XRP has shown positive price movement, signaling potential bullish momentum. Technical analysis suggests key resistance levels at $1.9327 and $1.9276 need to be breached for further gains. Midterm analysis points to $1.8209 as a crucial level; a strong weekly close above this could propel XRP toward $2-$2.10.

What to Know:

- XRP has shown positive price movement, signaling potential bullish momentum.

- Technical analysis suggests key resistance levels at $1.9327 and $1.9276 need to be breached for further gains.

- Midterm analysis points to $1.8209 as a crucial level; a strong weekly close above this could propel XRP toward $2-$2.10.

XRP, the digital asset closely associated with Ripple Labs, has been exhibiting signs of renewed bullish interest. As regulatory clarity around XRP’s status continues to evolve, institutional investors are keenly watching its price action and market structure. Recent price movements suggest potential opportunities, contingent on breaking through key resistance levels and maintaining positive momentum.

Short-Term Price Action

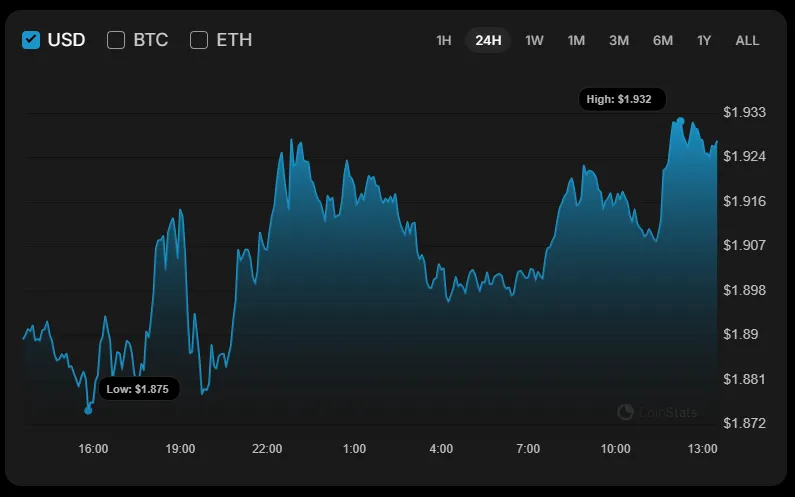

XRP has experienced a 2.14% increase over the last 24 hours, reflecting a broader recovery in the cryptocurrency market. Analysis of the hourly chart reveals a false breakout at the $1.9327 resistance level. A decisive close above this level could signal sustained upward momentum, attracting short-term traders and potentially triggering further accumulation.

The ability to overcome immediate resistance is crucial for confirming bullish sentiment. Similar patterns have been observed in the past, where false breakouts precede significant price movements. Institutional traders often use such patterns to gauge market sentiment and adjust their positions accordingly, looking for confirmation before committing significant capital.

Critical Resistance Levels

Focusing on the short-term, the $1.9276 level is critical. A breakout above this level, accompanied by a candle close above it with a short wick, could indicate sufficient energy for a move toward the $1.95-$2 range. This scenario would likely attract increased trading volume and potentially trigger algorithmic trading programs to initiate buy orders, further driving up the price.

Monitoring order book depth and trading volume around these levels will be vital. A thin order book above $1.9276 could facilitate a rapid price surge, while heavy resistance might indicate the presence of large sell orders, potentially stalling the upward movement. Institutional desks will be closely watching these dynamics to assess the viability of larger positions.

Midterm Outlook and Key Support

From a midterm perspective, the $1.8209 level is a key area of interest. A weekly close far from this level could empower bulls, potentially leading to a rally toward the $2-$2.10 area in the coming month. This level represents a significant support zone; holding above it would reinforce the bullish narrative, while a break below could signal a shift in market sentiment.

The positioning of derivatives, such as futures and options, around this level will provide additional insights. A high concentration of call options with strike prices around $2 would suggest strong bullish expectations, while a preponderance of put options could indicate hedging activity or bearish sentiment. Analyzing these factors helps refine the overall market outlook.

Broader Market Context

XRP’s performance is also influenced by broader market trends and regulatory developments. Any positive news regarding Ripple’s ongoing legal battles could act as a significant catalyst, potentially triggering a substantial price rally. Conversely, negative regulatory outcomes could dampen investor enthusiasm and lead to price corrections.

The introduction of spot ETFs for Bitcoin and Ethereum has set a precedent for potential future ETF products for other cryptocurrencies, including XRP. The launch of an XRP ETF could significantly increase institutional exposure to the asset, driving up demand and liquidity. However, this remains contingent on regulatory approval and market demand.

Conclusion

XRP’s recent price action indicates a potential for further gains, contingent on overcoming key resistance levels. The $1.9276 and $1.8209 levels are crucial for assessing the asset’s short-term and midterm prospects. Institutional investors should closely monitor these levels, along with regulatory developments and broader market trends, to make informed investment decisions. XRP is trading at $1.9294 at press time.

Related: XRP Lawsuit Crushed: What This Signals

Source: Original article

Quick Summary

XRP has shown positive price movement, signaling potential bullish momentum. Technical analysis suggests key resistance levels at $1.9327 and $1.9276 need to be breached for further gains. Midterm analysis points to $1.8209 as a crucial level; a strong weekly close above this could propel XRP toward $2-$2.10.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.