XRP faces bearish pressure, testing key support levels that could dictate near-term price action. Technical analysis suggests a potential breakdown below $2, with further correction towards $1.90 possible. Longer-term weekly charts indicate continued bearish momentum, targeting $1.8209 as the next support level.

What to Know:

- XRP faces bearish pressure, testing key support levels that could dictate near-term price action.

- Technical analysis suggests a potential breakdown below $2, with further correction towards $1.90 possible.

- Longer-term weekly charts indicate continued bearish momentum, targeting $1.8209 as the next support level.

XRP, the digital asset closely associated with Ripple Labs, finds itself at a critical juncture as bearish sentiment pervades the broader crypto market. Institutional investors are closely watching these levels, as XRP’s price action could offer clues about the overall health and risk appetite within the digital asset space. Understanding these technical levels is paramount for managing risk and identifying potential entry or exit points.

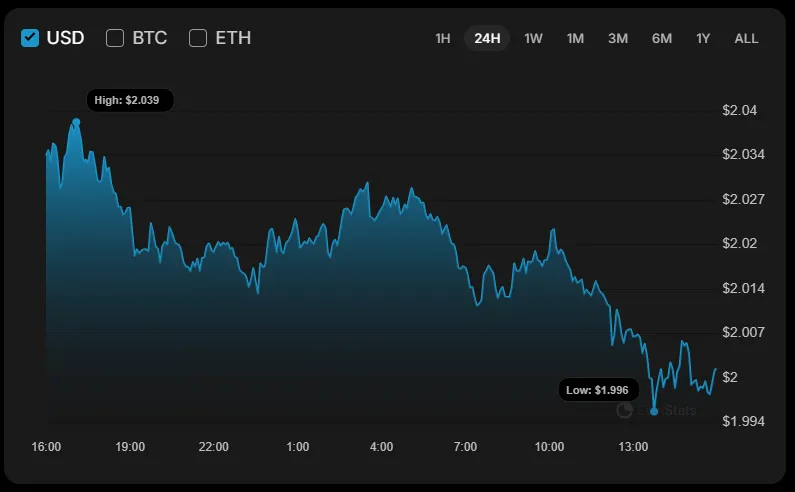

Hourly Chart Analysis

The short-term outlook for XRP, as depicted on the hourly chart, reveals a price leaning towards support rather than resistance. A failure by buyers to assert control could lead to a breakdown, potentially triggering a correction toward the $1.98 level. This immediate support level will be crucial in gauging the short-term directional bias for XRP. The current market structure does not favor the bulls.

Daily Time Frame Considerations

Stepping back to the daily time frame, the $2 mark emerges as an interim area of significance. Should XRP decisively break below this level, the bearish momentum could intensify, paving the way for a test of the $1.90 range. This scenario highlights the importance of monitoring trading volumes and order book depth around the $2 level to anticipate potential price movements. A break below $2 would likely trigger stop losses and accelerate the move down.

Weekly Chart Bearish Dominance

The weekly chart paints a more concerning picture, with bears firmly in control. Without any clear reversal signals, the prevailing trend suggests a continued decline toward the $1.8209 support level as the month progresses. This longer-term perspective underscores the need for caution and a strategic approach to managing XRP positions. The weekly chart often dictates the longer-term trend, and the current setup favors further downside.

Historical Parallels and Market Sentiment

The current technical setup for XRP evokes parallels to previous periods of market uncertainty and corrections. Similar patterns have been observed across various digital assets, underscoring the importance of risk management and strategic allocation. Market sentiment, influenced by regulatory developments and macroeconomic factors, will continue to play a crucial role in shaping XRP’s price trajectory. Sentiment can shift quickly, but the underlying technicals suggest caution.

XRP’s Price at Press Time

As of press time, XRP is trading around $2.004, teetering on the edge of potential further declines. This price level serves as a critical inflection point, with a break below potentially triggering a cascade of sell orders and exacerbating the bearish trend. Prudent investors will closely monitor this level and adjust their strategies accordingly. Watching the order books and trading volume around this level is key.

In conclusion, XRP’s technical outlook indicates a prevailing bearish sentiment, with key support levels at $2, $1.90, and $1.8209 warranting close attention. Institutional investors should carefully assess these levels and consider their risk tolerance when managing XRP positions, remaining vigilant for potential shifts in market sentiment and regulatory developments. A break of these levels could lead to a significant move, so manage risk accordingly.

Related: XRP vs Solana: Community Signals Division

Source: Original article

Quick Summary

XRP faces bearish pressure, testing key support levels that could dictate near-term price action. Technical analysis suggests a potential breakdown below $2, with further correction towards $1.90 possible. Longer-term weekly charts indicate continued bearish momentum, targeting $1.8209 as the next support level.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.