XRP shows signs of a potential short-term correction after a recent price increase. Low trading volumes suggest limited volatility in the near term. A bearish scenario may unfold if XRP fails to hold key support levels, potentially leading to further price declines.

What to Know:

- XRP shows signs of a potential short-term correction after a recent price increase.

- Low trading volumes suggest limited volatility in the near term.

- A bearish scenario may unfold if XRP fails to hold key support levels, potentially leading to further price declines.

XRP, the digital asset closely associated with Ripple Labs, has experienced a modest price increase, prompting analysis of its short-term trajectory. As regulatory clarity around XRP’s status evolves, institutional interest remains a key factor influencing its market behavior. Understanding XRP’s technical indicators and potential price movements is crucial for investors navigating the digital asset landscape.

Short-Term Price Correction

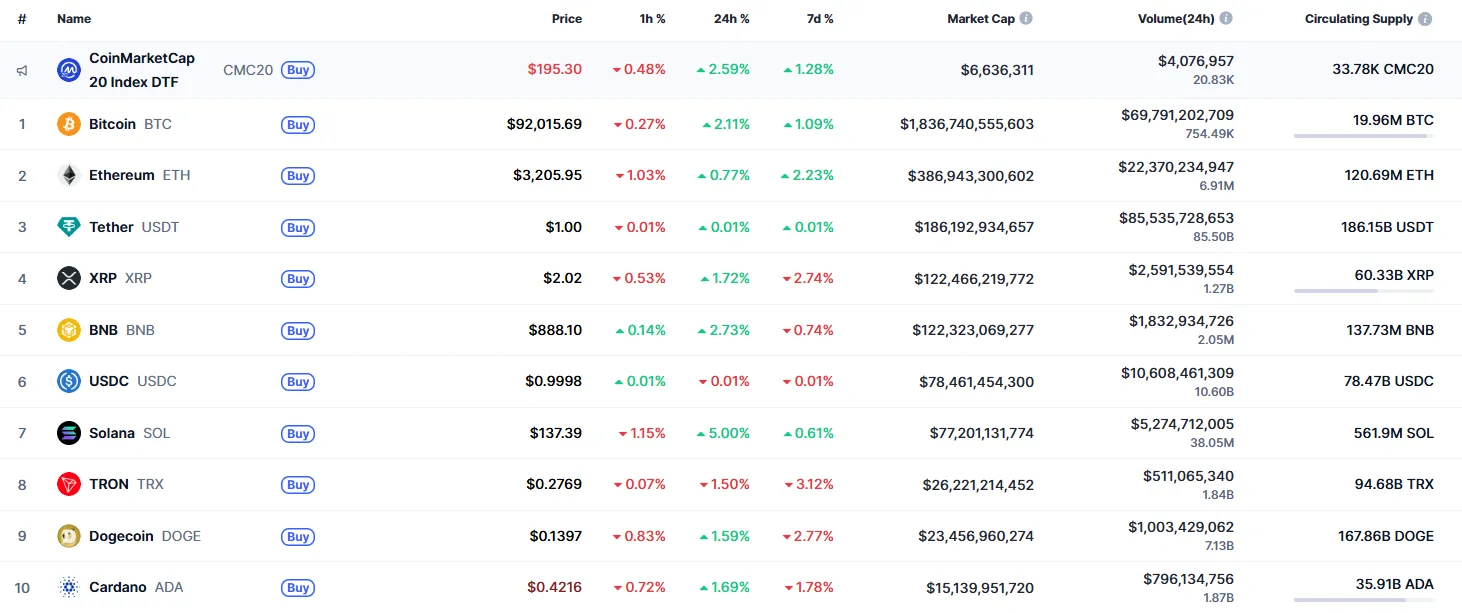

XRP’s price has seen a slight uptick, but hourly charts indicate a potential pullback. After a false breakout above a local resistance level, there’s a possibility of a correction toward the $2.02 zone. This pattern is common in crypto markets, where initial rallies are often followed by profit-taking, leading to short-term price reversals.

For institutional investors, these fluctuations offer opportunities for strategic entries and exits. The ability to identify these patterns and act accordingly can enhance portfolio performance. Monitoring order book depth and trading volumes is essential to gauge the strength of potential price movements.

Low Trading Volume Implications

The current low trading volume suggests that significant price volatility is unlikely in the immediate future. Low volume environments often reflect investor uncertainty or a lack of conviction, leading to range-bound trading. This can be frustrating for short-term traders but may present accumulation opportunities for long-term holders.

Historically, periods of low volatility have preceded major price breakouts, as pent-up energy eventually finds a release. Institutional investors often use these periods to accumulate positions quietly, anticipating future price appreciation. The key is to remain patient and disciplined, avoiding the temptation to chase short-term pumps.

Broader Timeframe Analysis

Looking at a longer timeframe, XRP’s price is currently situated far from critical levels, indicating a degree of stability. However, the balance of power appears to favor sellers, suggesting potential downside risk. If the weekly candle closes near the $1.9835 support level, it could signal a move toward the $1.85-$1.90 range.

This bearish scenario underscores the importance of risk management. Institutional investors should closely monitor price action and be prepared to adjust their positions accordingly. Setting stop-loss orders and diversifying across multiple assets can help mitigate potential losses.

Potential Downside Risks

The analysis suggests that a failure to hold the $1.9835 support level could trigger a more significant price decline. This is a critical threshold to watch, as a breach could lead to increased selling pressure. The $1.85-$1.90 range represents a potential target for sellers, indicating a possible downside of approximately 5-7%.

Such a move would not be unprecedented in the volatile world of crypto. Similar pullbacks have occurred in the past, often driven by a combination of technical factors and market sentiment. The ability to anticipate and prepare for these events is crucial for successful investing.

Regulatory and Market Sentiment

The regulatory landscape surrounding XRP remains a significant factor influencing its price. Any positive developments in Ripple’s ongoing legal battle with the SEC could provide a boost to XRP’s price. Conversely, negative news could exacerbate selling pressure.

Market sentiment also plays a crucial role. Social media chatter, news headlines, and overall investor confidence can all impact XRP’s price. Institutional investors need to stay informed and be prepared to adjust their strategies based on evolving market conditions.

In conclusion, XRP’s short-term outlook appears somewhat bearish, with potential for a price correction if key support levels fail to hold. Low trading volumes suggest limited volatility, but the longer-term trend favors sellers. Monitoring price action, regulatory developments, and market sentiment is essential for making informed investment decisions.

Related: XRP Scores National Bank Win

Source: Original article

Quick Summary

XRP shows signs of a potential short-term correction after a recent price increase. Low trading volumes suggest limited volatility in the near term. A bearish scenario may unfold if XRP fails to hold key support levels, potentially leading to further price declines.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.