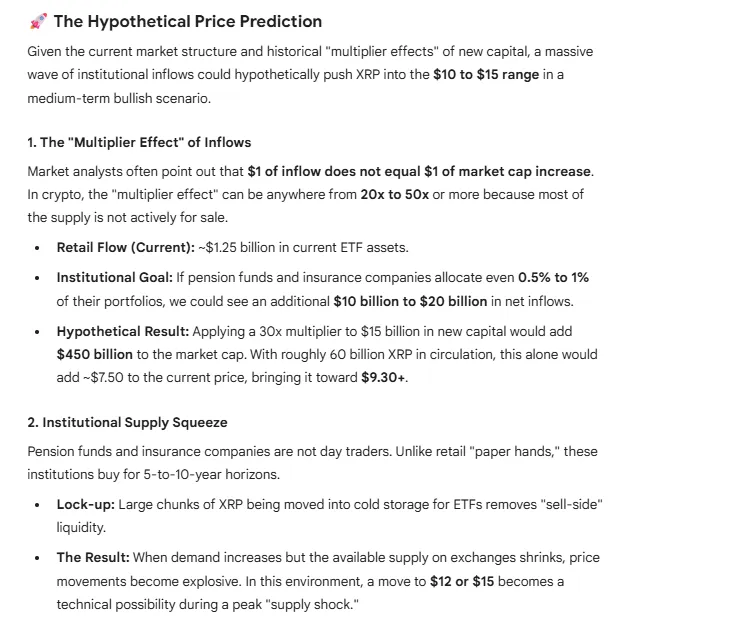

Google Gemini analyzed the potential price impact of increased pension fund and insurance company involvement in XRP ETFs, highlighting their long-term investment goals and substantial assets under management. Gemini noted the multiplier effect in crypto markets, where new capital can create disproportionately larger increases in market value due to limited token supply. If these institutions allocate a small percentage of their portfolios to XRP ETFs, it could result in significant inflows, potentially driving XRP’s price substantially higher.

In conclusion, the steady inflows into XRP ETFs and the growing interest from pension funds and insurance companies signal a maturing market for XRP. While speculative projections should be viewed with caution, the potential for increased institutional involvement suggests a positive long-term outlook for XRP’s price and market stability. The shift towards XRP as a recognized component of financial infrastructure could pave the way for broader adoption and integration into traditional financial systems.

Related: Crypto Fear Signals Bitcoin, Ethereum ETF Flows

Source: Original article

Quick Summary

XRP ETFs are seeing consistent inflows, signaling growing interest from both retail and institutional investors. The broader context involves traditional financial institutions like pension funds and insurance companies exploring digital asset investments. Increased institutional participation could significantly impact XRP’s price and market dynamics, potentially driving long-term value.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.