XRP faces renewed selling pressure, testing key support levels that could trigger further declines. Technical analysis suggests a bearish outlook in the short to medium term, contingent on holding critical price floors.

What to Know:

- XRP faces renewed selling pressure, testing key support levels that could trigger further declines.

- Technical analysis suggests a bearish outlook in the short to medium term, contingent on holding critical price floors.

- Broader market sentiment and potential Bitcoin movements will likely influence XRP’s price action.

XRP, the digital asset closely associated with Ripple Labs, finds itself at a crucial juncture. Recent price action indicates increasing selling pressure, raising concerns among investors about further downside risk. As regulatory uncertainties linger and market participants navigate broader crypto volatility, understanding XRP’s technical landscape becomes paramount for institutional and high-net-worth investors.

Short-Term Technical Outlook

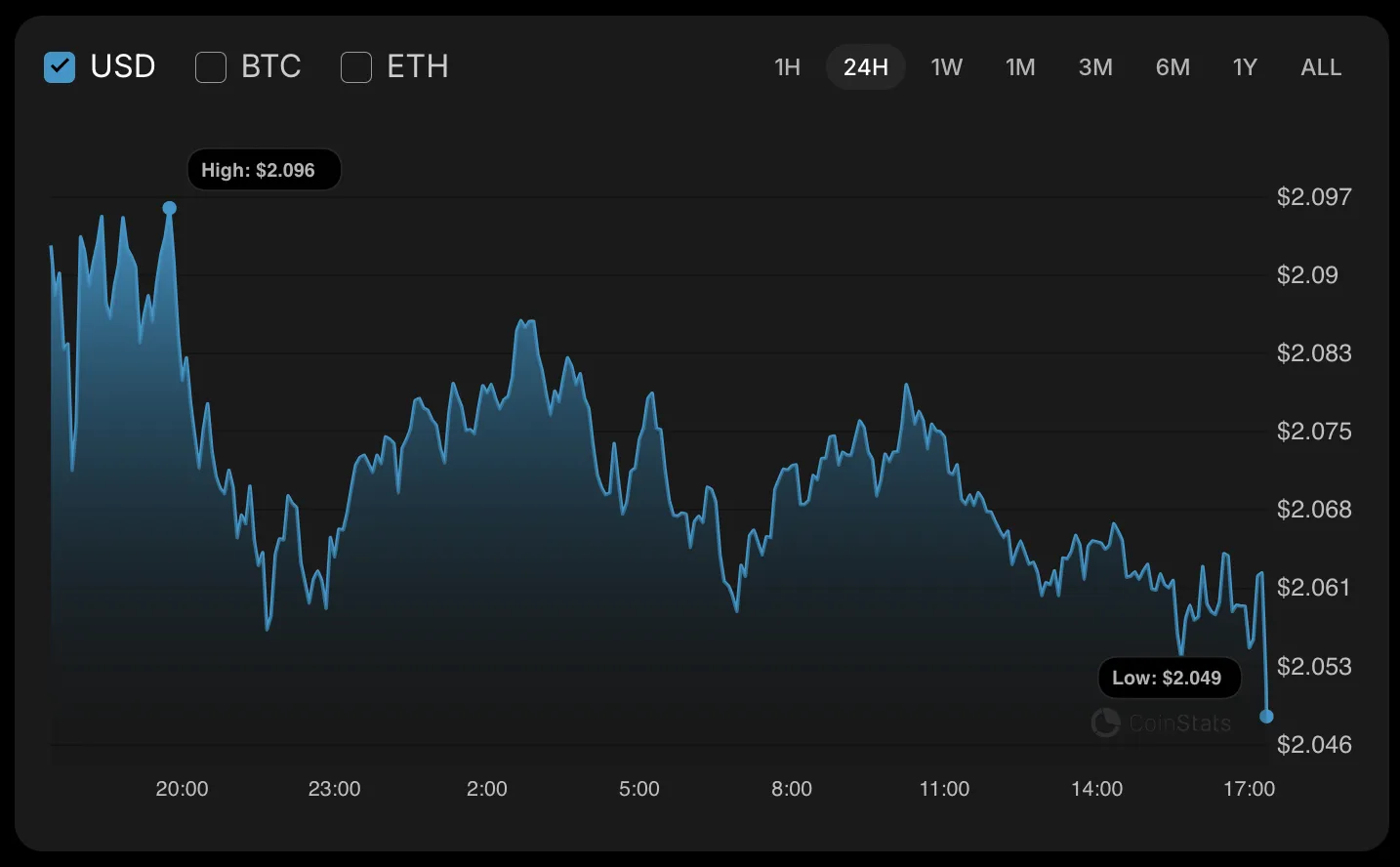

XRP’s price has declined by 2% recently, with the immediate focus on the $2.0530 support level. A break below this point could accelerate a decline toward the $2.03-$2.04 range. This level represents a critical area where buyers need to step in to prevent further losses. Failure to hold this support could signal increased bearish momentum, potentially triggering stop-loss orders and exacerbating the downward pressure.

Critical Support Levels

The $2.0450 level is the next key area to watch. A daily close below this price point could confirm a bearish trend, potentially leading to a more significant drop toward the $2.00 mark. This scenario highlights the importance of monitoring daily candle closes for confirmation of trend direction. Institutional investors often use such technical signals to adjust their positions, either by reducing exposure or initiating short positions to capitalize on further declines.

Mid-Term Bearish Scenario

The medium-term outlook appears bearish, contingent on XRP’s ability to hold the $2.00 support. Losing this level could open the door to a test of the $1.80 range, representing a substantial downside risk. This potential drop underscores the importance of risk management and strategic position sizing for institutional portfolios. Such a decline could also test the resolve of long-term holders and potentially lead to further selling pressure.

Broader Market Context

XRP’s price action does not occur in isolation. Broader market sentiment, particularly Bitcoin’s movements, significantly influences altcoin performance. Any sharp correction in Bitcoin could exacerbate the selling pressure on XRP, accelerating its decline. Conversely, a sustained Bitcoin rally could provide a tailwind for XRP, potentially helping it to recover and retest higher resistance levels. Monitoring Bitcoin’s price action and overall market sentiment is therefore crucial for assessing XRP’s potential trajectory.

Regulatory Considerations

The ongoing regulatory landscape surrounding Ripple continues to cast a shadow over XRP. Any adverse developments in the SEC case could trigger significant price volatility. While a favorable outcome could provide a substantial boost to XRP’s price, the uncertainty remains a key risk factor for institutional investors. Prudent portfolio management requires careful consideration of these regulatory risks and the potential impact on XRP’s long-term value.

In summary, XRP faces significant technical challenges, with key support levels under pressure. A bearish outlook prevails in the short to medium term, contingent on holding critical price floors. Broader market sentiment, particularly Bitcoin’s movements and regulatory developments, will likely influence XRP’s price action.

Related: XRP Amendment Targets Trillions in Capital

Source: Original article

Quick Summary

XRP faces renewed selling pressure, testing key support levels that could trigger further declines. Technical analysis suggests a bearish outlook in the short to medium term, contingent on holding critical price floors. Broader market sentiment and potential Bitcoin movements will likely influence XRP’s price action.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.