XRP’s exchange supply is tightening on South Korean exchanges like Upbit and Bithumb, while increasing on Binance. This divergence coincides with XRP breaking $2.40, a level not seen since late 2024, amid broader market speculation.

What to Know:

- XRP’s exchange supply is tightening on South Korean exchanges like Upbit and Bithumb, while increasing on Binance.

- This divergence coincides with XRP breaking $2.40, a level not seen since late 2024, amid broader market speculation.

- The shifting exchange balances and ETF flows could signal short-term profit-taking versus longer-term accumulation trends, impacting XRP’s price trajectory.

XRP has recently captured the market’s attention, surging past the $2.40 mark for the first time since November 2024. This rally occurred without a clear catalyst, sparking speculation about a potential run toward new all-time highs. However, a deeper look into exchange balances and ETF flows reveals a more nuanced picture of market dynamics and investor sentiment.

South Korean Exchange Outflows

Data from CryptoQuant indicates a notable decline in XRP reserves on South Korean exchanges. Upbit, for instance, saw its XRP holdings decrease by 31 million XRP within a week. Bithumb also experienced a similar trend, with a reduction of 10 million XRP in five days. Historically, such outflows from Upbit have preceded significant price appreciation for XRP, leading some to believe a similar pattern may unfold.

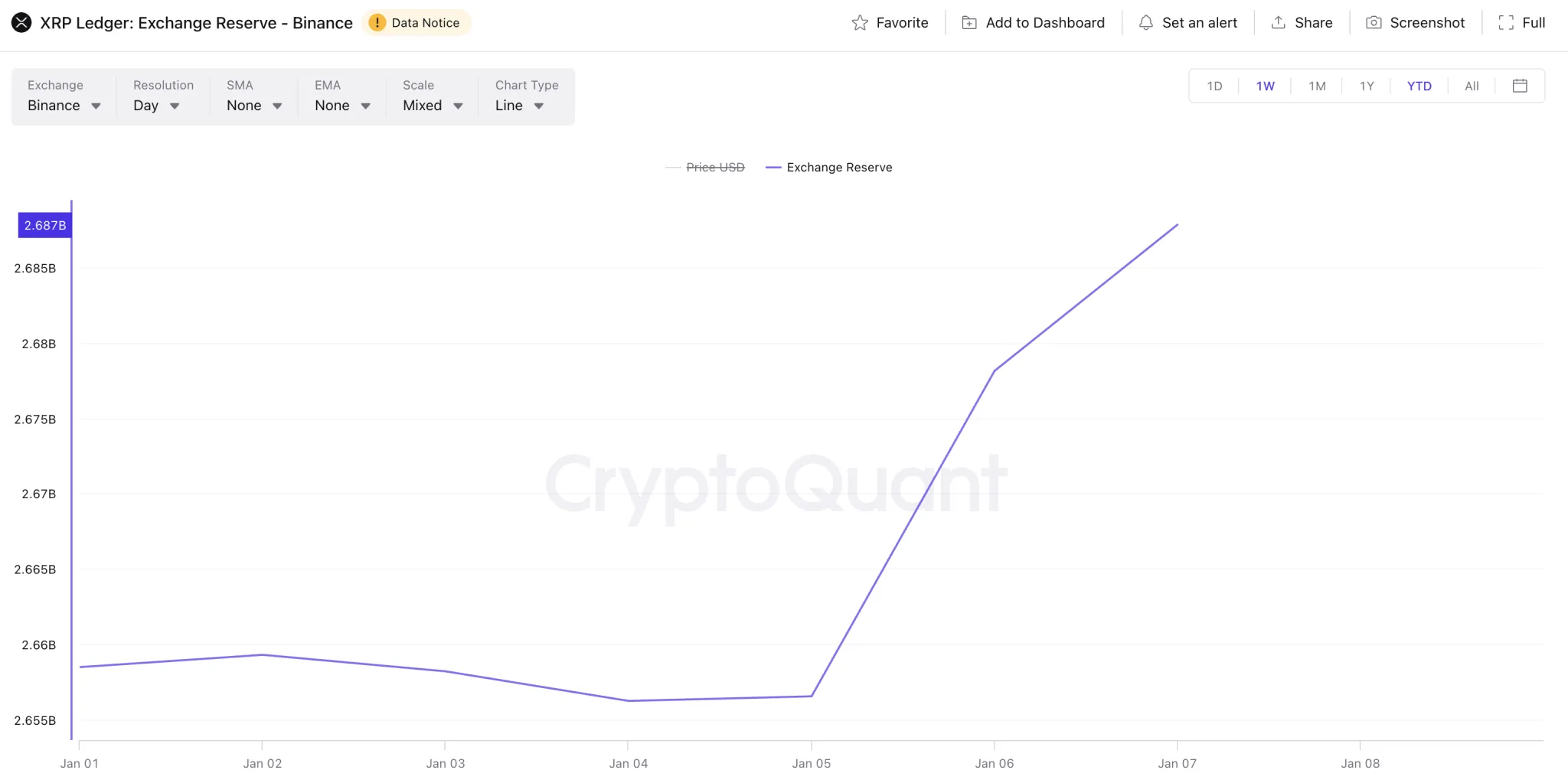

Divergence in Global Exchange Reserves

While South Korean exchanges are experiencing outflows, other major exchanges like Binance and Bitget are reporting increases in XRP reserves. Binance’s XRP holdings, for example, grew by approximately 48 million XRP in a week. This divergence suggests a regional difference in investor behavior, with South Korean investors potentially moving XRP off exchanges while international traders transfer assets onto exchanges to capitalize on the rally.

ETF Outflows Emerge

XRP ETFs have also experienced a shift in momentum, recording $40.8 million in outflows. 21Shares XRP ETFs drove this trend with a substantial $47.25 million sale. Despite these outflows, total assets under management for XRP ETFs remain substantial at $1.53 billion, indicating continued institutional interest, albeit with some profit-taking.

Potential Profit-Taking

The contrasting trends in exchange reserves and ETF flows suggest that some investors are realizing gains after XRP’s recent surge. The 7.34% price dip in the last 24 hours to $2.10, following a peak of $2.41, supports this interpretation. Traders may be opting to secure profits rather than holding out for a potential new all-time high, reflecting a cautious approach amid market uncertainty.

Market Outlook

While exchange data and ETF flows provide valuable insights, predicting XRP’s future trajectory remains challenging. The contrasting trends highlight the complexity of market dynamics and the influence of regional investor behavior. Whether XRP can sustain its upward momentum will depend on a combination of factors, including continued institutional interest, regulatory developments, and overall market sentiment.

Related: XRP ETF Outflow Signals Liquidity Shift

Source: Original article

Quick Summary

XRP’s exchange supply is tightening on South Korean exchanges like Upbit and Bithumb, while increasing on Binance. This divergence coincides with XRP breaking $2.40, a level not seen since late 2024, amid broader market speculation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.