XRP shows mixed indicates, exhibiting short-term volatility and potential for sideways trading. Technical analysis suggests a possible correction to the $1.80-$2.00 range if bearish trends persist. Institutional investors should monitor volume and weekly closing prices for clearer directional cues.

What to Know:

- XRP shows mixed signals, exhibiting short-term volatility and potential for sideways trading.

- Technical analysis suggests a possible correction to the $1.80-$2.00 range if bearish trends persist.

- Institutional investors should monitor volume and weekly closing prices for clearer directional cues.

XRP’s recent price action reflects the broader uncertainty in the digital asset market. As regulatory scrutiny intensifies and macro conditions remain fluid, institutional investors are carefully evaluating XRP’s potential. Understanding its technical setup and market behavior is crucial for informed decision-making in this evolving landscape.

Short-Term Price Volatility

XRP’s hourly chart reveals a false breakout above the $2.1053 resistance level, indicating potential for a short-term pullback. This volatility is typical in the crypto market, where rapid price swings can occur due to speculative trading and news events. For institutional investors, managing risk during these periods requires sophisticated trading strategies and robust risk management protocols.

Sideways Trading Scenario

The analysis suggests that XRP is currently trading within a range, lacking a clear bullish or bearish trend. Declining trading volume supports this sideways movement, implying reduced participation from both buyers and sellers. This consolidation phase could be a period of accumulation or distribution, making it essential for institutions to monitor order book depth and trading activity for signs of a potential breakout or breakdown.

Bearish Weekly Close

The weekly chart paints a potentially bearish picture, with the analysis noting that a continued downtrend could lead to a correction towards the $1.80-$2.00 area. A bearish weekly close often signals a shift in market sentiment, prompting investors to reduce their positions or implement hedging strategies. Institutions may interpret this as an opportunity to re-enter at lower prices or to allocate capital to other assets with stronger momentum.

Midterm Correction Potential

From a midterm perspective, the bearish weekly close suggests a possible correction. This aligns with historical patterns where sustained rallies are often followed by periods of consolidation or retracement. Institutional investors should consider the potential impact of this correction on their portfolios, adjusting their risk exposure and rebalancing their asset allocations as necessary. Monitoring key support levels and Fibonacci retracement levels can provide insights into the depth and duration of the correction.

XRP’s Market Position

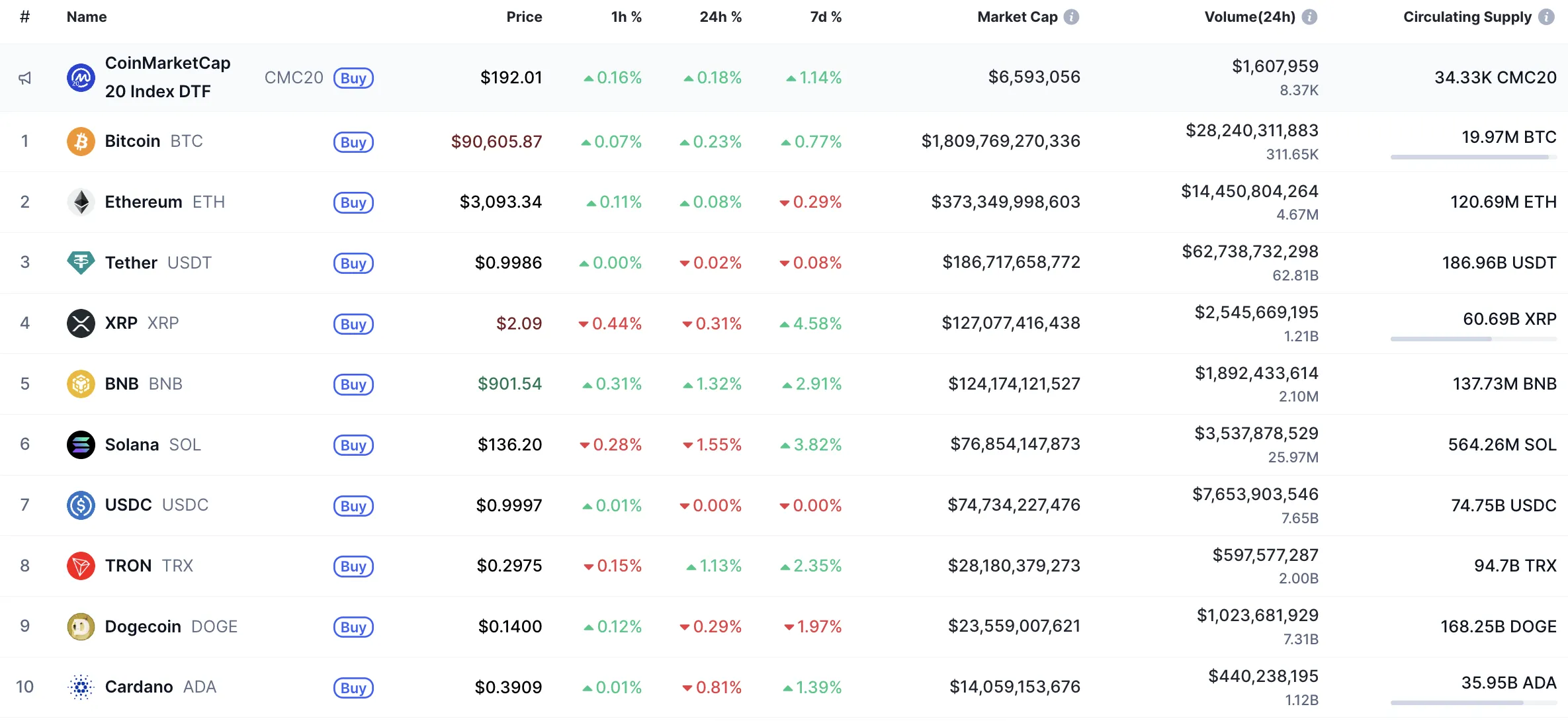

At the time of writing, XRP is trading around $2.0977, reflecting the ongoing tug-of-war between buyers and sellers. This price level serves as a crucial pivot point, with a break below potentially triggering further downside, while a sustained move above could signal renewed bullish momentum. Institutions should closely watch price action around this level to gauge the market’s next move and adjust their trading strategies accordingly.

Institutional Strategy

For institutional investors, the current market conditions warrant a cautious approach to XRP. The mixed signals from technical analysis, coupled with broader market uncertainties, suggest that patience and discipline are paramount. Diversification, hedging, and rigorous risk management are essential tools for navigating the volatility and capitalizing on potential opportunities that may arise during this period of consolidation.

In conclusion, XRP’s market behavior indicates a period of uncertainty, with potential for both short-term volatility and midterm correction. Institutional investors should remain vigilant, closely monitoring price action, trading volume, and key technical indicators to make informed decisions and manage risk effectively. The ability to adapt to changing market conditions will be crucial for success in the dynamic world of digital assets.

Related: XRP Forecast: Ripple Exec Reveals 2026 Target

Source: Original article

Quick Summary

XRP shows mixed signals, exhibiting short-term volatility and potential for sideways trading. Technical analysis suggests a possible correction to the $1.80-$2.00 range if bearish trends persist. Institutional investors should monitor volume and weekly closing prices for clearer directional cues.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.