XRP shows a slight upward movement of 0.47% since yesterday, reflecting minor positive momentum. Technical analysis suggests potential short-term declines toward the $1.80 support level if current resistance isn’t overcome.

What to Know:

- XRP shows a slight upward movement of 0.47% since yesterday, reflecting minor positive momentum.

- Technical analysis suggests potential short-term declines toward the $1.80 support level if current resistance isn’t overcome.

- Mid-term outlook remains bearish, with potential targets in the $1.70-$1.75 range if bearish trends continue.

XRP, also known as Ripple, continues to be a focal point for institutional investors, especially given its ongoing regulatory dynamics and potential use in cross-border payments. Recent price action indicates a struggle to maintain upward momentum, highlighting the importance of key support and resistance levels for traders. Monitoring XRP’s performance provides insights into broader market sentiment and the appetite for digital assets facing regulatory scrutiny.

Current Price Analysis

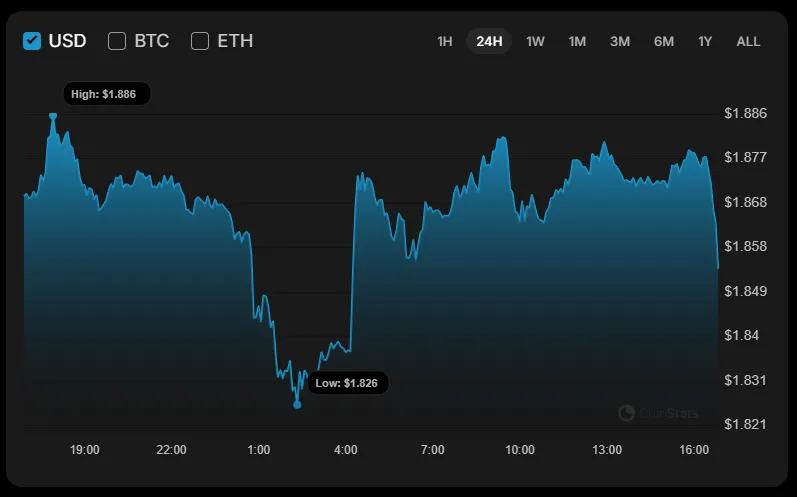

The current analysis shows XRP trading around $1.8330, with a modest increase of 0.47% since yesterday. This slight uptick is not indicative of a strong bullish trend, but rather suggests a period of consolidation. Institutional traders will likely view this as a moment to assess order book depth and liquidity before making significant moves.

Hourly Chart Observations

The hourly chart reveals a decline after a false breakout at the $1.8807 resistance. This false breakout can trap retail traders, while sophisticated investors often use such levels to initiate short positions. A close near the support level could signal further downside, potentially testing the $1.80 zone. This level will be critical as a break below it could trigger stop-loss orders, exacerbating the decline.

Mid-Term Bearish Outlook

From a mid-term perspective, sellers appear to have the upper hand. The analysis points to a likely move toward the $1.80 support. A break below this level could open the door to further declines, potentially targeting the $1.70-$1.75 range. Institutional investors often look at these broader timeframes to gauge overall market sentiment and trend direction.

Potential Downside Targets

If the $1.80 support fails, the accumulated selling pressure could drive XRP toward the $1.70-$1.75 range. The lack of reversal signals and low trading volume suggest that bulls are not yet ready to step in and defend these levels. This scenario highlights the importance of risk management and strategic positioning for traders.

Volume and Market Initiative

The low volume remains a concern, indicating a lack of strong buying interest. Without significant volume, any attempts to rally are likely to be short-lived. This situation increases the probability of further downside, with a potential test of the $1.60-$1.70 zone. Institutional desks will be closely monitoring volume as a key indicator of market strength or weakness.

In conclusion, XRP’s current technical outlook suggests a cautious approach. The inability to sustain rallies, coupled with low trading volume, points to potential further declines. Monitoring key support levels and volume trends will be crucial for assessing future price action and making informed investment decisions.

Related: XRP Signals Potential Price Move

Source: Original article

Quick Summary

XRP shows a slight upward movement of 0.47% since yesterday, reflecting minor positive momentum. Technical analysis suggests potential short-term declines toward the $1.80 support level if current resistance isn’t overcome. Mid-term outlook remains bearish, with potential targets in the $1.70-$1.75 range if bearish trends continue.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.