XRP displays muted price action, consolidating within a narrow range. Low trading volumes suggest a lack of strong directional conviction. A breakout above $2 could signal a potential move towards $2.20.

What to Know:

- XRP displays muted price action, consolidating within a narrow range.

- Low trading volumes suggest a lack of strong directional conviction.

- A breakout above $2 could signal a potential move towards $2.20.

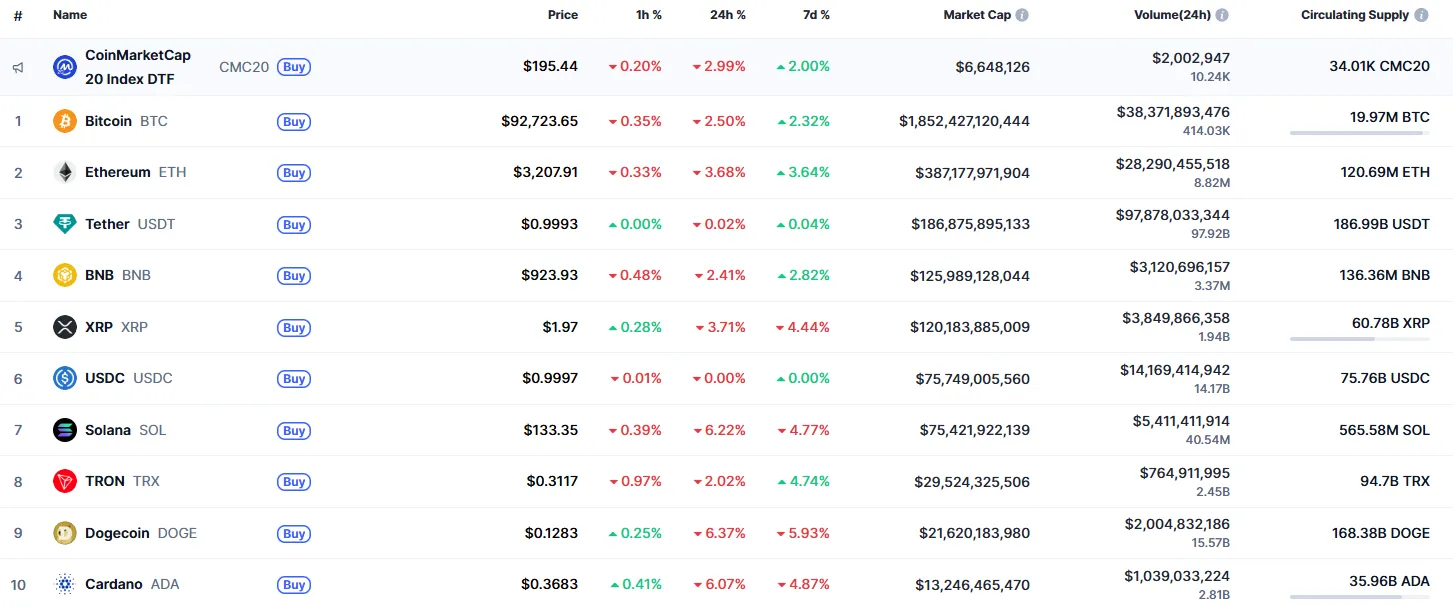

XRP has been relatively quiet, mirroring the broader crypto market’s recent consolidation. While Bitcoin and Ethereum capture headlines, XRP’s price action remains subdued, leaving institutional investors searching for clearer signals. The current market structure suggests a lack of strong conviction, with both buyers and sellers hesitant to commit heavily.

Short-Term Technical Outlook

XRP’s hourly chart reveals a struggle near the $1.9829 resistance level. The Average True Range (ATR), a measure of volatility, indicates that intraday price swings are likely to be limited. Bulls need to sustain any upward momentum to test the $2-$2.05 range.

From a trading perspective, the subdued volatility may deter short-term speculators. Institutional desks often look for higher ATR readings to justify deploying capital. A breakout above the immediate resistance could attract momentum traders, potentially fueling a rally.

Sideways Trading Range

The daily chart shows XRP trading far from key support and resistance levels. Trading volumes remain low, suggesting neither bulls nor bears have enough strength for a decisive move. A sideways trading range between $1.95 and $2.05 appears to be the most probable scenario.

Such consolidation periods are common in crypto markets, especially after periods of high volatility. Institutional investors often use these phases to accumulate positions discreetly, waiting for a catalyst to trigger a breakout. The lack of volume, however, is a concern, as it suggests limited institutional participation at current price levels.

Mid-Term Perspective

Looking at the mid-term picture, the situation remains largely unchanged. It’s still early in the week to make any definitive long-term predictions. Traders should closely monitor the $2 level; a decisive close above this mark could pave the way for a move towards $2.20.

The $2 level is acting as a key psychological barrier. If XRP can decisively breach this level, it could trigger a wave of buy orders, potentially leading to a sustained rally. Conversely, failure to break above $2 could lead to further consolidation or a pullback towards lower support levels.

Broader Market Context

XRP’s price action needs to be viewed within the context of the broader crypto market. Bitcoin’s performance, regulatory developments, and macroeconomic factors all play a role in shaping XRP’s trajectory. Any positive news regarding Ripple’s ongoing legal battle with the SEC could act as a significant catalyst.

Institutional investors are closely watching the regulatory landscape. Clarity on XRP’s legal status could unlock significant capital inflows. The launch of Bitcoin ETFs, for example, demonstrated the impact of regulatory approval on market sentiment and price discovery.

Concluding Thoughts

XRP’s current consolidation phase reflects a period of uncertainty and low conviction. While a breakout above $2 could signal renewed bullish momentum, traders should remain cautious and monitor trading volumes closely. The broader market context and regulatory developments will continue to play a crucial role in shaping XRP’s future price action.

Related: Crypto: XRP Liquidation Signals Bitcoin Whale Dump

Source: Original article

Quick Summary

XRP displays muted price action, consolidating within a narrow range. Low trading volumes suggest a lack of strong directional conviction. A breakout above $2 could signal a potential move towards $2.20. XRP has been relatively quiet, mirroring the broader crypto market’s recent consolidation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.