XRP demonstrates relative strength amid broader crypto market consolidation, hinting at potential short-term bullish momentum. Technical analysis suggests a potential breakout above the $2.00 level if current support holds, though longer-term trends remain neutral.

What to Know:

- XRP demonstrates relative strength amid broader crypto market consolidation, hinting at potential short-term bullish momentum.

- Technical analysis suggests a potential breakout above the $2.00 level if current support holds, though longer-term trends remain neutral.

- Low trading volume indicates a lack of strong conviction from either buyers or sellers, potentially leading to continued sideways price action.

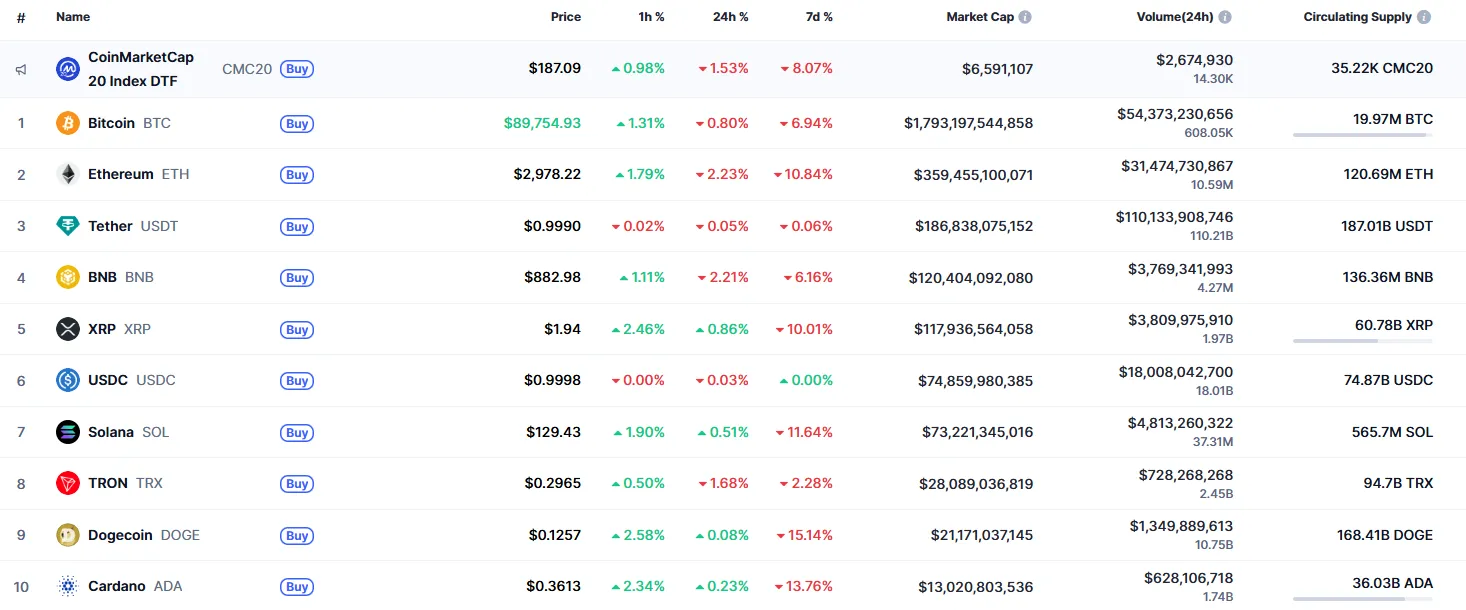

XRP is showing signs of resilience as the broader cryptocurrency market navigates a period of consolidation. While many digital assets are experiencing downward pressure, XRP has managed to maintain its ground, even exhibiting a slight upward trajectory. This relative strength is capturing the attention of institutional investors who are closely monitoring the market for opportunities amidst regulatory uncertainties and macro headwinds.

Short-Term Technical Outlook

XRP’s recent price action reveals a potential breakout from a local resistance level, suggesting a possible short-term bullish trend. The ability of bulls to sustain prices above this resistance could pave the way for a test of the $2.00 mark. However, this bullish scenario hinges on maintaining sufficient buying pressure to overcome any potential selling pressure at this key psychological level. Similar patterns have played out across the crypto landscape before, where initial breakouts face stiff resistance, leading to consolidative price action until a clear directional bias emerges.

XRP/USD

XRP is an exception to the rule, rising by 0.86% over the last 24 hours.

On the hourly chart, the rate of XRP has broken the local resistance of $1.9268. If bulls can hold the gained initiative and keep the price above that mark until the end of the day, one can expect a test of the $2 zone tomorrow.

Sideways Consolidation

Despite the short-term bullish signals, a longer-term analysis paints a more neutral picture. XRP’s price action remains confined within a defined range, indicating a lack of strong directional momentum. This sideways trading pattern suggests that neither buyers nor sellers have enough conviction to drive a sustained price trend. Such consolidation phases are common in the crypto market, particularly when faced with regulatory uncertainty or broader macroeconomic concerns. The sideways movement often precedes a significant breakout or breakdown, making it crucial for investors to monitor key levels for potential trading opportunities.

On the longer time frame, the situation is less positive for bulls. The price of XRP is within yesterday’s bar, which means none of the sides has enough energy for a further drop or a bounce back.

In this case, sideways trading in the range of $1.90-$2 is the most likely scenario until the end of the week.

Volume and Volatility

One of the key factors contributing to the current market indecision is the low trading volume. This suggests a lack of strong participation from both institutional and retail investors, which can lead to subdued price movements and reduced volatility. Low volume environments can be deceptive, as they can lull traders into a false sense of security before a sudden spike in activity triggers a sharp price swing. Seasoned traders often interpret low volume as a signal to exercise caution and avoid making aggressive bets until a clearer trend emerges.

Macro and Regulatory Landscape

XRP’s price action is not occurring in a vacuum. The broader macroeconomic environment, regulatory developments, and overall market sentiment all play a significant role in shaping its trajectory. Uncertainty surrounding regulatory clarity, particularly in the United States, continues to weigh on investor sentiment. Any positive developments on the regulatory front could act as a catalyst for renewed institutional interest and increased trading volume. Conversely, further delays or negative rulings could exacerbate the current sideways trend and potentially lead to a price correction.

From the midterm point of view, the picture is similar. The volume remains low, which means neither buyers nor sellers have enough energy for sharp ups or downs. All in all, traders are unlikely to witness increased volatility.

XRP is trading at $1.9449 at press time.

XRP’s ability to maintain relative strength amidst broader market consolidation is noteworthy. However, low trading volumes and regulatory uncertainties suggest that a sustained breakout may require a significant catalyst. Investors should closely monitor key technical levels and regulatory developments to gauge the potential for future price movements.

Related: XRP Signals Extreme Fear After Price Drop

Source: Original article

Quick Summary

XRP demonstrates relative strength amid broader crypto market consolidation, hinting at potential short-term bullish momentum. Technical analysis suggests a potential breakout above the $2.00 level if current support holds, though longer-term trends remain neutral.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.