XRP whale activity has hit its highest levels in nearly a decade, raising speculation about a potential upward breakout in the cryptocurrency’s market movement. According to recent on-chain statistics from CryptoQuant, large wallet addresses moving significant amounts of XRP have surged since the end of 2023.

XRP whale activity has hit its highest levels in nearly a decade, raising speculation about a potential upward breakout in the cryptocurrency’s market movement. According to recent on-chain statistics from CryptoQuant, large wallet addresses moving significant amounts of XRP have surged since the end of 2023. This marks the most substantial level of whale involvement since 2015.

Despite elevated whale transactions, XRP’s market {price} has remained largely stable. Such accumulation patterns during periods of flat trading historically precede steep upward moves. Crypto analyst Mikybull Crypto recently pointed to this trend as an extremely bullish signal for XRP enthusiasts.

Wow! The most aggressive $XRP accumulation is going on right now

This is massively bullish https://t.co/jnfS6EWJbt pic.twitter.com/47ojxRmdhh

— Mikybull 🐂Crypto (@MikybullCrypto) September 28, 2025

Repetitive Market Pattern Suggests Similar Outcome

Analyst-shared charts suggest XRP is once again forming a descending channel—identical to one observed earlier in 2024, preceding a rally from below $0.60 to almost $3.60. As of now, XRP trades around $2.77, and technical traders are watching closely for hints of another breakout.

Interestingly, the phrase “XRP is dead” noted near prior price lows on historical charts highlights how pessimistic sentiment can often precede strong price recoveries. This echo of market psychology adds weight to bullish interpretations of the current chart setup.

Bull Flag Pattern Backs Up Bullish Scenarios

Technical analyst group Bitcoinsensus has also flagged a bullish pattern in XRP’s daily charts—specifically, a bull flag. In this scenario, prices climb steeply before consolidating in a downward-sloping range.

Chart showing repeat of bullish flag formation—Source: Bitcoinsensus/X

In the current formation, XRP is repeating touches of a major support level and facing rejection at the same resistance. Should this formation play out similarly to earlier this year, it could send XRP beyond the $4 mark—an all-time high in 2025.

XRP ETF Proposals Nearing Key Deadlines

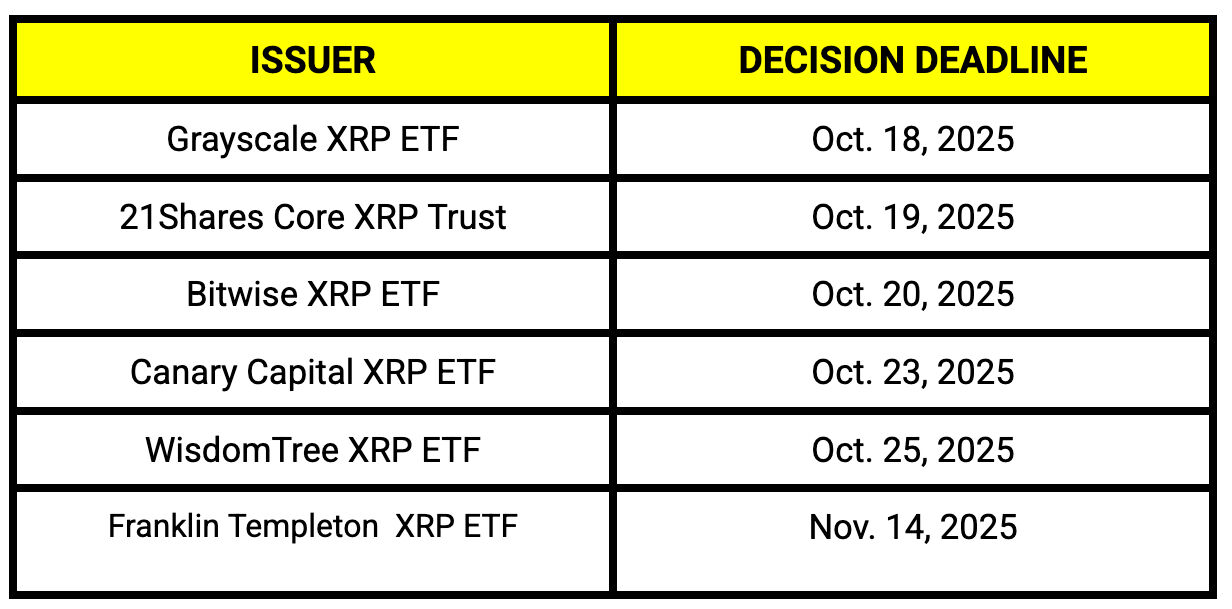

Another key driver for XRP could be imminent regulatory decisions. The U.S. Securities and Exchange Commission (SEC) is expected to deliver its rulings on six XRP-based ETF applications between October 18 and November 14, 2025. The applicants include major players such as Grayscale, Bitwise, 21Shares, WisdomTree, Franklin Templeton, and Canary Capital.

Key upcoming deadlines for XRP ETF applications—Source: CryptoPotato

The first XRP-linked fund to go live this year, the REX-Osprey XRPR ETF, launched on September 18. With multiple decisions pending, institutional and retail investors alike are paying close attention to how the SEC responds—particularly as ETF approvals could drive new liquidity into XRP markets.

However, some legal experts are sounding caution. Crypto attorney Bill Morgan highlighted language in the ETF risk disclosures that points to potential price manipulation. He commented specifically on concerns that “whale manipulation” was listed as a risk factor. If even ETF sponsors consider this a credible threat, it underscores the scale of influence that large players hold over XRP’s market movements.

Related: XRP Price: $12M Max Pain for Bears

As XRP navigates a mix of technical setups and regulatory catalysts, all signs point to an inflection point ahead. Whether whale accumulation leads to a breakout, or if ETF outcomes steer the price direction, XRP’s next chapter is rapidly taking shape.

Quick Summary

XRP whale activity has hit its highest levels in nearly a decade, raising speculation about a potential upward breakout in the cryptocurrency’s market movement. According to recent on-chain statistics from CryptoQuant, large wallet addresses moving significant amounts of XRP have surged since the end of 2023.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.