XRP faced mounting market pressure as major holders offloaded hundreds of millions in tokens, driving speculation about future price action and investor sentiment.

XRP faced mounting market pressure as major holders offloaded hundreds of millions in tokens, driving speculation about future price action and investor sentiment.

Heavy Whale Activity Shakes XRP Market

Over the past ten days, crypto whales sold around 470 million XRP, creating substantial selling pressure and triggering notable price declines. Yet, despite these sell-offs, whales also demonstrated buying interest during recent dips, accumulating approximately $360 million worth of XRP tokens. This dual behavior reflects both tactical exits and confidence in the asset’s long-term appeal.

The market has responded accordingly. XRP was recently priced at $2.89, with a daily trading volume of $6.74 billion. Within the last 24 hours, the coin dropped 4%, extending to an 11% loss over the past week. This represents a cooldown after XRP’s strong July rally, where it briefly crossed $3.60.

Exchange Inflows Signal Sustained Pressure

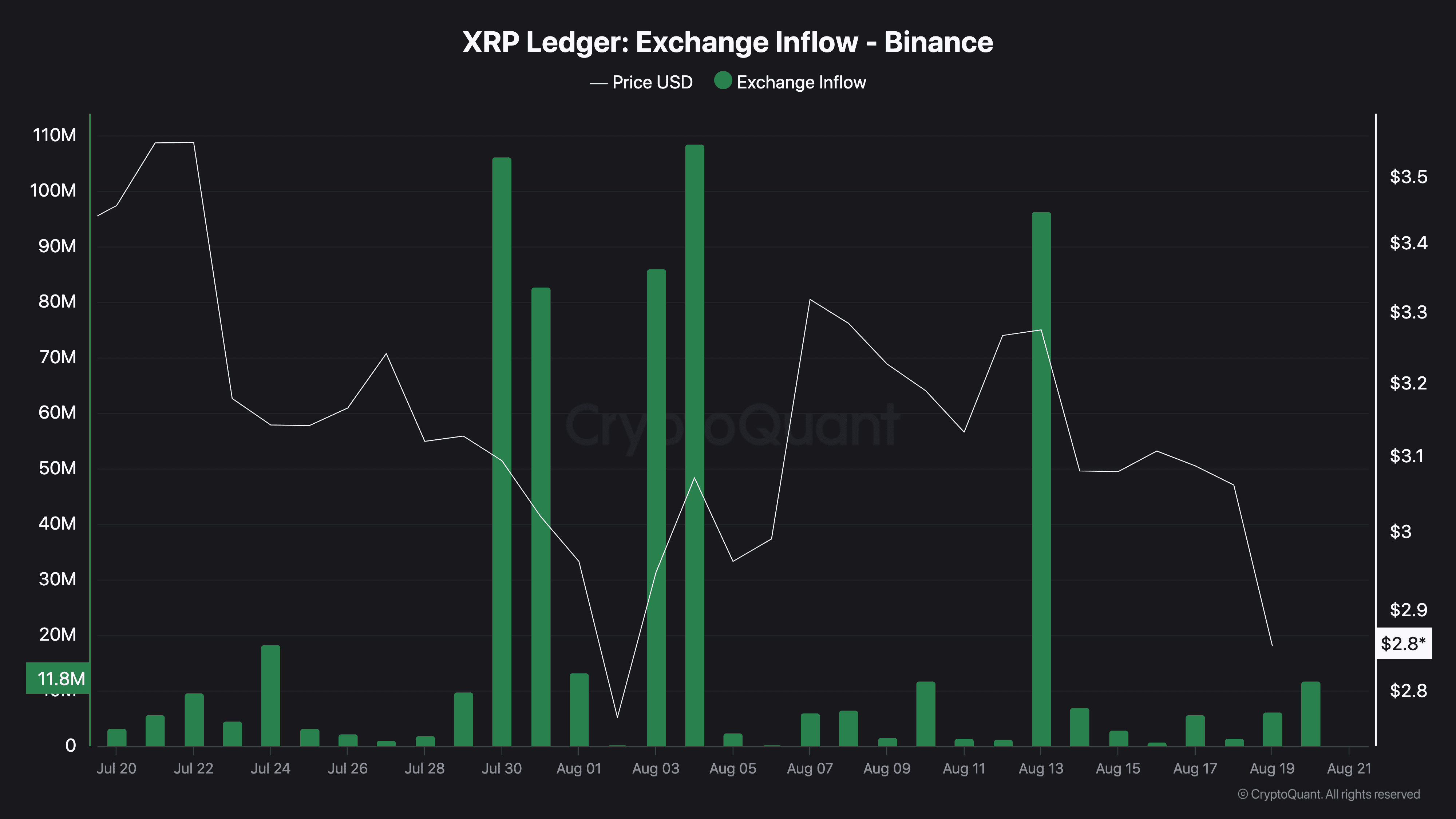

Crypto analyst Ali Martinez highlighted the whale activity, citing significant reductions in large wallet holdings over the recent sell-off period. On-chain signals show that major wallets have offloaded their positions aggressively, a move mirrored by a spike in XRP inflows to centralized exchanges like Binance.

One notable trend is the wave of multi-million XRP transfers—some exceeding 100 million per transaction—that coincided with weakened price momentum. As of now, another 11.8 million XRP has entered Binance, extending the downward pressure.

Marked exchange inflows show elevated whale activity during recent price movements. Source: CryptoQuant.

While much of the recent attention has focused on selling, whales were also significant buyers earlier this month. Martinez reported that another buying spree saw whales acquire approximately 320 million XRP in just three days, representing close to $1 billion in total value. These shifts demonstrate how whale actors continue to influence XRP’s availability and pricing volatility.

Market Context and Legal Developments

The broader crypto market experienced a minor retracement ahead of Federal Reserve Chairman Jerome Powell’s upcoming Jackson Hole address, which traders expect to shape sentiment around liquidity and inflation policy. XRP’s performance continues to mirror broader trends while also being influenced by whale strategies.

Crucially, XRP’s price has continued to evolve following Ripple’s legal resolution with the U.S. Securities and Exchange Commission (SEC) and regulatory shifts initiated under the Trump administration. Now that these events have been absorbed into the market outlook, investor focus has shifted firmly to large-scale wallet activity and macroeconomic events.

Price Outlook and Accumulation Trends

Technical analysts warn that continued sell-offs could push XRP toward the $2.70 or even $2.50 support zones. However, if market absorption continues and whale-led accumulation resumes, the price may stabilize or even recover. A tweet from market analyst Galaxy pointed out that XRP has spent the last five years in accumulation mode against Bitcoin, hinting at the potential for a breakout as that cycle matures.

Related: XRP Price: $12M Max Pain for Bears

Overall, XRP’s short-term path hinges on the balance between selling pressure, regulatory clarity, and macroeconomic sentiment. The whales, as ever, remain the silent architects behind the token’s most volatile moves.

Quick Summary

XRP faced mounting market pressure as major holders offloaded hundreds of millions in tokens, driving speculation about future price action and investor sentiment. Heavy Whale Activity Shakes XRP Market Over the past ten days, crypto whales sold around 470 million XRP, creating substantial selling pressure and triggering notable price declines.

Source

Information sourced from official Ripple publications, institutional research, regulatory documentation and reputable crypto news outlets.

Author

Ripple Van Winkle is a cryptocurrency analyst and founder of XRP Right Now. He has been active in the crypto space for over 8 years and has generated more than 25 million views across YouTube covering XRP daily.

Editorial Note

Opinions are the author's alone and for informational purposes only. This publication does not provide investment advice.