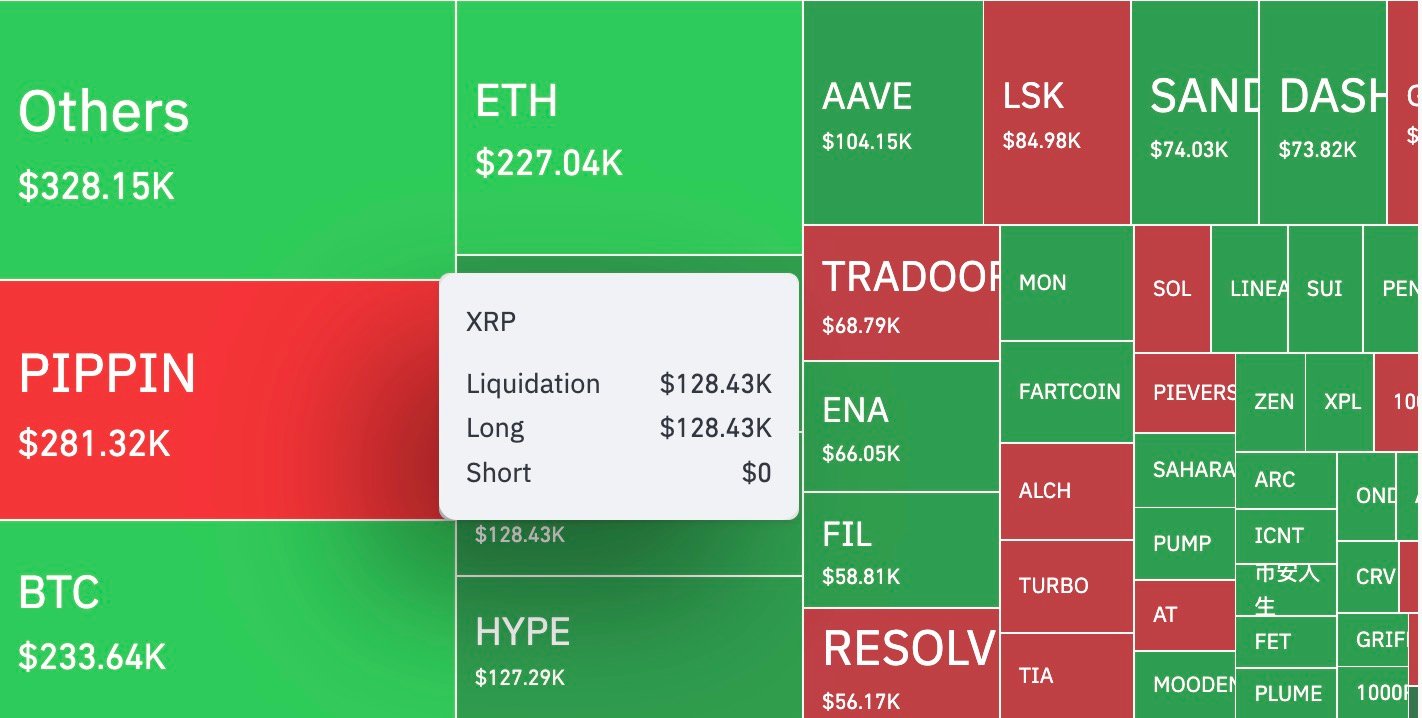

XRP exhibited a rare liquidation event, with $128,430 in long positions liquidated in a single hour and zero short liquidations. This imbalance suggests a market heavily positioned on the long side, with shorts remaining light, indicating a potential setup for a directional move.

What to Know:

- XRP exhibited a rare liquidation event, with $128,430 in long positions liquidated in a single hour and zero short liquidations.

- This imbalance suggests a market heavily positioned on the long side, with shorts remaining light, indicating a potential setup for a directional move.

- A break above $2.23-$2.25 could trigger a rapid ascent to the $2.30-$2.34 range, while a drop below $2.17 could lead to a swift decline toward $2.12-$2.14.

XRP recently flashed an unusual signal in the derivatives market, highlighting the nuances of trading smaller altcoins. An hourly liquidation snapshot revealed a complete wipeout of long positions totaling $128,430, while short positions remained untouched. This imbalance, where one side of the market is entirely liquidated, is rare and often indicative of specific market dynamics at play, with implications for future price action and institutional positioning.

One-Sided Liquidation Event

The data from CoinGlass showed a stark contrast in liquidations, with XRP displaying a one-sided hit that underscores the market’s positioning during that specific hour. While other major cryptocurrencies like Bitcoin and Ethereum experienced liquidations on both sides, XRP’s complete absence of short liquidations is noteworthy. This suggests that traders were overwhelmingly positioned long, with very few willing to bet against XRP in that particular price range. The concentration of leveraged long positions created a ripe environment for a cascade of liquidations when price dipped even slightly.

Price Action and Market Sentiment

Despite the significant liquidation event, XRP’s price movement was relatively muted, remaining within a tight range of $2.19-$2.20. This suggests that the liquidations were triggered by overexposed longs who were attempting to anticipate a price increase. The absence of short liquidations indicates that traders were hesitant to press the downside, possibly viewing the $2.19-$2.20 range as a support level. The sideways drift in price, coupled with the long liquidation event, highlights the challenges of trading in low-volatility environments, where even small price movements can trigger significant liquidations.

Potential for a Sharp Move

The clearing out of long positions sets the stage for a potential directional move. With the overleveraged longs already liquidated, a push above $2.23-$2.25 could trigger a rapid ascent toward the $2.30-$2.34 zone. Conversely, a drop below $2.17 could open the path for a swift decline toward the $2.12-$2.14 range. This potential for a sharp move underscores the importance of managing risk and avoiding overleveraged positions, particularly in altcoins like XRP that can experience sudden price swings.

Implications for Institutional Investors

For institutional investors, these types of liquidation events offer insights into market positioning and potential trading opportunities. The one-sided liquidation in XRP suggests that the market may have been overly optimistic, with too many traders betting on a price increase. This can create an opportunity for contrarian investors to take the other side of the trade, anticipating a potential correction. Additionally, the potential for a sharp move in either direction highlights the importance of having a well-defined risk management strategy when trading altcoins. Institutional desks often monitor order book depth and derivatives positioning to anticipate such events.

XRP’s Stubborn Zone

The article rightly points out that shorts were not liquidated as “the chart never gave them a candle that could force a margin call.” This highlights a key aspect of market behavior: the importance of price action in triggering liquidations. The $2.19-$2.20 range has been a “stubborn zone” for almost two days, indicating a level of support or resistance that the market has been hesitant to break. This stubbornness can lead to a build-up of leveraged positions on one side of the market, creating the potential for a significant liquidation event when the price finally moves decisively.

In summary, the recent liquidation event in XRP, where long positions were wiped out while shorts remained untouched, underscores the importance of understanding market positioning and risk management. The potential for a sharp move in either direction highlights the need for traders to be nimble and prepared to react quickly to changing market conditions. This event serves as a reminder of the inherent volatility in the cryptocurrency market and the importance of having a well-defined trading strategy.

Related: XRP Price: $12M Max Pain for Bears

Source: Original article

Quick Summary

XRP exhibited a rare liquidation event, with $128,430 in long positions liquidated in a single hour and zero short liquidations. This imbalance suggests a market heavily positioned on the long side, with shorts remaining light, indicating a potential setup for a directional move.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.