New staking protocols like mXRP and FXRP are emerging for XRP, offering holders new ways to earn yields. If staking projects secure 80% of XRP’s circulating supply, it could create a significant supply squeeze and drive up the price.

What to Know:

- New staking protocols like mXRP and FXRP are emerging for XRP, offering holders new ways to earn yields.

- If staking projects secure 80% of XRP’s circulating supply, it could create a significant supply squeeze and drive up the price.

- Google Gemini estimates that XRP could reach between $10.17 and $83.33 per token, depending on market capitalization.

XRP is gaining traction with the emergence of new staking protocols, potentially revolutionizing how holders utilize their tokens. These platforms allow XRP owners to earn yields, adding a new dimension to the XRP ecosystem. The introduction of these staking options could have significant implications for XRP’s price and market dynamics.

The XRP Ledger (XRPL) has historically lacked a built-in staking feature, but projects like mXRP and FXRP are bridging this gap. FXRP, for instance, operates on the Flare Network and functions as an ERC-20 token, wrapping XRP and connecting it to Flare’s EVM-compatible chain. This integration enables XRP holders to engage in decentralized finance activities, such as lending and trading.

Currently, Flare aims to secure approximately 5 billion XRP by mid-2026, representing 8.3% of the total circulating supply. Combined, mXRP and FXRP plan to lock up around 8.9 billion XRP, or about 14.83% of all tokens in circulation. Should staking projects secure 80% of XRP’s circulating supply, the resulting supply shock could significantly impact its valuation.

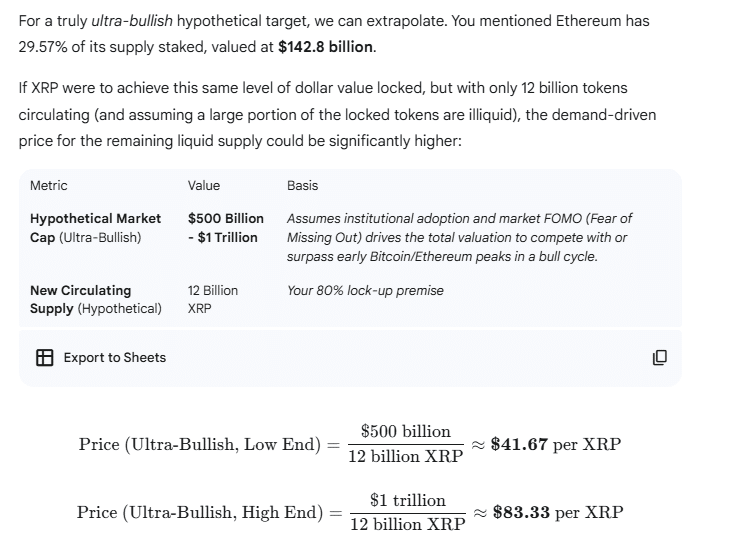

Analyzing potential outcomes, Google Gemini modeled scenarios where 80% of XRP’s supply is locked in staking, leaving only 12 billion XRP in circulation. Gemini estimated that if the market capitalization remained constant, XRP could reach around $10.17 per token. In a more bullish scenario, with increased institutional demand, XRP’s price could potentially soar to between $41.67 and $83.33 per token if its market cap rose to between $500 billion and $1 trillion.

As the crypto landscape evolves, the growth of XRP staking protocols presents promising opportunities for investors and traders. The potential for significant price appreciation, driven by supply dynamics and increased market participation, makes XRP an interesting asset to watch in the coming years, especially as regulatory clarity around crypto assets like Bitcoin ETFs continues to develop.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

New staking protocols like mXRP and FXRP are emerging for XRP, offering holders new ways to earn yields. If staking projects secure 80% of XRP’s circulating supply, it could create a significant supply squeeze and drive up the price.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.