Shiba Inu’s exchange supply is decreasing, potentially indicating a shift towards longer-term holding strategies or private custody. An analyst predicts XRP could outperform gold and silver in 2026, hinging on a potential catalyst after a year of underperformance.

What to Know:

- Shiba Inu’s exchange supply is decreasing, potentially indicating a shift towards longer-term holding strategies or private custody.

- An analyst predicts XRP could outperform gold and silver in 2026, hinging on a potential catalyst after a year of underperformance.

- Bitcoin ETFs are experiencing significant outflows, testing the “sticky capital” narrative as institutional investors face potential losses.

The digital asset landscape is currently marked by intriguing shifts in token distribution, ambitious price predictions, and a stress test for Bitcoin ETF investment theses. Shiba Inu, XRP, and Bitcoin ETFs each present unique facets of the evolving market structure, offering insights into investor sentiment and institutional behavior. As regulatory scrutiny intensifies and macroeconomic conditions fluctuate, these developments warrant close attention from institutional and high net worth investors.

Shiba Inu Exchange Outflows

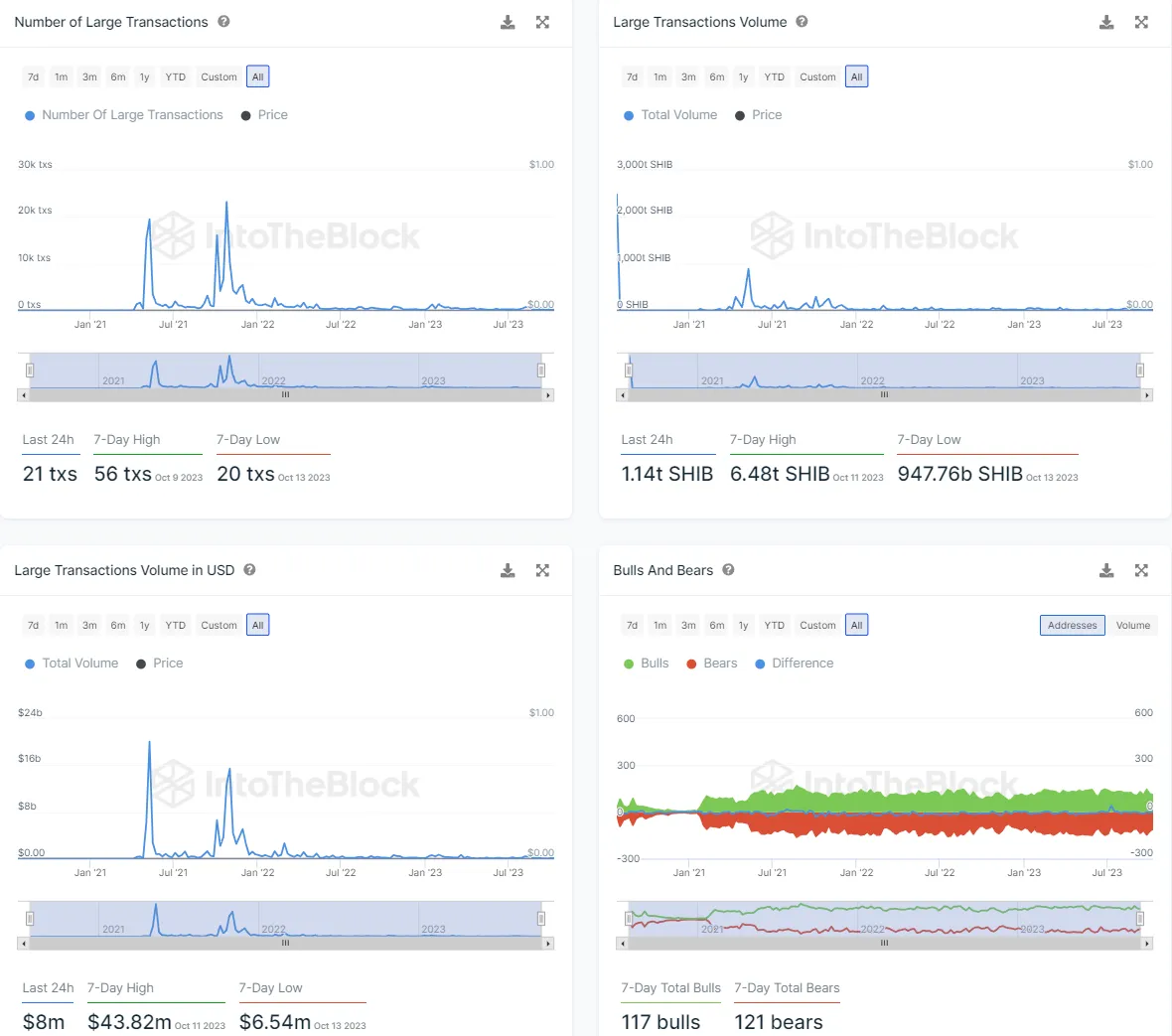

Recent data indicates a notable decrease in the supply of Shiba Inu held on centralized exchanges. Over the past week, approximately 459 billion SHIB tokens have been withdrawn from exchange wallets, suggesting a shift in token location. This exodus could mean investors are moving their holdings into DeFi protocols for staking or yield farming, or alternatively, transferring them to cold storage for longer-term holding.

The implication here is a potential reduction in immediate sell-side pressure, as tokens are removed from active trading environments. This behavior is often seen as a bullish signal, indicating a belief in the asset’s future value. However, it’s important to note that while reduced exchange supply can support price appreciation, it does not guarantee it. The market’s overall risk appetite and specific project developments will also play crucial roles.

XRP’s Ambitious Price Target

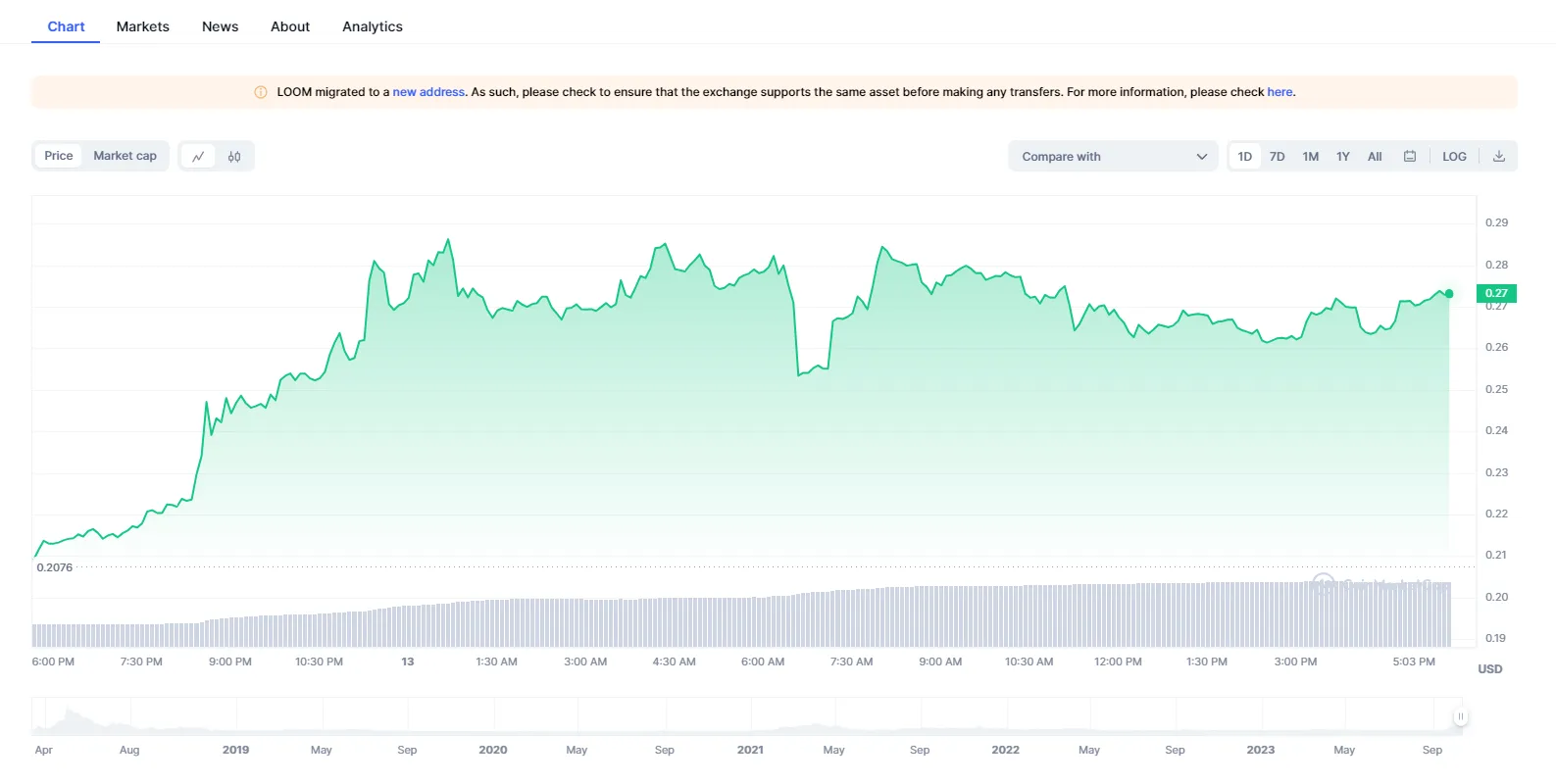

An attention-grabbing forecast from an analyst with a self-proclaimed high IQ suggests that XRP is poised to outperform both gold and silver by 2026. This prediction, while bold, arrives after a year where XRP has lagged behind traditional safe-haven assets. The rationale behind this bullish outlook likely rests on the assumption that XRP will experience a significant catalyst, potentially linked to regulatory clarity or broader adoption within financial institutions.

From an institutional perspective, such a prediction warrants cautious consideration. While the potential for high returns is enticing, the digital asset market is known for its volatility and susceptibility to unforeseen events. Comparing XRP to gold and silver, which have established roles as stores of value, requires a substantial shift in market perception and utility for XRP. Investors should weigh this speculative upside against the inherent risks and conduct thorough due diligence.

Bitcoin ETF Outflows and “Sticky Capital”

Bitcoin ETFs, once heralded as a source of “sticky capital” from institutional investors, are now facing a significant test. Recent data reveals that total outflows from these ETFs have reached $5.55 billion since their all-time highs, marking a new record drawdown. This development challenges the notion that institutional investors are unwavering in their commitment to Bitcoin, regardless of short-term price fluctuations.

The implications of these outflows are twofold. First, it indicates that even institutional investors are susceptible to market pressures and may reallocate capital based on performance and risk considerations. Second, it raises questions about the true long-term conviction of some ETF holders. As Bitcoin’s price approaches the realized price for many ETF investors, the potential for further outflows increases, adding downward pressure on the market. This situation underscores the importance of closely monitoring ETF flows as a key indicator of institutional sentiment.

Historical Parallels and Market Cycles

The current market dynamics echo previous cycles in the digital asset space. The outflow from Shiba Inu on exchanges resembles periods of accumulation seen in other altcoins before significant price rallies. Similarly, the bold prediction for XRP mirrors the optimistic forecasts that often accompany emerging technologies, although these should be viewed with skepticism. The Bitcoin ETF outflows serve as a reminder that even seemingly “sticky” capital can be influenced by market conditions, as seen in traditional asset classes during periods of economic uncertainty.

Regulatory and Macroeconomic Considerations

The developments discussed above are further influenced by the broader regulatory and macroeconomic landscape. Regulatory clarity, or the lack thereof, can significantly impact the adoption and valuation of digital assets like XRP. Macroeconomic factors, such as interest rate policies and inflation, can affect investor appetite for risk assets, including Bitcoin and altcoins. Institutional investors must carefully consider these external forces when making investment decisions in the digital asset market.

Conclusion

The digital asset market is currently undergoing a series of tests, from shifts in Shiba Inu’s exchange supply to the challenges faced by Bitcoin ETFs. While bullish narratives persist, investors must maintain a balanced perspective, acknowledging both the potential upside and the inherent risks. By closely monitoring market dynamics, regulatory developments, and macroeconomic conditions, institutional and high net worth investors can navigate this evolving landscape with greater confidence.

Related: XRP Targets $2 as Bitcoin Signals Year-End Rally

Source: Original article

Quick Summary

Shiba Inu’s exchange supply is decreasing, potentially indicating a shift towards longer-term holding strategies or private custody. An analyst predicts XRP could outperform gold and silver in 2026, hinging on a potential catalyst after a year of underperformance.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.