Ripple Chairman Chris Larsen suggested years back that XRP could work alongside SWIFT. SWIFT has been exploring its own blockchain initiatives, potentially moving away from needing XRP. An XRP integration with SWIFT could significantly impact XRP’s price, but current moves by SWIFT suggest this is less likely.

What to Know:

- Ripple Chairman Chris Larsen suggested years back that XRP could work alongside SWIFT.

- SWIFT has been exploring its own blockchain initiatives, potentially moving away from needing XRP.

- An XRP integration with SWIFT could significantly impact XRP’s price, but current moves by SWIFT suggest this is less likely.

The potential for XRP to integrate with SWIFT has long been a topic of discussion within the Ripple community and the broader crypto market. Back in 2015, Ripple’s chairman, Chris Larsen, proposed a vision where XRP could complement existing financial infrastructure like SWIFT, rather than replace it. This concept has resurfaced, prompting speculation about the potential impact on XRP’s price, especially given SWIFT’s massive global transaction volumes. However, recent developments indicate that SWIFT is pursuing its own blockchain solutions, which may reduce the likelihood of an XRP integration.

Larsen’s Vision of XRP and SWIFT

In a 2015 interview, Chris Larsen articulated Ripple’s vision for global payments, emphasizing collaboration rather than disruption. He contrasted Ripple with Bitcoin, noting that while Bitcoin aimed to replace existing financial systems, Ripple was designed to connect financial networks and enable real-time settlement in any currency. Larsen specifically mentioned that Ripple could operate alongside SWIFT, enhancing its capabilities without requiring a complete overhaul of existing systems. This perspective highlighted Ripple’s focus on interoperability and its potential to bridge traditional finance with emerging blockchain technology.

Speculation on XRP Price Impact

The XRP community has often revisited Larsen’s comments, particularly the idea of Ripple working alongside SWIFT. Market analysts have speculated on the potential market reaction if SWIFT corridors were to migrate to Ripple’s XRPL-based payment network, RippleNet. Given that SWIFT processes approximately $150 trillion in cross-border value each year through around 40,000 corridors, the integration of XRP as a bridge asset for global settlement could have a substantial impact on its price. While the exact magnitude of the price increase remains uncertain, the potential for XRP to become a key component of global financial infrastructure is a compelling narrative.

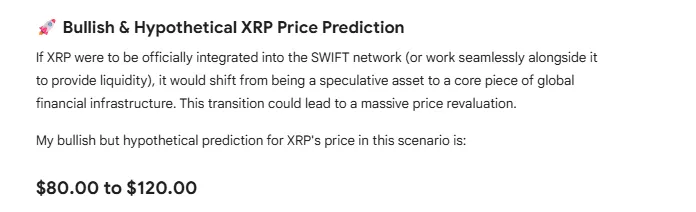

Hypothetical Price Projections

Hypothetical projections estimate that XRP could potentially reach a price range of $80 to $120 if it were to integrate directly into SWIFT or work seamlessly with it. This valuation is based on the assumption that XRP would capture a significant share of the liquidity needed to facilitate the $150 trillion in annual cross-border transactions processed by SWIFT. Such an integration would transform XRP from a speculative asset into a critical element of global financial infrastructure, justifying a substantial increase in its market capitalization. These projections, while speculative, underscore the potential upside if XRP were to play a central role in SWIFT’s operations.

SWIFT’s Blockchain Initiatives

Despite the potential synergies, discussions around XRP working with SWIFT have diminished due to SWIFT’s own advancements in blockchain technology. SWIFT has been actively pursuing its own blockchain initiatives that do not involve XRP. In late 2025, SWIFT unveiled plans to integrate a blockchain-based shared digital ledger into its infrastructure, collaborating with over 30 banks and Consensys, an Ethereum-focused firm. This project aims to enable real-time, 24/7 cross-border payments using regulated tokenized assets, stablecoins, and CBDCs, signaling a move towards internal blockchain solutions rather than external integrations.

Implications for Institutional Flows

SWIFT’s decision to develop its own blockchain solutions has significant implications for institutional flows and the potential role of XRP in the global financial system. While the integration of XRP with SWIFT would have likely driven substantial institutional investment in XRP, SWIFT’s internal initiatives suggest a different path forward. This shift could lead institutional investors to focus on other digital assets and blockchain platforms that are directly involved in SWIFT’s new infrastructure, potentially diverting capital away from XRP. The evolving landscape highlights the importance of staying informed about the strategic directions of major financial institutions like SWIFT and their impact on the broader crypto market.

While the prospect of XRP integrating with SWIFT once held considerable promise, recent developments suggest a different trajectory. SWIFT’s pursuit of its own blockchain solutions diminishes the likelihood of XRP playing a central role in its operations. Institutional investors will need to reassess their strategies in light of these changes, focusing on emerging opportunities within SWIFT’s evolving ecosystem. The future of XRP and its relationship with traditional finance remains uncertain, but the potential for innovation and disruption in the global payments landscape is undeniable.

Related: XRP ETF Flows Top $1B, Signals Strong Interest

Source: Original article

Quick Summary

Ripple Chairman Chris Larsen suggested years back that XRP could work alongside SWIFT. SWIFT has been exploring its own blockchain initiatives, potentially moving away from needing XRP. An XRP integration with SWIFT could significantly impact XRP’s price, but current moves by SWIFT suggest this is less likely.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.