XRP’s recent price increase contrasts with a significant drop in trading volume, a divergence that warrants closer inspection by institutional investors.

What to Know:

- XRP’s recent price increase contrasts with a significant drop in trading volume, a divergence that warrants closer inspection by institutional investors.

- On-chain data reveals substantial whale accumulation during the price dip, suggesting strong conviction among larger holders and potential for further price appreciation.

- Upcoming amendments to the XRP Ledger, including permissioned DEX and token escrow functionalities, could enhance the utility and attractiveness of XRP for institutional use cases.

XRP, the digital asset closely associated with Ripple, presents a mixed picture for institutional investors. While the price has shown resilience with a recent uptick, a sharp decline in trading volume raises questions about the sustainability of this upward momentum. Understanding the interplay between price action, on-chain metrics, and upcoming network upgrades is crucial for informed investment decisions.

Volume Decline Amidst Price Rise

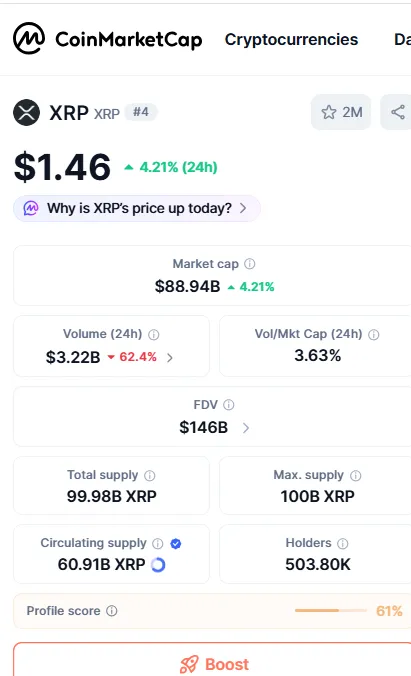

The most immediate concern is the 63% drop in XRP’s trading volume, which contrasts starkly with the nearly 5% price increase. Such divergence often signals a lack of broad market participation, potentially indicating that the price rise is driven by a smaller group of investors or even susceptible to manipulation. Seasoned traders often view volume as confirmation of a price trend; without it, rallies can be short-lived. Institutional investors should be wary of chasing price increases that are not supported by robust trading activity.

Whale Accumulation as a Bullish Signal

Despite the concerning volume drop, on-chain data from Santiment offers a potentially bullish counterpoint. The data indicates significant whale accumulation during the price dip, with a high number of $100,000+ transactions. This suggests that larger holders view the dip as a buying opportunity, indicating strong conviction in XRP’s long-term prospects. This behavior mirrors patterns seen in other crypto assets, where strategic accumulation by whales often precedes significant price reversals.

XRP Ledger Developments

February is slated to bring key amendments to the XRP Ledger, including the activation of a permissioned decentralized exchange (DEX) and token escrow features. These upgrades could significantly enhance XRP’s utility, particularly for institutional applications such as cross-border payments and decentralized finance (DeFi). The introduction of a permissioned DEX could attract institutions seeking a more regulated and compliant trading environment, while token escrow could facilitate secure and transparent transactions.

Technical Levels and Market Sentiment

From a technical analysis perspective, XRP faces key resistance levels at $1.71, followed by the daily moving averages at $1.88 and $2.44. A sustained break above these levels would signal a stronger bullish trend. Conversely, failure to hold support around $1 could lead to further declines. Market sentiment, as reflected in social media and news coverage, remains cautiously optimistic, but investors should closely monitor these levels for confirmation.

Regulatory Landscape

The regulatory landscape surrounding XRP remains a critical factor for institutional investors. While there have been some positive developments in the ongoing legal battle between Ripple and the SEC, uncertainty persists. Clarity on XRP’s regulatory status is essential for attracting larger institutional inflows and fostering long-term price stability. The outcome of this case will likely have far-reaching implications for the broader crypto market, influencing how digital assets are classified and regulated.

Broader Market Context

XRP’s performance should be viewed within the context of the broader crypto market. The recent market recovery, with several digital assets trading in green, suggests a potential shift in investor sentiment. However, macroeconomic factors, such as interest rate hikes and inflation concerns, continue to exert downward pressure on risk assets, including cryptocurrencies. Institutional investors should carefully assess these macro trends and their potential impact on XRP’s price trajectory.

In conclusion, XRP presents a complex picture for institutional investors. While the recent price increase and whale accumulation offer encouraging signs, the sharp decline in trading volume warrants caution. Upcoming network upgrades and developments in the regulatory landscape could significantly influence XRP’s long-term prospects. A balanced approach, combining technical analysis, on-chain data, and an understanding of the broader market context, is essential for making informed investment decisions.

Related: Bitcoin Hashrate Plunge Signals Downturn

Source: Original article

Quick Summary

XRP’s recent price increase contrasts with a significant drop in trading volume, a divergence that warrants closer inspection by institutional investors. On-chain data reveals substantial whale accumulation during the price dip, suggesting strong conviction among larger holders and potential for further price appreciation.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.